Bitcoin, Ethereum, Dogecoin deep price withdrawals

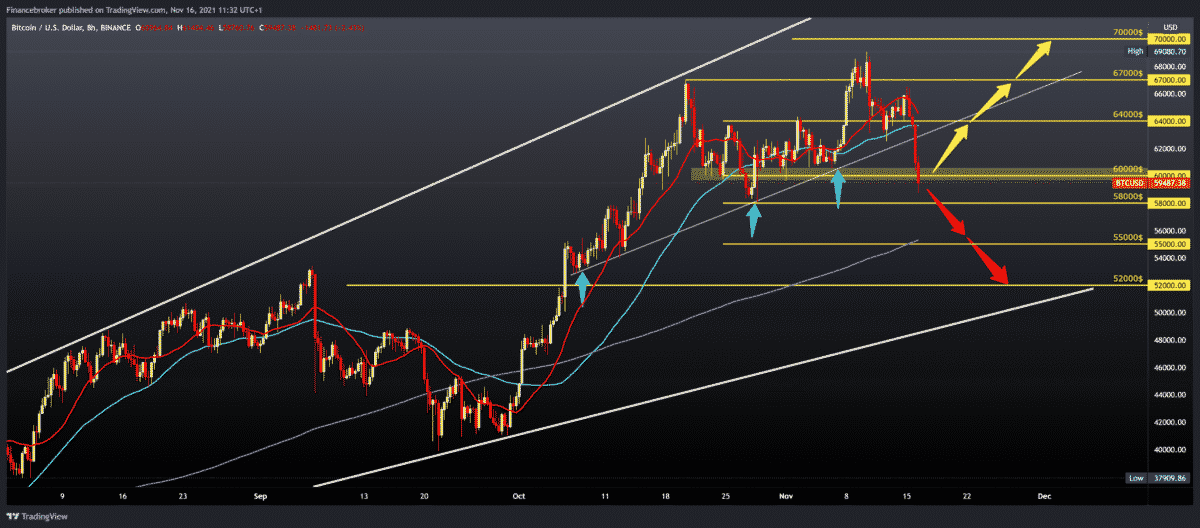

The price of bitcoin has made a massive drop from yesterday’s $ 66,500 to the current $ 59,300, losing 7 percent of its value in the last 24 hours. The BTCUSD broke below the support trend line and below the MA20 and MA50 moving averages. We are now looking at the previous October higher low at $ 58,000, and the break below will direct the price towards the next lower supports.

Bullish scenario:

- We now need positive consolidation and a breakout above $ 60,000.

- If we find support above $ 60,000, then we can expect a further price recovery.

- Our next resistance zone is around $ 64,000, and then the previous high is at $ 66,500.

Bearish scenario:

- We need further negative consolidation and a break below the $ 58,000 October low.

- Our next lower support is at $ 55,000 with the MA200 moving average.

- Our maximum bearish target is the bottom line of a larger growing channel at $ 52,000.

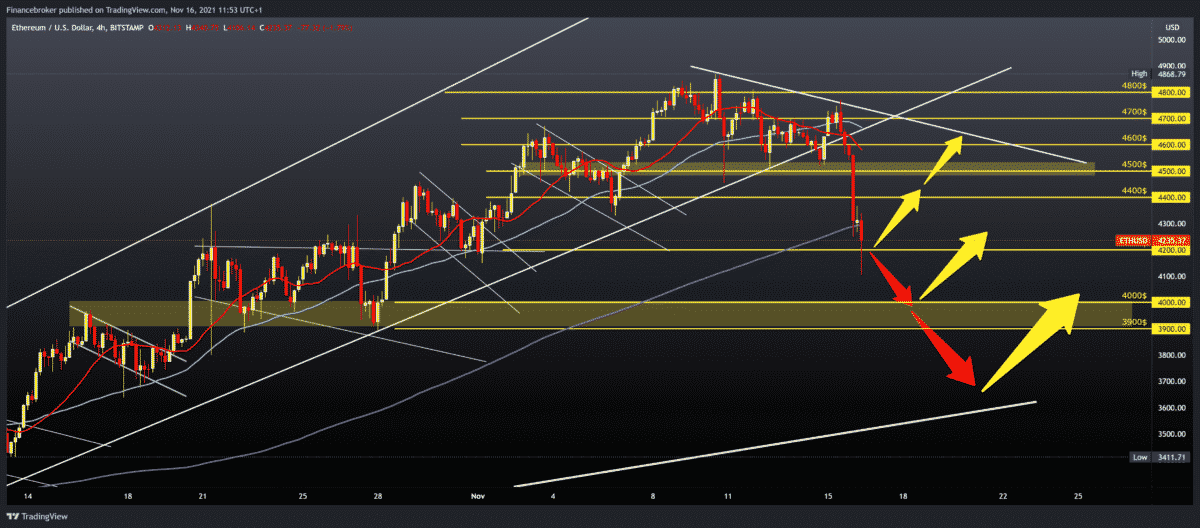

Ethereum chart analysis

The price of Ethereum dropped 14.0%, from $ 4769 to $ 4100. A break was made below the lower support line, which led to increased pressure on the price. After that, there was a drastic drop. We have current support at $ 4200, and if the price finds support here, we can expect a smaller recovery.

Bullish scenario:

- We need a price return above the MA200 moving average and a positive consolidation above $ 4300.

- Then the next resistance is at $ 4400, and the next larger resistance zone is around $ 4500.

- For a more concrete bullish impulse, we need a jump above $ 4700.

Bearish scenario:

- Further negative consolidation brings us below $ 4,200.

- Breakthrough below the descent us into the zone 3900-4000 $ instead of the October higher low.

- The maximum drop on this time frame is up to the bottom line of this large rising channel in the $ 3600-3700 zone.

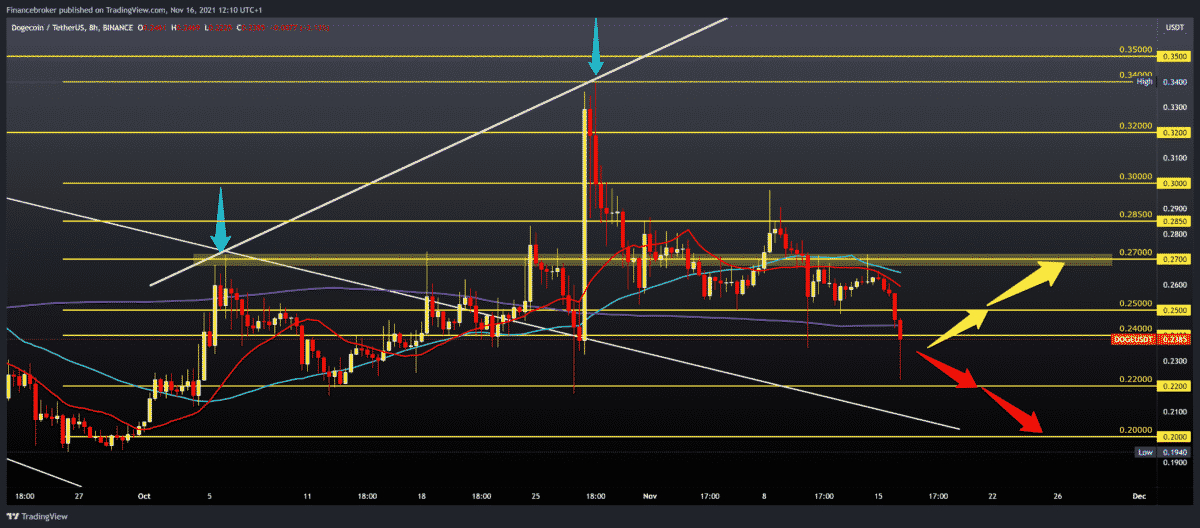

Dogecoin chart analysis

The price of Dogecoin, like other cryptocurrencies, fell from 0.27000 to 0.22000 in October support. Bearish pressure rose sharply as the price fell below the MA200 moving average. Based on this picture, we can expect a further drop towards the October minimum to 0.20000.

Bullish scenario:

- We need a price return above the MA200 moving average and 0.25000.

- The next resistance is in MA20 and MA50 moving averages in the zone 0.26000-0.27000.

- Only a breakthrough above this zone of resistance is we returning to the bullish trend.

Bearish scenario:

- We need continued negative consolidation to the first lower support at 0.22000.

- Breakthrough below pushes the price to the October lows in the zone around 0.20000.

Market news

Bitcoin and cryptocurrency prices have fallen sharply in the last 24 hours, and bitcoin prices have fallen below $ 60,000 per bitcoin.

Other major cryptocurrencies, including Ethereum, Binance’s BNB, Solana, Cardano, and Ripple, also fell, losing between 7% and 10% of their value.

The sudden drop in cryptocurrency prices wiped out about $ 400 billion from the combined crypto market, which reached a record value of about $ 3 trillion last week.” “Cryptocurrencies have experienced a sell-off, reducing major cryptocurrencies below recent short-term support lines,” said Alex Kuptsikevch, senior financial analyst at FxPro.

A stronger dollar against major currencies and a desire to lock in profits triggered a strong but relatively even overnight sell-off. The market capitalization of cryptocurrencies fell 7.5% in the last 24 hours to $ 2.66 trillion, breaking a long consolidation. The sudden drop in the price of cryptocurrencies came after bitcoin experienced its first major upgrade in four years over the weekend.

The cryptocurrency fear and greed index has so far not reacted to yesterday’s outpouring in the sector, ending at 71, and is still in the territory of greed, Alex Kuptsikevch added, warning traders to watch out for “interruptions or short-term earthquake.”

-

Support

-

Platform

-

Spread

-

Trading Instrument