Bitcoin analysis for April 26, 2021

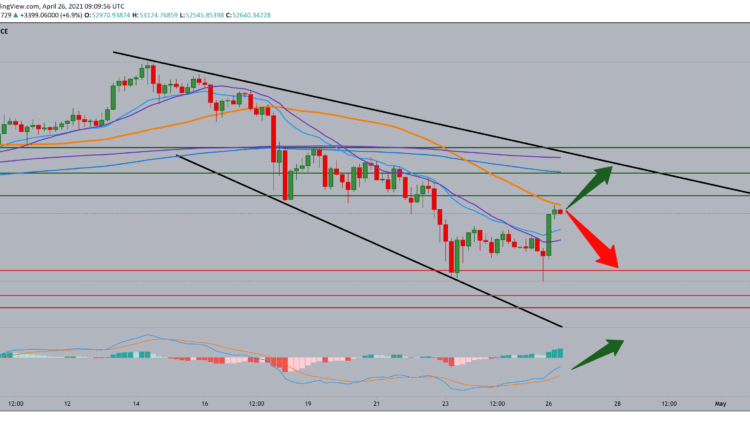

Looking at the Bitcoin chart on the four-hour time frame, we see that we tested the previous low at $ 47,200 and immediately bounce up from that zone in the morning. We are currently testing the moving average of the MA50, and breaking above and closing the candlestick also above the moving average will only amplify the current bullish signal.

We are targeting Bitcoin and our targets toward the upper resistance line in the $ 56000-57000 zone. In that zone, in addition to the upper resistance line, the moving averages MA200 and EMA200 will also be waiting for us.

For the bearish option, we can wait for the rejection now at this level around MA50 or on the upper resistance line, with the appropriate confirmation of candlesticks. Looking at the MACD indicator, we have pure support for continuing the current bullish option.

Although Bitcoin has recovered slightly from a deep drop below $ 50,000, market sentiment has changed during the last week of price action. The index of crypto fear and greed, which measures current feelings in the crypto market, has moved from “Extreme Greed” to “fear” because most cryptocurrencies are traded in a sea of red. The index measures aspects of the market, including its volatility, trading volume, momentum, feelings, and social media trends.

According to the behavioral analytics company Santiment, Bitcoin’s social indicators point out that investors no longer expect new highs and a multi-year bull market in the near future. The market has shifted to a bearish appearance, indicating the expectation of further losses and deeper corrections.

-

Support

-

Platform

-

Spread

-

Trading Instrument