11 April Analysis for Individual Market Sections

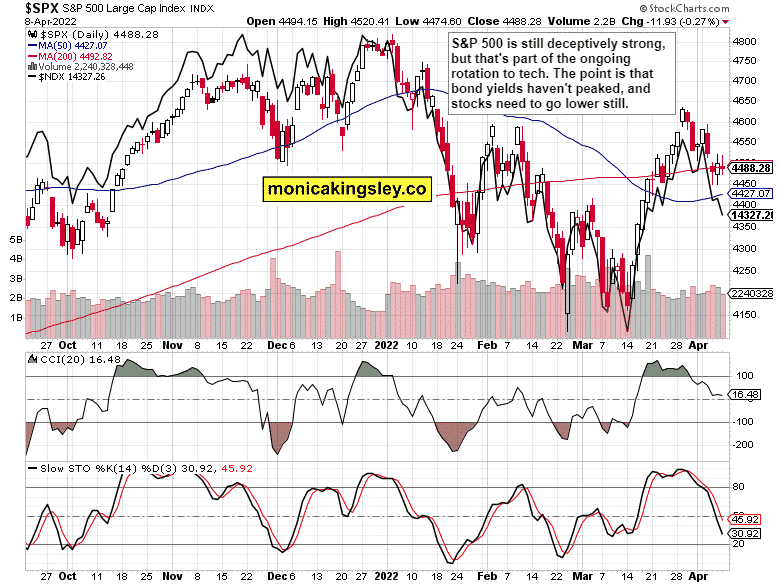

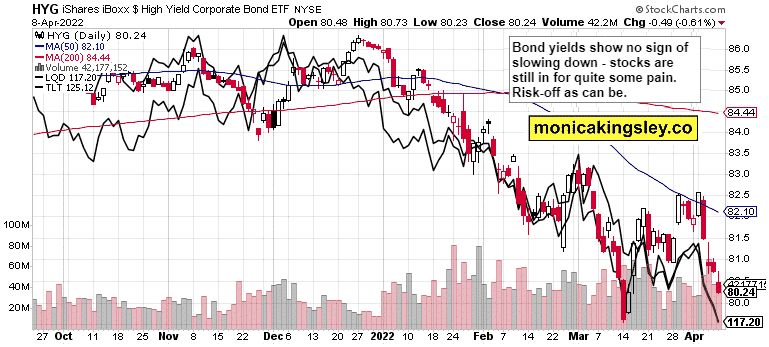

S&P 500 intraday resilience fizzled out, predictably. I just didn‘t like the credit markets performance, this yields spike isn‘t over yet as everyone and their brother listen to the Fed‘s hawkish tune. Sure, they‘ll make a good talk, and also deliver quite a few hikes, even the 50bp one at the next FOMC that‘s in the air, but how about intentions to shrink the balance sheet monthly by $95bn as well? Sounds like a bridge too – while the real economy is decelerating, it hasn‘t yet tipped into a recession – but looking at the 10-year to 2-year spread, we‘re past the inversion point (and I‘m not even bringing up select other spread which have inverted earlier already).

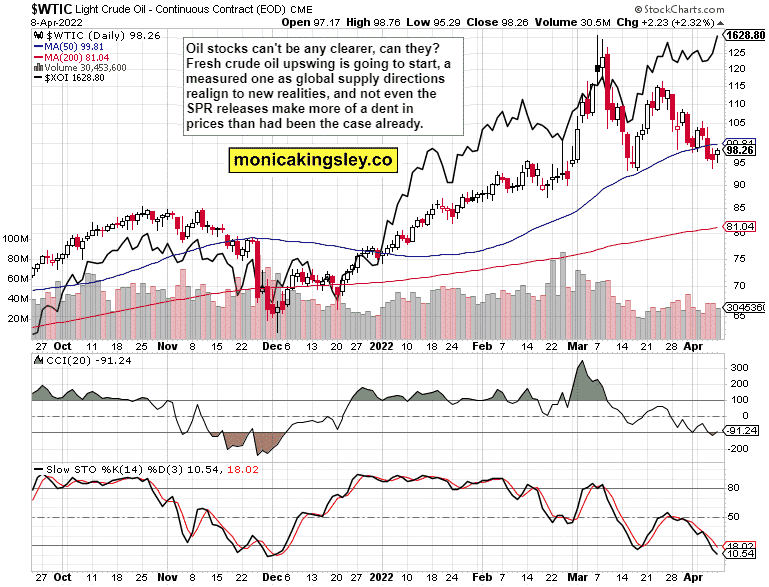

So, it‘s pretty safe to say we‘re in the countdown to the recession, and that‘s not a function of yields only but of oil prices too – practically doubling, and the real economy just keeps humming along? Gimme a break. Usually, it takes 12-18 months since the inversion for recession to arrive, but this time around, I think that 6, max 9 months is more appropriate an expectation.

For stocks, this means we‘re still going down until yields turn, which would be a replay of the safety trade. But the 60-40 model is dead, and in the inflation paradigm I‘ve been hammering since early Jun 2020, the themes would be rotations out of growth into value, and of course also out of cyclicals into defensives, those not cyclically dependent areas. I keep pounding the table for energy, precious metals, base metals, uranium, water, agrifoods, fertilizer, timber etc. Retail and consumer discretionaries would be hurt – but real estate not so much. I would though wait for yields to come down (which would mark a nice stock bear market bottom as well) before looking at housing twice.

Expect wild stock market swings – bull and bear markets lasting 1+ years that take you nowhere if you aren‘t picky about stocks allocation favoring real asset overtones. This is the era of inflation – make no mistake, the Fed won‘t break it, and the geopolitical consequences would soon drive inflation into double digits. Not even Strategic Petroleum Reserve (in place of that vaunted OPEC spare capacity?) record releases all the way to midterms would cushion it.

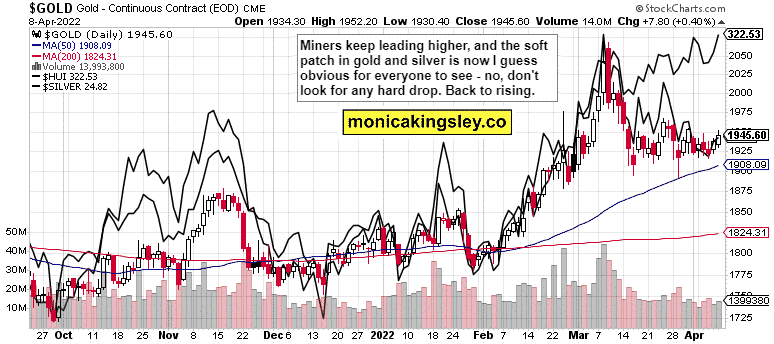

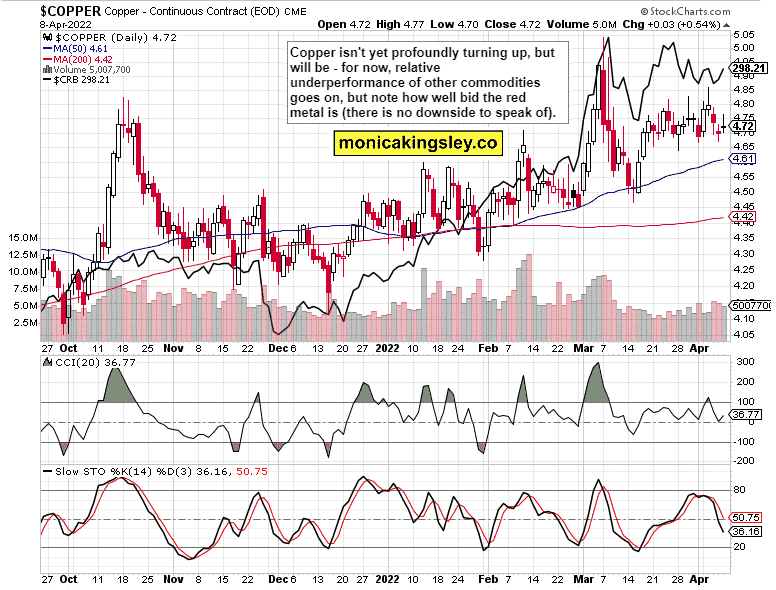

A few more thoughts on yields – let‘s take 10-year Treasury one now at 2.72%. As we approach, and cross that psychological 3% threshold, that would be a nice catalyst of more stock market selling (brace yourself, tech – I had been transparently a bear on you for a long time, but played S&P 500 as that‘s more of an interest to the audience). The short profits can keep growing, we aren‘t yet at the end of the ride. Precious metals, crude oil and copper are to extend gains, and break higher out of their current consolidations – the local bottoms have been made.

Enjoy and profit!

This extensive analysis is a gift for your patience when I had been providing you with brief yet timely and nimble market analyses during the past three weeks. During April and at least part of May, I‘ll at times stick to this short format, but rest assured that you – as subscribers on my site and Twitter followers – would be in the loop real-time whenever my thinking changes, just as had been the case over the past 3 weeks. At turning points of key importance, and in preparation for them, I‘ll of course issue a regular length analysis to explain thoroughly, but over the coming weeks numerous shorter and to the point updates would be more numerous. Keep an eye on my site and Twitter handle for updates before I revert to regular programming, thank you very much!

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

S&P 500 and Nasdaq Outlook

S&P 500 is deceptively strong here, and ready to move down again. Tech is leading, yields are leading, and the rotation into value won‘t save the day. The bear market rally is over, and we‘re starting the next downleg.

Credit Markets

Sea of red, anywhere you look – HYG giving up intraday gains, and quality debt instruments still going down. We aren‘t yet anywhere near seeing yields reverse, there isn‘t even enough panic in stocks to send some fresh demand bonds‘ way.

Gold, Silver and Miners

Precious metals are smartlty turning up, and the permabears will have once again egg on their faces. With miners leading higher, it‘s a tough job being bearish, and looking to make such a case with a straight face. Tightening cycle is here, I get it – but first, that‘s usually a bullish catalyst, and second, the current conditions and market performance don‘t favor any steep drops, the only question is the length of the prior sideways consolidation.

Crude Oil

Crude oil has found a floor, and is ready to rise again. Oil stocks are leading, and there aren‘t bearish news on the horizon. I just wonder at what price would the SPR be replenished – how close to $120 or even $150. Prices in this range are doable – not this not next month, but energy will continue spiking this year.

Copper

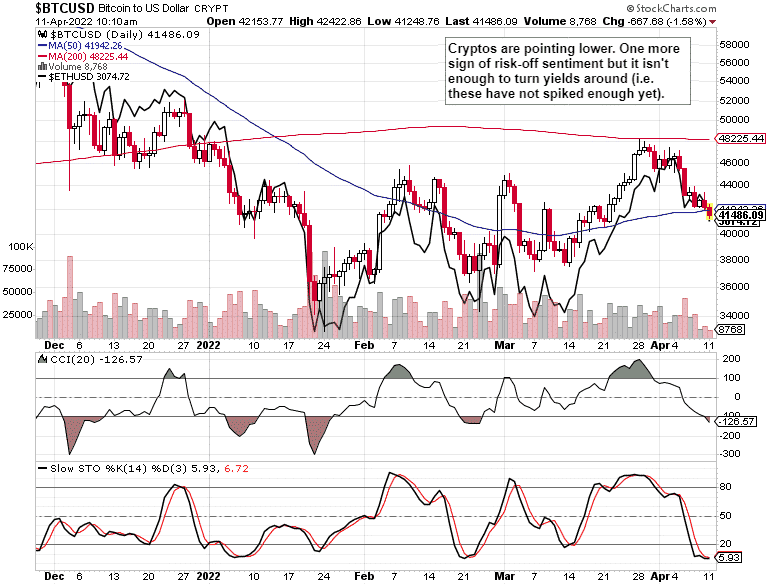

Bitcoin and Ethereum

Cryptos are under pressure well before the markets open today, and this doesn‘t bode well for risk-on assets really. I doubt enough buyers would materialize later today to turn the tide.

Summary

Today‘s extensive analysis is best read from the long start through the rich individual market sections. It‘s a gift for your patience when I had been providing you with brief yet timely and nimble market analyses during the past three weeks. During April and at least part of May, I‘ll at times stick to this short format, but rest assured that you – as subscribers on my site and Twitter followers – would be in the loop real-time whenever my thinking changes, just as had been the case over the past 3 weeks. At turning points of key importance, and in preparation for them, I‘ll of course issue a regular length analysis to explain thoroughly, but over the coming weeks shorter and to the point updates would be more numerous. Keep an eye on my site and Twitter handle for updates before I revert to regular programming, thank you very much!

Now, some more market action meat and potatoes.

S&P 500 is bound to decline again as the prior bear market rally ran its course – the fresh dive to the lows (could still happen early July as I told you roughly a month ago) is on, and yields confirm. At the same time, precious metals and commodities are setting up for a great rally. As for medium- and long-term views of stocks, sectoral picks and real assets, I can‘t stress enough how key today‘s analysis is – have a good read, and enjoy positioning yourselves accordingly.

Thanks for your patience once again!

Thank you for having read today‘s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for all the five publications: Stock Trading Signals, Gold Trading Signals, Oil Trading Signals, Copper Trading Signals and Bitcoin Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

Oil Trading Signals

Copper Trading Signals

Bitcoin Trading Signals

www.monicakingsley.co

[email protected]

* * * * *

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

-

Support

-

Platform

-

Spread

-

Trading Instrument