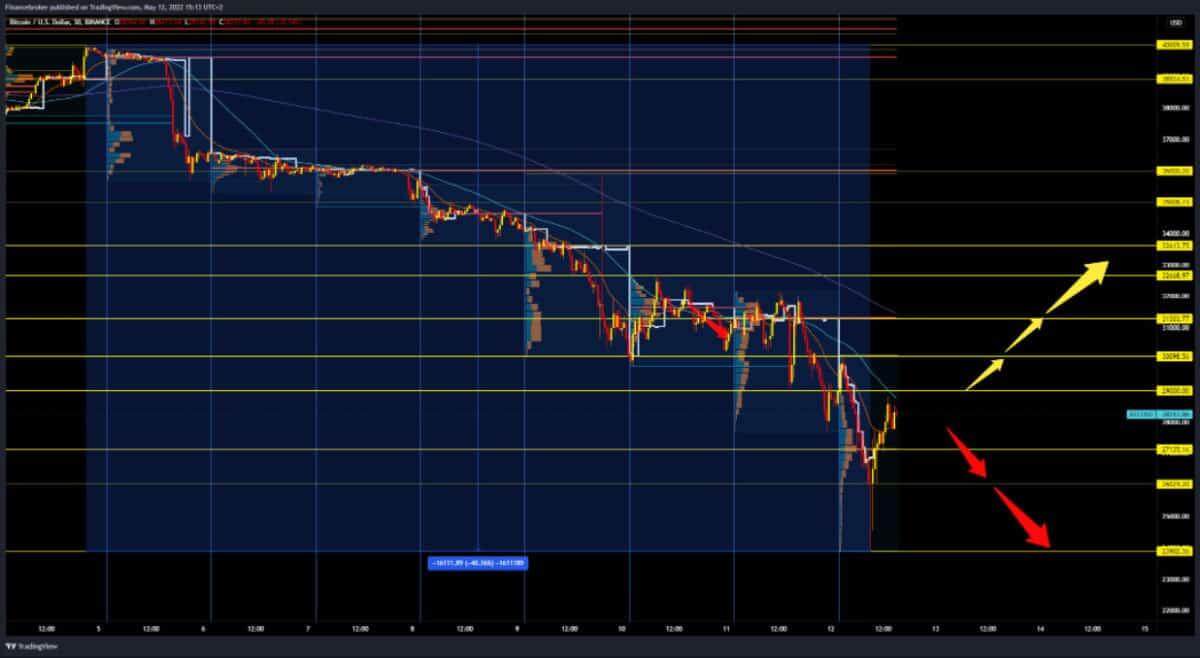

12 May chart overview for Bitcoin and Ethereum

Bitcoin chart analysis

The bitcoin price continued its bearish trend and dropped to 23,900 dollars early this morning. Bitcoin has lost 40% of its value since the beginning of May. drop from $ 40,000 to $ 23,900. The price dropped quickly from the minimum and is now consolidating at 28355 dollars. If this recovery continues, our target is yesterday’s zone with the largest volume of 31300-32000 dollars. Break prices above could solidify the bullish reversal. We need a new negative consolidation for the bearish option, withdrawing the price first below $ 27,130, then $ 26,000. After that, we will probably test the previous lower low again. Break prices below would form new lows for Bitcoin this year.

Ethereum chart analysis

The price of Ethereum fell to 1697 dollars this morning, forming May’s lower low. The recovery was quick and the price consolidated at the $ 1920 level. In the last two days, Ethereum has lost 30% of its value by falling from $ 3,450 to $ 1,697. If the price stays above $ 1890, then we can expect a potential recovery. Bullish targets are $ 2,000, $ 2,100, $ 2,200, and so on. For the bearish option, we need a new withdrawal below $ 1890. after that, the bearish pressure will increase, and we may revisit the $ 1697 level. Our bearish targets are $ 1,800, $ 1,700, $ 1,600, $ 1,500, and so on.

Market overview

The sharp decline in cryptocurrencies and stocks came after the U.S. Bureau of Labor Statistics announced that inflation in the U.S. rose 8.3 % year on year, slightly more than the forecasts of economists polled by Dow Jones.

That information worried investors and led them to “get out” of risky assets, including cryptocurrencies. Cryptocurrency prices continue to move strongly correlated with the S&P 500 index and, more recently, with the Nasdaq Composite.

But it could be worse. The cryptocurrency market could go in the direction of the “ice age”, where prices remain low for years and investors are gradually losing interest, said Paul Jackson, head of research on the distribution of funds from Invesco.

“The cryptocurrency market is under pressure for some time. The Fed remains with raising interest rates, which, in general, has caused great fear in the market, so the decline in shares and crypto assets continues, “says Michael Rinko, an associate at the brokerage house AscendEx.

This is the second time this week that bitcoin has fallen to around $ 29,000. Analysts say the $ 30,000 level is the psychological threshold for the largest cryptocurrency by market capitalization and could sink even deeper if it slips below that limit.

Federal Reserve Chairman Jerome Powell confirmed the determination of the American central bank to reduce inflation, announcing that a more aggressive increase in its interest rates is possible already at the Fed session in May.