What Is a Bullish Breaker in Crypto?

The breaker block trading strategy is a concept used in financial markets, particularly in technical analysis for trading stocks, cryptocurrencies, or other financial instruments.

There are many questions about the breaker block trading strategy like, “What is a bullish breaker in crypto?” Let’s answer several popular questions.

It’s important to understand the fundamental concepts of order blocks and how they’re adapted in the Breaker Block strategy, especially in the dynamic and volatile world of crypto trading.

Order blocks in the trading

An order block in trading is essentially a collection of buy or sell orders gathered at a certain price level. These blocks often represent the interests of institutional traders or large market participants.

Identification: Traders identify order blocks on a price chart as a range where a strong and rapid price movement has occurred. These are typically seen as large bullish or bearish candles preceding a change in trend direction.

Role: The idea is that these blocks act as zones where significant market orders have been placed, which can affect future price movements.

Breaker blocks: Adaptation in crypto markets

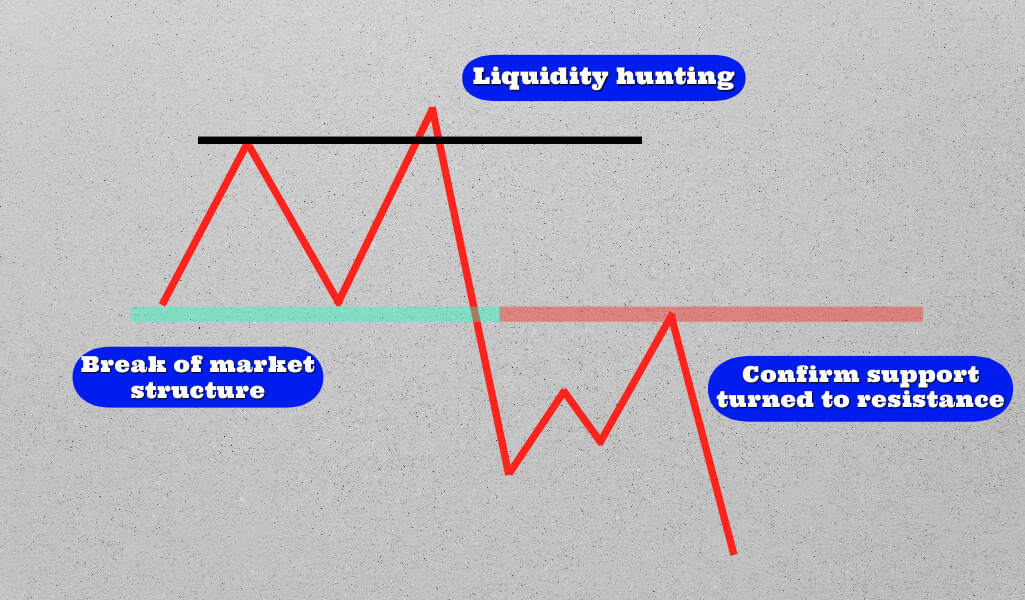

A breaker block is a specific type of order block that forms after a market structure shift. It’s identified when a bullish or bearish order block is broken by price movement in the opposite direction.

This broken block often turns into a resistance or support zone. In the crypto market, where trends can be sharply defined, these zones are crucial for traders to determine potential reversals or continuation of trends.

Bullish breaker block

A bullish breaker is formed when a bearish order block (a drop in prices) is broken by a subsequent upward price movement.

Usage: In a trading strategy, a bullish breaker becomes a significant support area. Traders often look for buy opportunities when the price returns to this breaker block, expecting the price to bounce off this support.

Practical application in crypto trading

Market analysis: Traders use technical analysis tools to identify these breaker blocks on crypto price charts.

Entry and exit points: The strategy involves entering a trade when the price revisits the breaker block and shows signs of respecting the new support or resistance level. Exit points are often set based on predetermined profit targets or if the price action indicates a failure of the breaker block.

Risk management: Due to the volatile nature of cryptocurrencies, using stop-loss orders is crucial when trading with the breaker block strategy to minimize potential losses.

How to analyze financial markets

It is important to take into account numerous factors when it comes to analyzing the crypto market, and financial markets, in general.

Analyzing financial markets, including the dynamic and multifaceted world of cryptocurrencies, involves a deep dive into various aspects such as market trends, economic indicators, geopolitical events, and technological advancements. This comprehensive analysis aims to understand the intricate interplay of factors influencing these markets.

Global economic indicators and their impact

Interest rates: Central banks’ interest rate policies significantly influence financial markets. Lower rates can boost investment in stocks due to cheaper borrowing costs, while higher rates might make fixed-income assets more attractive. Cryptocurrencies, although not directly linked to interest rates, can be influenced by the broader investment climate shaped by these rates.

Inflation: Inflation levels are closely watched by market participants. High inflation can erode the value of fixed-income investments, making equities or commodities more attractive. Cryptocurrencies, especially Bitcoin, are often viewed as a hedge against inflation.

Gross domestic product (GDP): GDP growth or contraction signals the health of an economy. Strong GDP growth can boost confidence in equities, while weak growth might lead to caution and a shift towards safer assets.

Unemployment rates: Higher unemployment can lead to lower consumer spending and corporate profits, impacting stock markets negatively. It can also influence government policies, which in turn affect market sentiment.

Geopolitical events

We also need to mention the impact of geopolitical events on the financial markets.

Trade wars and sanctions: These can disrupt global supply chains, impacting international markets and currencies. Cryptocurrencies can sometimes benefit as they are viewed as independent of any single country’s policies.

Political instability: Political events like elections, policy changes, or unrest can create uncertainty, leading to market volatility. The instability could influence the market dynamics. As a reminder, market dynamics are pricing signals resulting from changes in the supply and demand for products and services.

Investors might seek safe-haven assets like gold or potentially cryptocurrencies in such times.

Technological advancements

The rise of fintech has revolutionized traditional financial markets, introducing new investment platforms and tools. The blockchain technology underpinning cryptocurrencies has particular significance, offering decentralization, transparency, and security.

Cryptocurrency evolution: Innovations in the crypto space, like DeFi (Decentralized Finance) and NFTs (Non-Fungible Tokens), have opened new avenues for investment and utility, influencing market dynamics.

Market trends and analysis

What about market trends?

Stock markets: Equity markets are influenced by corporate earnings, macroeconomic factors, and investor sentiment. Technical analysis, including trend lines and indicators, is widely used to predict future movements.

Bond markets: The bond market, representing government and corporate debt, is sensitive to interest rate changes and economic outlooks. Yield curves are a critical indicator here, with an inverted curve often seen as a recession predictor.

Cryptocurrency markets: Highly volatile and driven by a mix of technical factors, market sentiment, and regulatory news, crypto markets require a unique approach. Trends in Bitcoin often set the tone for the broader crypto market.

Risk factors and diversification

All financial markets are subject to market risk, including the potential for significant losses. Diversification across asset classes is a common strategy to mitigate this.

Regulatory risk: Especially pertinent to cryptocurrencies, regulatory announcements can have immediate and significant impacts on prices.

Technological risk: For cryptocurrencies, technological risks like security breaches or network issues can lead to substantial price swings.

The analysis of financial markets, including cryptocurrencies, is a complex task that requires understanding a range of economic, political, and technological factors. The interconnectedness of global economies means that events in one part of the world can have ripple effects across various markets.

With the advent of digital currencies, this landscape has become even more intricate. Investors and traders must stay informed and adapt to the continuously evolving environment, balancing risk and reward in their investment decisions.

In summary, the breaker Block trading strategy adapts the concept of order blocks to the specific conditions of the cryptocurrency market. It provides a structured way to identify potential support and resistance zones, aiding traders in making informed decisions.

However, it’s important for traders to combine this with other analysis methods and proper risk management techniques, considering the high volatility and unpredictability of crypto markets.