Bitcoin testing prices at $ 40,000

On the topic of shaking off traders, fresh data from Glassnode shows how much leverage has been released from the market to $ 30,000 and back to $ 40,000. Open interest in Bitcoin futures fell from over 17 billion to below 13 billion and remained at those levels. First of all, the sharp drop to $ 30,000 resulted in Bitcoin funding rates shifting negative levels to record lows, which could provide fuel for a massive short pressure. That cleanup set a target for Bitcoin for $ 100,000. Funding rates have been largely reset, commented Messari analyst Mira Christanto on the Bitcoin funding rate.

Altcoins quickly followed BTC’s example when they joined Bitcoin in its downfall—resulting in a $ 437 billion cut in total market capitalization to $ 1.672 trillion, the lowest level since April 25. Since Bitcoin and Ether (ETH) make up a large portion of the funds locked in such protocols, their rapid price declines have resulted in a similar drop in TVL in the entire DeFi sector that fell 21.5% to $ 114.15 billion, according to Defi Lama.

Over the course of a few days, the market has shifted from talking about the possibility of a “DeFi 2.0 flight” to concerns about the upcoming multi-year bear market. This is just the latest example of why investors should not feel too comfortable in the crypto market because circumstances can quickly change.

Despite the current downturn, DeFi’s path of transformation to reshape financial markets is just beginning, and this correction could provide a rare opportunity to buy on the stock market. Data on derivatives for weekly options for Bitcoin suggest that bears could prevail today, May 21, Bitcoin weekly options worth $ 930 million are running out of time. Leader Deribit holds a 90% share, but the recent market downturn may have given the bears too much strength. Of the 11,872 call options, only 15% are still open using $ 44,000 and below. This means that the remaining 85% became worthless, as there were less than 12 hours left until the end of the week.

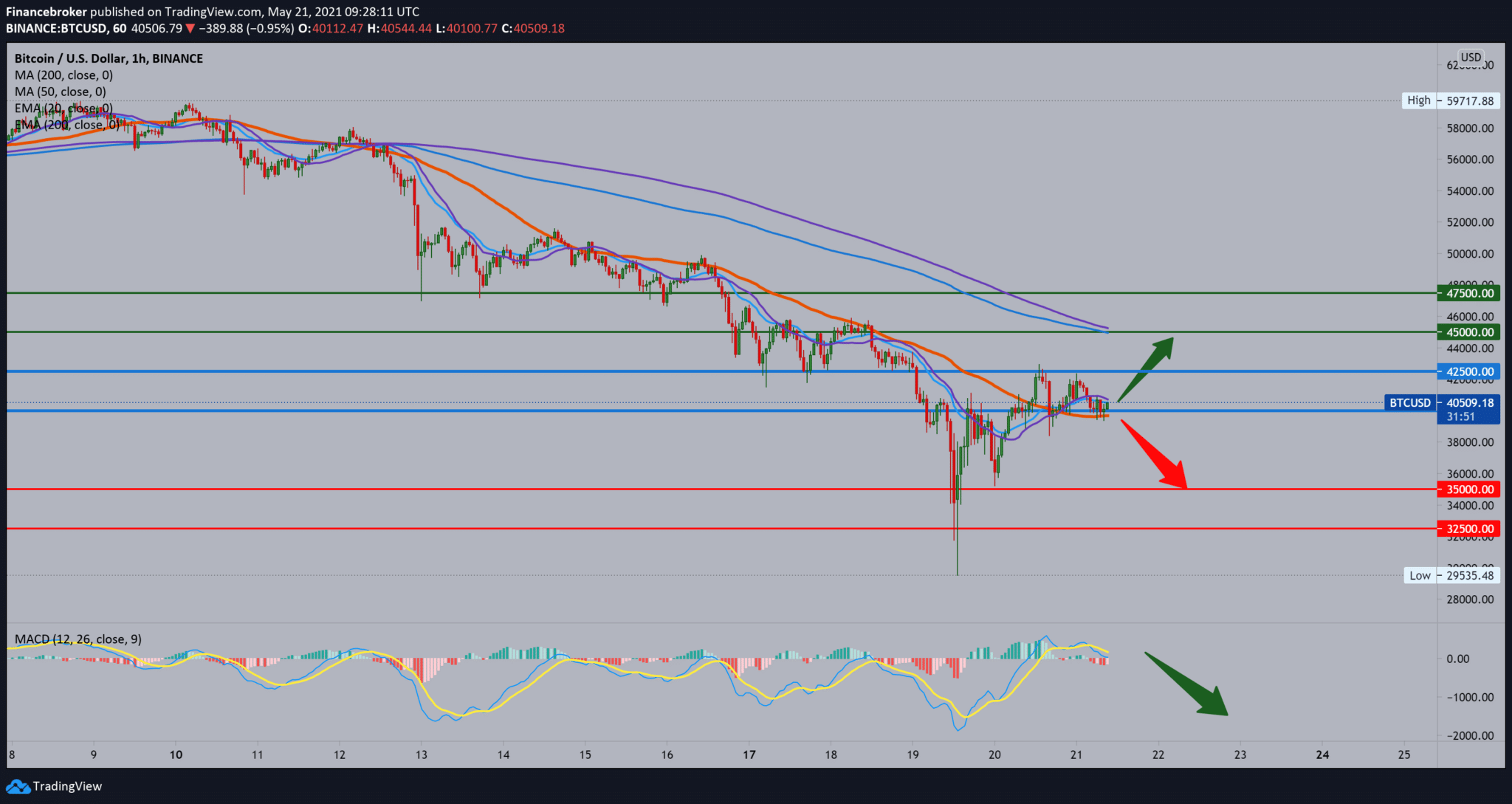

Making a technical analysis, we see the following in the chart:

Bitcoin finds support in the moving average of MA50, and that we now also need a break above MA20 and EMA200 to consider a target on MA200 and EMA200 in the $ 45,000 zone. The MACD indicator predominates on the bearish side, and for a stronger bullish signal, we need to break the blue MACD lines above the signal line for better support. The bearish scenario is a retreat below the MA50 and descent to retest the previous low, first to $ 35,000 and then to $ 30,000.

-

Support

-

Platform

-

Spread

-

Trading Instrument