Bitcoin and Ethereum charts overview for April 12

- The price of bitcoin last night formed a new April low at $ 39,250.

- The price of Ethereum dropped to 2950 dollars this morning.

- Glassnode says about 70% of wallets make a profit despite falling bitcoin prices and estimates that bitcoin could trade even lower in the coming weeks.

- According to a Coinglass report, cryptocurrencies worth about $ 439 million have been liquidated in the last 24 hours.

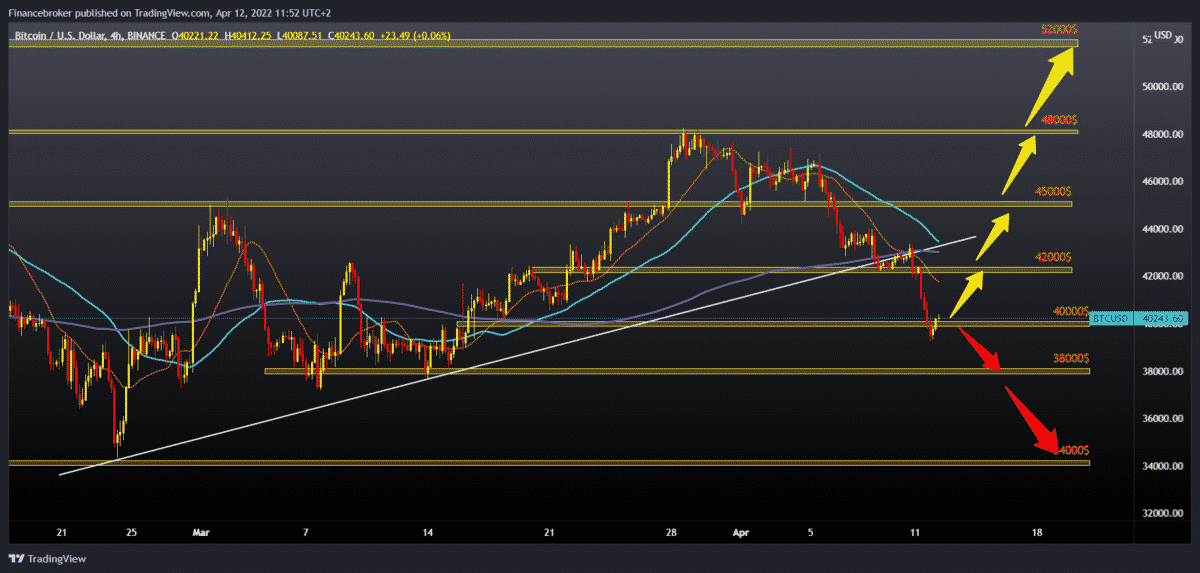

Bitcoin chart analysis

The price of bitcoin last night formed a new April low at $ 39,250, after which we have a smaller recovery to $ 40,200. The price does not manage to consolidate better and form a stable growth trend. Following the moving averages, we see that they remained in the zone of about 42,000 dollars, far above the current price. If the current bearish trend continues, our next target is the $ 38,000 support zone, the March support zone. The March low was at $ 37,200. For the bullish option, we need new positive consolidation and price growth to the zone of 42000-43000 dollars. With further bullish consolidation, the next resistance zone is around $ 45,000. Then our next resistance is around $ 48,000, the March high.

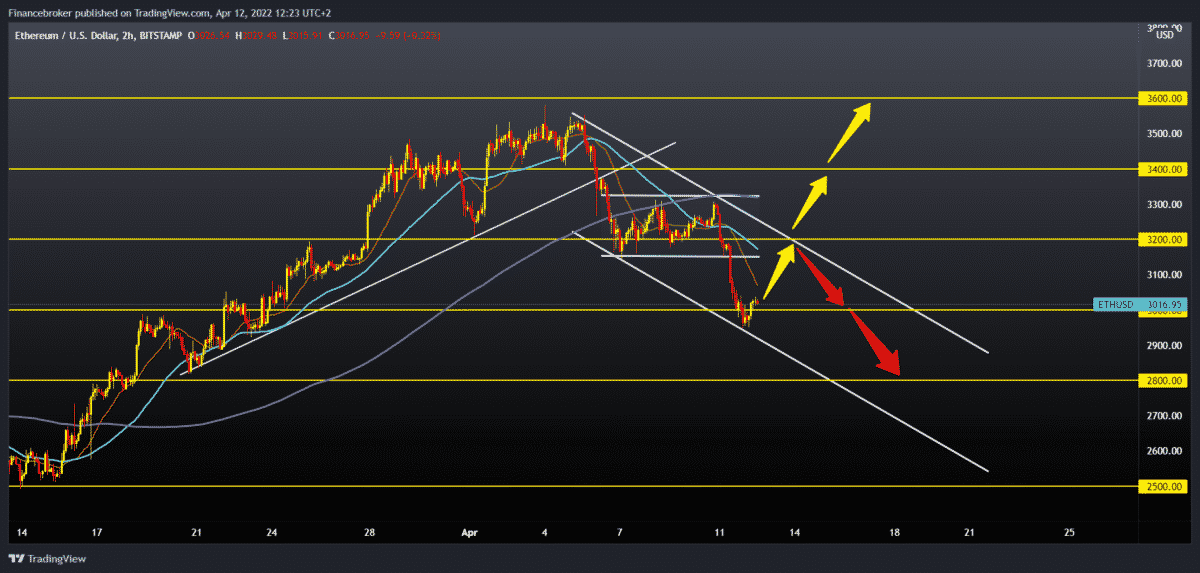

Ethereum chart analysis

The price of Ethereum dropped to 2950 dollars this morning. For the first time in the last two weeks, the price fell below 3000 dollars of psychological level. Previous support at $ 3,150 did not last, and Ethereum formed this drop on the chart. If bearish pressure continues, we can expect ETH to drop to the next support at $ 2,800. Ethereum fell into a bearish trend after falling below the MA200 moving average on April 7, and on April 8 and 10, only the MA200 was confirmed as resistance and an obstacle to the bullish option. For the bullish option, we need a refund above $ 3,200 to get back to last week’s consolidation zone. After that, we need a break above the $ 3,200 level and the MA200 moving average for potential confirmation of the transition to the bullish trend.

Market overview

70% of Bitcoin wallets are in profit

Glassnode says about 70% of wallets make a profit despite falling bitcoin prices and estimates that bitcoin could trade even lower in the coming weeks. In the last few weeks, the crypto market has been flooded with volatility, which has led to the loss of assets and a drastic decline in value. Bitcoin has not been left out either, as digital assets have fallen significantly recently. However, a new survey by chain analysis company, Glassnode, pointed out that about 75% of Bitcoin wallets still keep their profits in the wallet despite market turmoil. In the report, Glassnode pointed out that bitcoin owners are unlikely to be affected by the deep decline of the market in the long run.

The dollar impact on crypto market

According to a Coinglass report, cryptocurrencies worth about $ 439 million have been liquidated in the last 24 hours. Hawk’s turn in the Federal Reserve has restarted the growth of the dollar while at the same time putting pressure on risky assets such as Bitcoin. The U.S. Dollar Index (DYX), which measures the dollar’s strength against a basket of foreign currencies, recently jumped above 100, reaching a new two-year high. The U.S. stock market also ended in the red on Monday, with the Dow Jones Industrial Average falling 1.89%.

According to the report, Bitcoin is now on track to test a critical support level of around $ 37,500. Failing to find any foothold here could prove disastrous for the bulls.