Copper’s Price: What’s happening?

In this article, we will discuss what has happened to the price of copper. When your money loses some of its purchasing power, you stop caring about supply and demand. Your main issue is that your paycheck isn’t lasting as long as it once did. Scarce assets like gold can’t be generated nearly as quickly as a society’s money. They remain valuable always. They are not only valuable during inflation. Let’s use the last couple of years as an illustration. Just look at the counter to the economic repercussions of the Coronavirus.

Governments all around the world minted trillions of dollars. The supply of gold, on the other hand, increased by roughly 106 million ounces. The value of the additional gold mined in 2020 was a little over $201 billion. It is over $1,900 U.S. dollars per ounce. Little in comparison to global money printing.

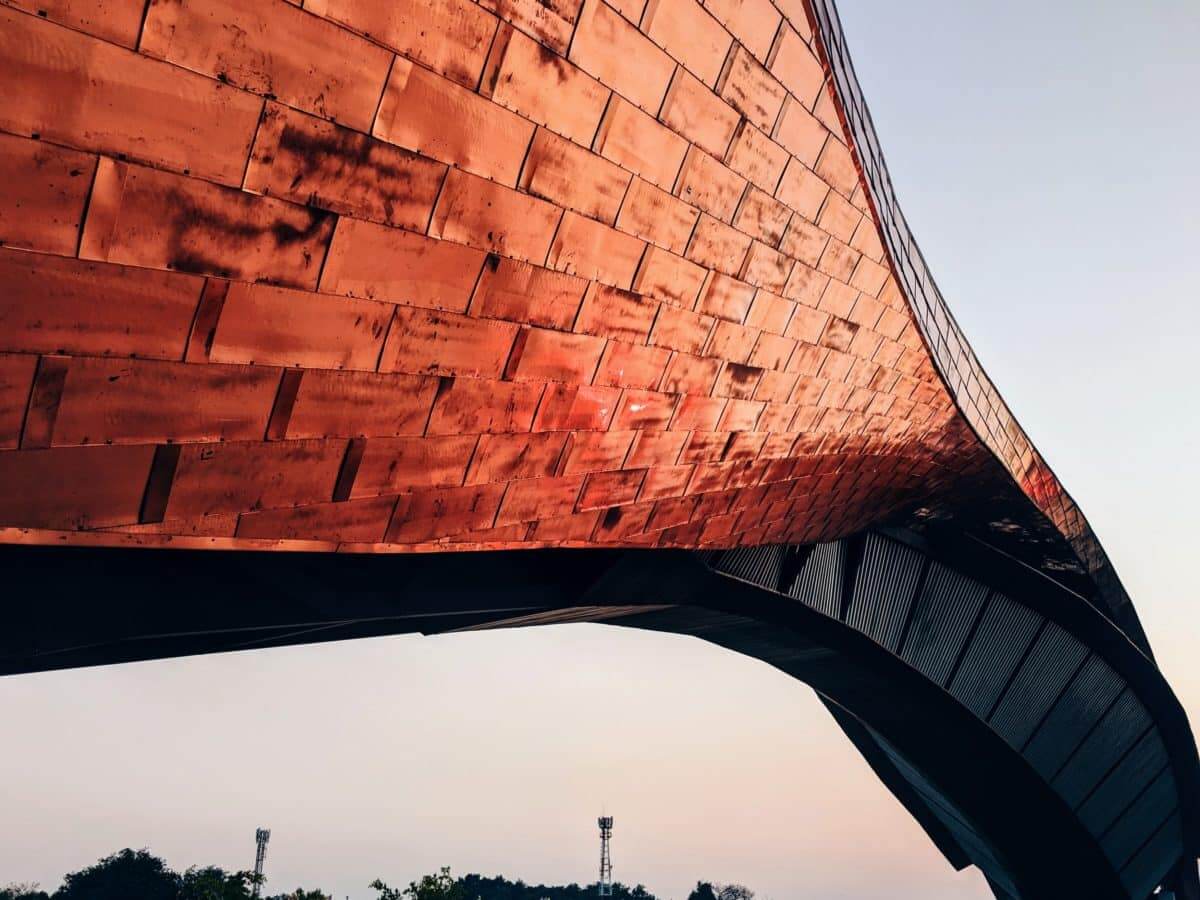

If you don’t give copper much thought you really should. Especially in light of cryptocurrencies. Copper is a metal that people usually use for wiring in homes, automobiles, appliances, gadgets, and other structures.

In 2019, almost 20 million metric tons of copper were extracted from the ground. Miners increase production to address supply shortages as copper demand rises. In order to prevent an oversupply from driving down the price of copper, miners reduce their mining activities when demand for copper declines. The supply of copper is rather elastic.

Copper prices increase on a weaker dollar

A weaker dollar on Tuesday helped to support the price of copper and other base metals ahead of U.S. inflation data and worries about smelter closures owing to power outages and low stocks. By 1025 GMT, the price of three-month copper on the London Metal Exchange had increased by 0.9% to $8,027 per tonne, its highest level since August 25. Since reaching a five-week low on September 2, it has increased by 7%.

Ole Hansen, head of the commodity strategy at Saxo Bank in Copenhagen, said, “The tightness in copper is not going away. The price is recovering fairly nicely despite all of the recessionary drums sounding progressively louder across the world, worries about China, and continuous lockdowns.” At its highest level since November 2021, the premium for LME cash copper over the three-month contract (MCU0-3) soared to $150 per tonne on Tuesday, signaling a lack of immediately usable copper in the exchange warehouse system.

Markets anticipate a slowdown in the U.S. inflation statistics, which are coming at 1230 GMT, Hansen continued. The dollar DXY on Tuesday was headed for its worst losing streak in a year. A declining dollar helps commodities priced in US dollars by lowering their cost to consumers using foreign currencies.

Additionally, the announcement that Yunnan, a province in southwest China, has ordered electrolytic aluminum factories to cut back on power use this week helped boost aluminum prices. LME zinc (CMZN3), another energy-intensive commodity whose production has been curtailed, increased by 2% to $3,261.50 per tonne.