Bitcoin, Ethereum, Dogecoin Optimism Pushes Prices Up

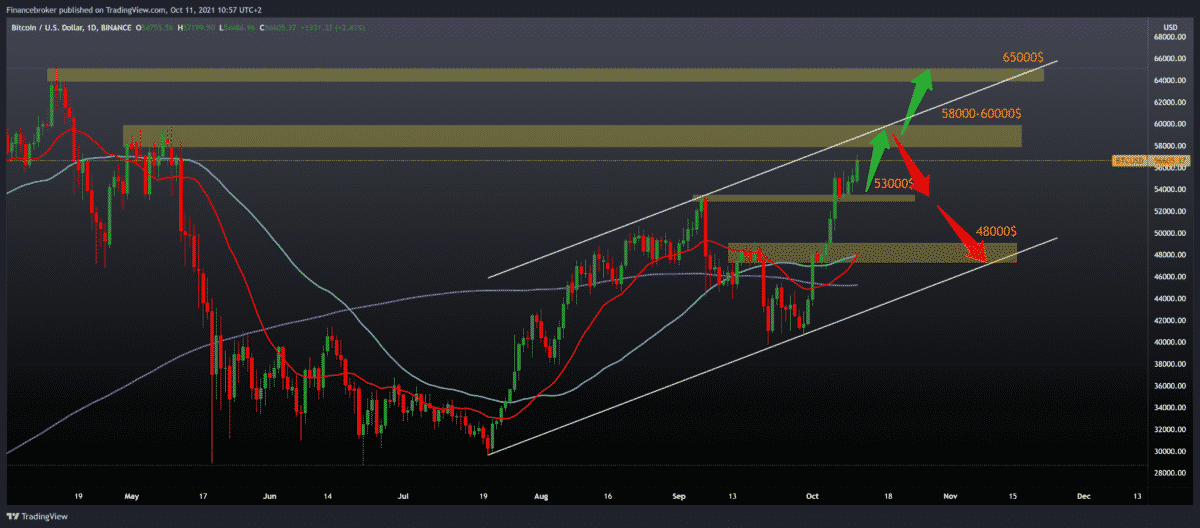

Looking at the BTCUSD chart on the daily time frame, we see that the price found support at $ 53,000, and after that, we climbed to the current $ 56,520. We are in the ascending channel from the middle of July, and soon the price will rise to the upper line of the channel in the zone of the previous high 58000-60000 $. Above, we can expect some resistance and potential pullback to the bottom channel line to confirm the waves of price movement within the channel. The first support below is in the $ 53,000 zone.

Our next support is in the $ 47,000-48,000 zone. In this lower zone, additional support along the lower channel line is our 20-day and 50-day moving averages, and our 200-day moving average is in the zone around $ 45,000. We need a break above the $ 58000-60000 zone and the upper trend line for a stronger bullish trend. If the price breaks this resistance, we can expect to visit the previous high at $ 65,000.

Ethereum chart analysis

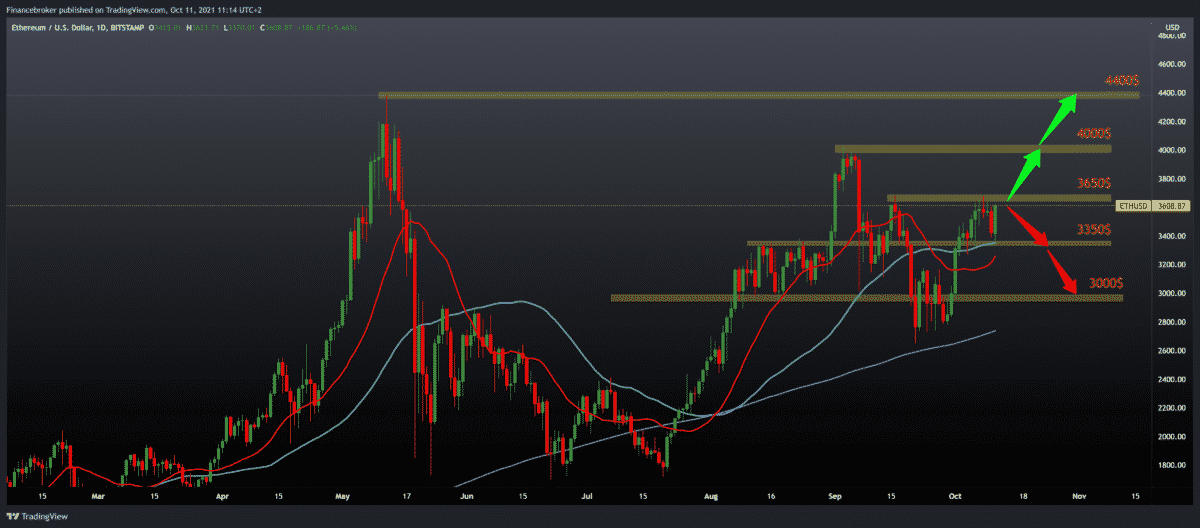

Looking at the ETHUSD chart on the daily time frame, we see that the price after yesterday’s withdrawal is from $ 3650 to $ 3350. Today we have the opposite situation because the price erased yesterday’s loss and climbed to the current 3620, again pressing the previous high to $ 3650 resistance zone in September. To continue on the bullish side, we need a break above this resistance zone, and after that, we can expect the price to visit the previous high at $ 4000.

Upstairs, the next resistance or consolidation can also occur, making an inevitable pullback before the next bullish impulse. We need a price withdrawal below $ 3350 and a 20-day and 50-day moving average for the bearish scenario. After that, we are looking for support at a price of $ 3,000 with the support of a 200-day moving average.

Dogecoin chart analysis

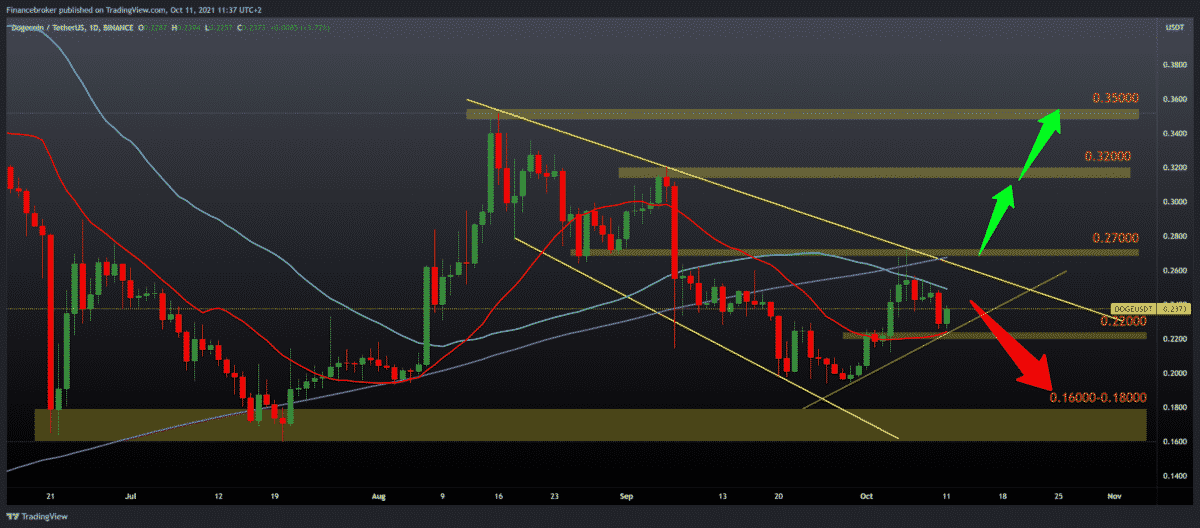

Looking at the Dogecoin chart on the daily time frame, we see that yesterday’s price made a pullback from 0.25000 to 0.22500. Here we found support today, and the price rose to 0.23750 with the support of a 20-day moving average. We can also draw a smaller trend line within this declining consolidation with 0.35000, which is our technical support on the chart towards a further bearish trend. A drop below 0.22000 can take us back to the previous support zone around 0.20000.

Looking at the bullish side, we need a break above the 50-day and 200-day moving averages, as well as a break above the upper trend line of resistance and a zone around 0.27000. The further continuation can take us to the previous high at 0.32000, and then at a higher level on the chart at 0.35000, high from mid-August.

Market overview

One of the most significant bullish signals is the accumulation of whales, where top-class whales holding between $ 100-1000 BTC accumulated another 85.7K of Bitcoin last week. What makes this accumulation of whales even more bullish is that these whales continued to accumulate even when the price jumped to a new multi-month high. This suggests that market sentiment is relatively high, and whales expect the price to jump further.

Many Bitcoin proponents, and even giants on Wall Street Banking, have given a Bitcoin price forecast of $ 100,000 by the end of the year. Although this forecast seemed far above the target just a few months ago, it is back in the game as $ BTC could very well retest its historical high this month and then re-enter a mode of further price growth, very similar to price growth in the first quarter of this year.

Another major factor that could contribute to the bitcoin race would be the approval of the US SEC for the first-ever Bitcoin Futures ETF. The SEC was quite sceptical of the crypto market led by boss Gary Gensler, but they convinced the U.S. had no plans to ban cryptocurrencies. Thus, the first BTC ETF would open the market to many new institutional investors and a higher Bitcoin price.

-

Support

-

Platform

-

Spread

-

Trading Instrument