Bitcoin and Ethereum continue their bullish recovery

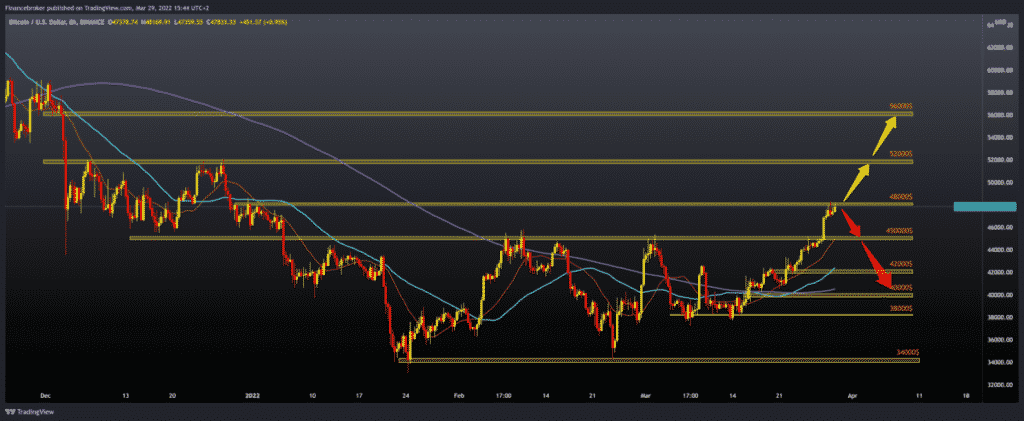

The Bitcoin chart analysis

Bitcoin today kept its position below its maximum this year, touched the day before, with the growth of the price of Bitcoin exceeding 27% since the Russian invasion of Ukraine.

Bitcoin reached $ 48,240 on Monday night, the highest level since December 31. It was last traded 0.7% on $ 47,780. For the bullish option, we need further positive consolidation above $ 48,000. After that, we can expect the price to climb first to a psychological $ 50,000 before we test the resistance zone at $ 52,000. We need to withdraw the price from the current level for the bearish option, and we are looking for support at $ 45,000, the previous resistance zone. Potential support at that level is the MA20 moving average. If the bearish pressure increases, then we can see a further withdrawal to $ 42,000, then to $ 40,000 and the MA200 moving average. Its gains have raised smaller cryptocurrencies that tend to move in tandem with bitcoin.

Market participants have recognized the signs of a new wave of cryptocurrency adoption by institutional investors and financial firms, whose interest has spurred the shift of cryptocurrencies to core assets in the last two years.

Bitcoin has risen by over 12% in the last seven days alone.

He commented on the support from the CEO of BlackRock Inc., who said last week that the war between Russia and Ukraine could lead to the acceleration of digital currencies as a tool for settling international transactions.

Although bitcoin and other cryptocurrencies are now being talked about at the same level as traditional assets, from stocks and foreign exchange to bonds, it is still very volatile as always.

Bitcoin reached an all-time high of $ 69,000 in November before falling nearly 30% in just one month.

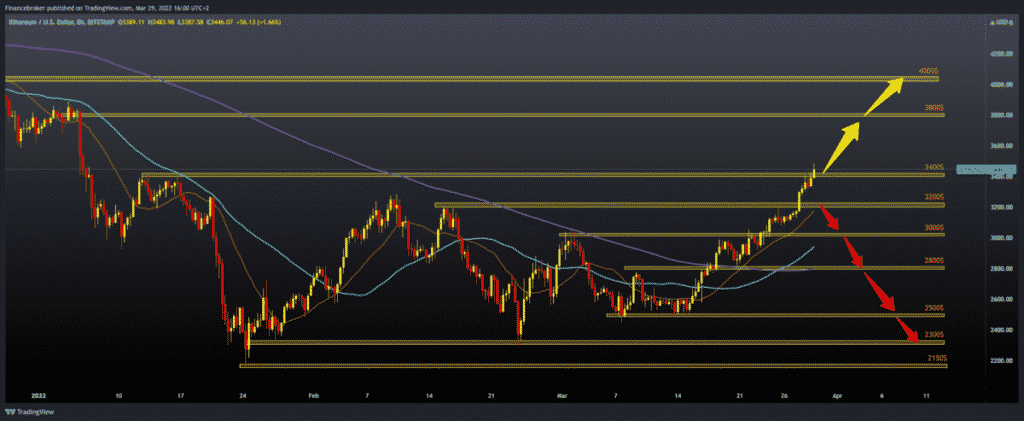

Ethereum chart analysis

The price of Ethereum continues its bullish campaign, conquering the $ 3400 level. Today’s current high is at $ 3,484. Now we have a smaller withdrawal, and we expect to make a consolidation from which a new bullish impulse should come. Our next target is the $ 3,800 resistance zone, the previous high of January 5th. We need a new negative consolidation and a pull towards the $ 3,200 level for the bearish option. The MA 20 moving average provides additional support at that level. If bearish pressure continues, our next support is at $ 3,000.

ETH and excessive fees

Buterin said his frustration with the impact of high fees. With high fees, the decentralized goal of the platform may be disrupted.

Ethereum founder Vitalik Buterin confirmed that high costs remain a critical test for a computerized resource, which threatens the vision of creating a decentralized economy.

Speaking during a meeting with Time magazine, Buterin said the high fees undermine the ease of use of Ethereum as the transition to proof of ownership continues.

Fees are a huge problem for the ease of use of Ethereum, especially for parts of money applications that have been overloaded lately.

The central thing that prevents Ethereum from being used for cool stuff today is just fees. It seems like an exhausting answer; there is a big social problem in Ethereum, and the primary motivation for something specialized has not been done fast enough, Buterin added.

-

Support

-

Platform

-

Spread

-

Trading Instrument