Bitcoin analysis for May 7, 2021

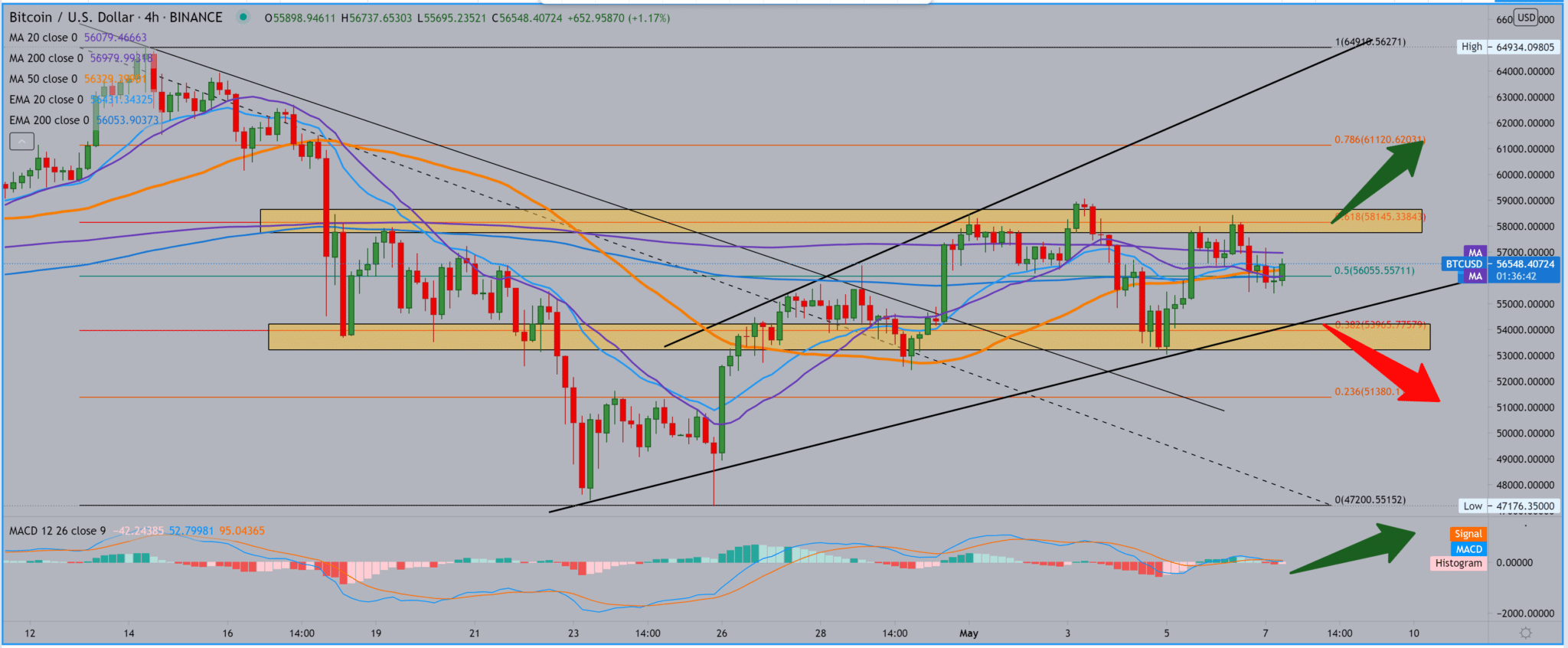

Looking at the chart on the four-hour time frame, we see that Bitcoin is moving in one ascending channel, testing moving averages, and continuing up; we need a break above the bit MA200. We see the Fibonacci retracement level, and we have resistance at 61.8% Fibonacci level at $ 58,150, and the break above opens the door to 78.6% Fibonacci level at $ 61120. The opposite scenario is a retreat below moving averages and 50.0% Fibonacci levels, directing us to 38.2% Fibonacci levels at $ 54,000 and the bottom line of support. Of course, a break below that support leads us to a $ 50,000 psychological level for traders. Looking at the MACD indicator, we see that the solution is lateral to the middle of the indicator with slight tendencies to the bearish side. We need a stronger impulse on the chart to get a clearer signal from the MACD indicator.

Goldman Sachs now offers Bitcoin undeliverable referrals to institutional investors. To reduce risks, the global investment bank buys and sells Bitcoin futures in block trades on CME. The Wall Street giant quietly started offering crypto derivatives to customers last month. Last month, the investment banking giant began offering trading in non-deliverable futures, a derivative tied to the price of Bitcoin. These derivatives are contracts between two parties that agree to settle the difference between the spot price and the agreed price on a specific date.

Contracts are paid in cash, and Goldman’s clients could speculate on the price of Bitcoin. On the other hand, a global investment bank with over $ 2 trillion in assets under management will protect itself by buying Bitcoin futures in block trades on the Chicago Mercantile Exchange (CME) using Cumberland DRV as its trading partner. Mac Minton, Goldman’s Asia-Pacific head of digital assets, said: Institutional demand continues to grow significantly in this space.

The ability to work with partners like Cumberland will help us expand our capabilities. Goldman’s entry into the crypto space signifies that the industry is maturing, said Justin Chow, global head of business development at Cumberland DRV. He added: Goldman Sachs serves as a signal for how the sophisticated approach of institutional investors is changing in the market. This year, we have seen rapid adoption and interest in crypto from more traditional financial companies.

-

Support

-

Platform

-

Spread

-

Trading Instrument