What is day trading – Get all the crucial information

Have you ever wondered what Day Trading really is? What key elements do every successful day trader do in their daily trading routine? Whether you want to make Forex trading on trading platforms your full-time job or you have just started trading, you must know such a Forex strategy as day trading.

As a beginner who is just stepping into the market, you certainly have encountered the term Day Trading. But what’s it exactly? If you consider yourself a day trader, you are your boss. Thanks to advances in mobile technology, you can operate from your office or home or even on the go.

However, Day Trading is not for everyone, and there are a few things to keep in mind before you start trading financial markets, be it commodities, forex, or indices. This guide discusses Day Trading techniques with examples and some key things to remember for beginners.

The definition of day trading

No strategy always works, but even a straightforward daily trading strategy can help identify lower-risk, high-returns at essential points during the trading day. Besides, some traders would use the failure as a chance to place another. If the levels break, it can indicate that a new market trend has started, enabling other opportunities to profit.

If you want to invest in the stock market, you should know that there are several trading styles. Among them is Day Trading. As its name suggests, this strategy is based on making various trades during the same session.

Day Trading consists of opening and closing positions during the same session.

According to the definition, Day Trading involves buying and selling financial instruments (in the form of stocks, options, currencies, or futures contracts) during a single trading day.

In other words, it is a short-term investment strategy consisting of closing all its positions before the markets close: all the positions created by a day trader are closed on the same day.

We open and close one or more positions during the same session before opening others the next day. In this context, we can use the terms session trading or speculation.

The classic “Buy and Hold Strategy”

This type of strategy is opposed to the classic “Buy and Hold” strategy, which consists of buying and holding securities for the medium or long term and then reselling them at a high price.

The main objective when day trading is to multiply potential small gains to achieve an overall positive trade at the end of the day.

The Day Trader is thus often satisfied with gains of between 0.5 and a few percent on each transaction, but he compensates by placing many orders per day, sometimes up to several dozen. It also seeks to make more winning trades than losing trades, ensuring that you lose as little as possible on losing trades.

Day Trading and its rise in popularity

The possibility of day exchanging has expanded in prevalence over ongoing years. IT innovation has had a major impact on this – because of quick broadband and versatile associations, we have abundant, continuous market data readily available.

That has prompted many more individuals to get to the business sectors through day trading, all in all, setting trades for the day to attempt to benefit from unpredictability as market prices jump and go down.

In any case, what systems could you use at any point? Would it be good to keep it basic or use something more complex? As a day broker, You are your boss. Thanks to advances in mobile technology, you can operate from your office or home or even on the go.

Intraday trading strategies

Day trading is a common short-term trading strategy that involves buying and selling financial instruments to close positions at the end of the day to benefit from small price movements.

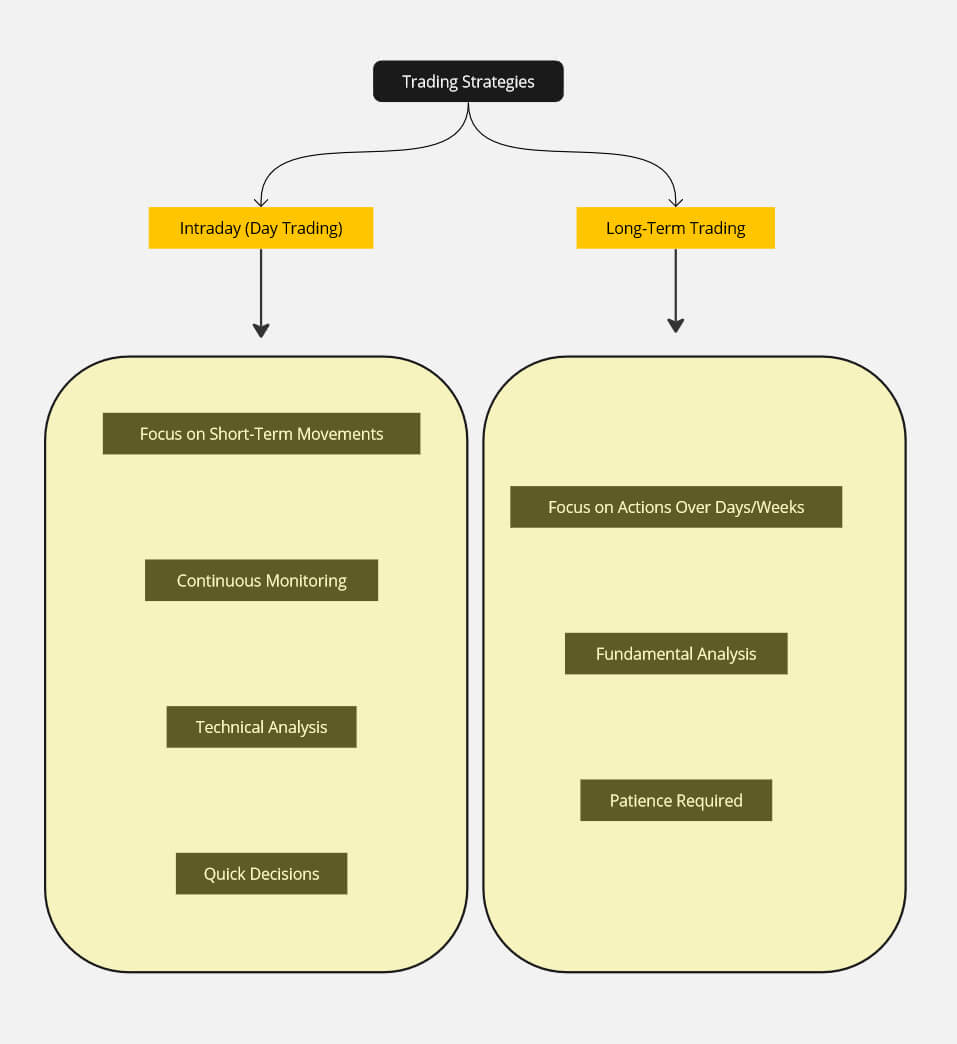

These strategies can differ from long-term strategies.

They focus more on profiting from short-term movements in the market than actions throughout several days or weeks. Intraday traders must be continually on the lookout and monitor their trades, as markets can flick in the short term.

Day traders should do technical analysis to quickly study trading charts and patterns, rather than fundamental analysis, which requires much more time and patience and is unsuitable for such a volatile trading method.

Technical analysis

Numerous informal traders utilize specialized tech tools and would prescribe a ‘spotless’ way to deal with their trading methods. These traders don’t want to stack their diagrams with bunches of various indicators to attempt to re-think trading directions.

Rather, they will zero in exclusively on values and prices; it’s frequently alluded to as ‘price action day trading. While trading along these lines, you have some key reference points in light of what has already happened on the market to assist you with planning future trades.

For many day traders, the earlier day’s high and low are significant levels to watch regarding arranging a system for that day.

This is an entirely coherent method: the previous high denoted the point where market sentiment has changed while the sellers returned to the market, making the market prices go down. The market consensus, subsequently, was that the prices were excessively high. What’s more the earlier day’s low points out where the purchasers recaptured certainty as they felt the market prices were undervalued.

These levels could be significant if they become possibly the most important factor and can give the foundation of a day exchanging system.

How day trading works

In general, Day Trading applies mainly to assets that show high volatility. The most suitable markets for Day Trading are stocks, indices, cryptocurrencies, or Forex investments.

Within Day Trading itself, there are several investment strategies, including Trend Trading, which consists of analyzing the direction of asset prices and buying or selling according to the trend observed;

Scalping – Explained

Scalping, which is based on purchases and sales over a very short period (a few seconds or a few minutes) to take advantage of micro-variations in price; Swing, which tries to detect in advance and take advantage of small reversals in short-term price changes;

Day trading strategies are logically different from longer-term trading strategies because they focus primarily on the profits from short-term market movements rather than medium to long-term potential.

Be careful, as always, in the stock market. None of these strategies guarantees a return for sure. Therefore, everyone should opt for the strategy best suited to their needs and ambitions, being aware of the risks of loss incurred. The capital invested may be partially or totally lost.

The benefits of day trading

The main advantage of Day Trading is to allow investors to speculate on a wide variety of markets and to pocket gains quickly and regularly. In particular, unlike traders who invest for the long term, day traders can generate profit even on a falling stock thanks to short selling, which consists of selling stock to buy it back later.

Moreover, with a very short market position, there is generally less risk of experiencing an unexpected change. Finally, day traders must remain vigilant and do not need technical knowledge to engage in this trading style. Some do not take the time to study the financial health of a company and its projected profits to make decisions.

The disadvantages

This style of trading requires a lot of time and a high level of dedication to the stock market: beyond buying and selling multiple assets during the same session, day traders buy and sell several times during the same session. Clearly, they follow the slightest price variations throughout the day to enter and/or exit a market at the best possible time. In addition, Day Trading requires concentration, great flexibility, and determination.

This technique involves making decisions quickly and placing many orders each day for an often relatively small gain on each transaction.

Finally, it is important for investors to master the operating rules of the markets in order to make the best possible decisions at the right time. Otherwise, significant and/or numerous losses are to be feared.

In other words, Day Trading is generally unsuitable for casual or beginner investors because the goal is to be very active in the markets and always try to stay one step ahead.

And like any activity on the stock market, it involves a risk of total or partial loss of the capital invested.

How to profit from day trading?

To practice Day Trading, two conditions must be met: market liquidity and high volatility. In other words, you ought to be able to enter or exit the market at any time, with a counterparty ready to buy back your assets or sell them to you. There must be significant price variations for you to generate profits during the session.

Also, to succeed in this style of trading, it’s important to know how to use technical analysis, an analysis method based on the study of technical indicators (often more relevant in this context than fundamental analysis, which makes it possible to evaluate the intrinsic value of an asset and to analyze the factors that may influence its future price, as mentioned above) and thus be able to study stock market charts to understand price variations.

Finally, it is important that the investor closely follows all the news that can potentially influence the markets to be able to act quickly in the event of variations.

Bottom line

Day trading is a widely adopted method of buying and selling securities in the stock market within a short time frame. Although it has the potential to generate profits, it also carries a considerable risk of loss. To be successful, day traders must have discipline, knowledge, and a willingness to take calculated risks. Quick decision-making based on changes in stock prices is crucial to succeed in day trading.

A well-defined strategy is key to successful day trading, including setting stop-loss orders and adhering to predetermined entry and exit points. Furthermore, day traders must possess extensive knowledge about the market, including technical and fundamental analysis, and stay updated on news and events that could potentially impact stock prices. They must also manage the psychological pressures that come with making quick trades, such as fear, greed, and anxiety.

In conclusion, day trading can potentially provide significant rewards in the stock market if traders have the right mindset, skills, and strategies. However, traders must also be aware of the risks and be ready to handle the psychological pressures of making quick trades. With discipline and a thorough understanding of the market, day trading can be a profitable approach to trading securities.

-

Support

-

Platform

-

Spread

-

Trading Instrument