Bitcoin and Ethereum: September Maximum

- The price of bitcoin continues its recovery started on September 7, when it fell to the $18560 level.

- The price of Ethereum formed its September maximum at the $1790 level over the weekend.

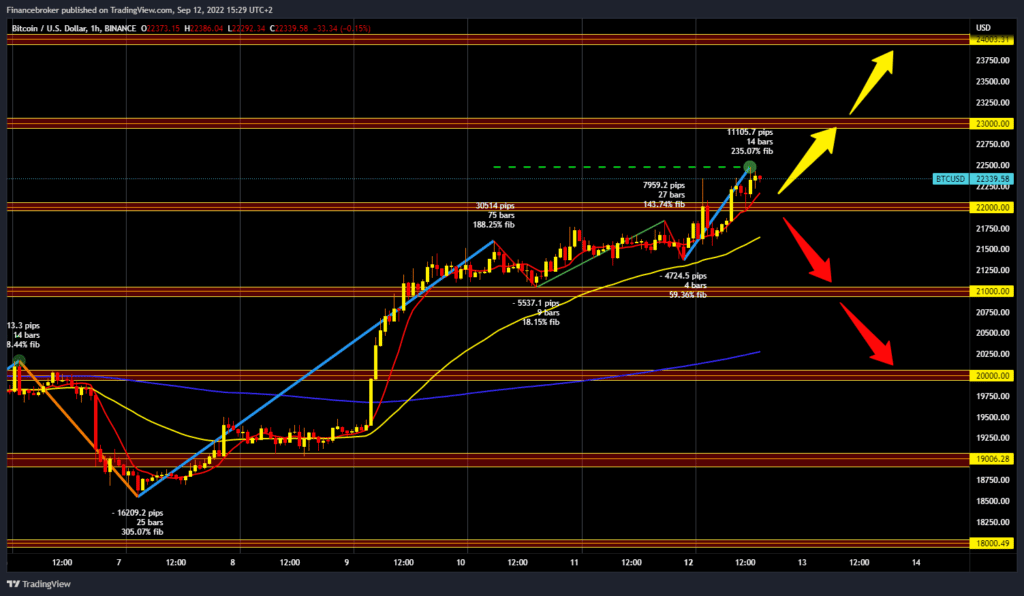

Bitcoin chart analysis

The price of bitcoin continues its recovery started on September 7, when it fell to the $18560 level. Today, the price managed to break the barrier above the $22000 level and thus forms a new higher high at the $22500 level. Bitcoin could continue the current bullish trend by reaching the $23,000 level. The dollar could weaken until September 21, when the FED is expected to announce a new interest rate increase. So now, it would be desirable for bitcoin to manage to move as much as possible to have a better position at the time of the Fed announcement. We need a new negative consolidation and pullback below the $22000 level for a bearish option. After that, the price of bitcoin could go down to $21000, our weekend support zone. Ma200 moving average is in the zone around the $22250 level.

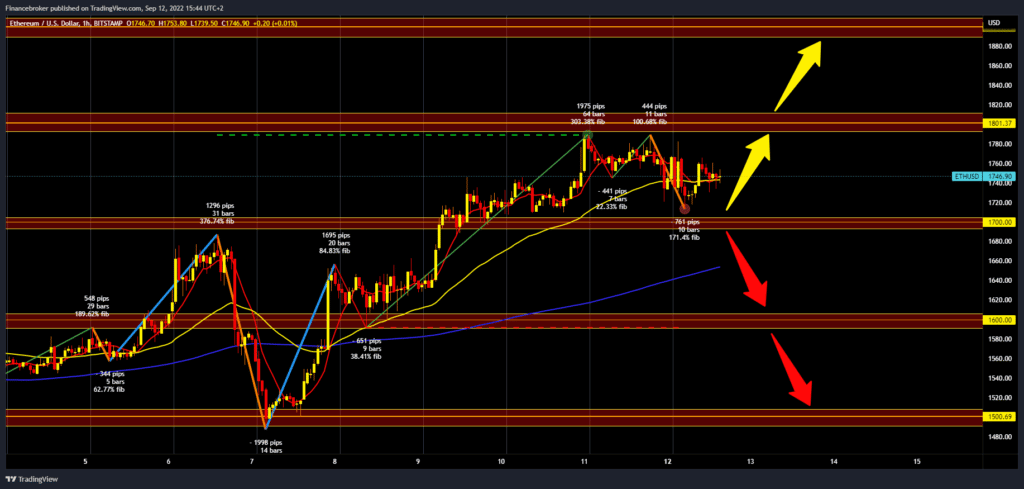

Ethereum chart analysis

The price of Ethereum formed its September maximum at the $1790 level over the weekend. Today we had a pullback to the $1720 level, where we found support and started a new bullish consolidation. We have support in the MA20 and MA50 moving averages, and they could push us to the $1800 level. A break above and staying above would be very helpful as the next bullish impulse could happen. Potential higher targets are the $1850 and $1900 levels. We need a negative consolidation and a break below the moving averages for a bearish option. Then we would probably go down to the $1700 level. A price break below would increase the bearish pressure, and the price could continue to fall further. We could look for the first support at the $1650 level and the MA200 moving average. Potential lower targets are $1600 and $1500, last week’s low.