What does the Australian Financial Security Authority do?

The Australian Financial Security Authority AFSA represents an executive agency in the Attorney-General’s portfolio. They are responsible for the regulation, monitoring and administration of the personal proceeds of financial crime, the personal insolvency system, and the Personal Property Securities Register (PPSR) administration.

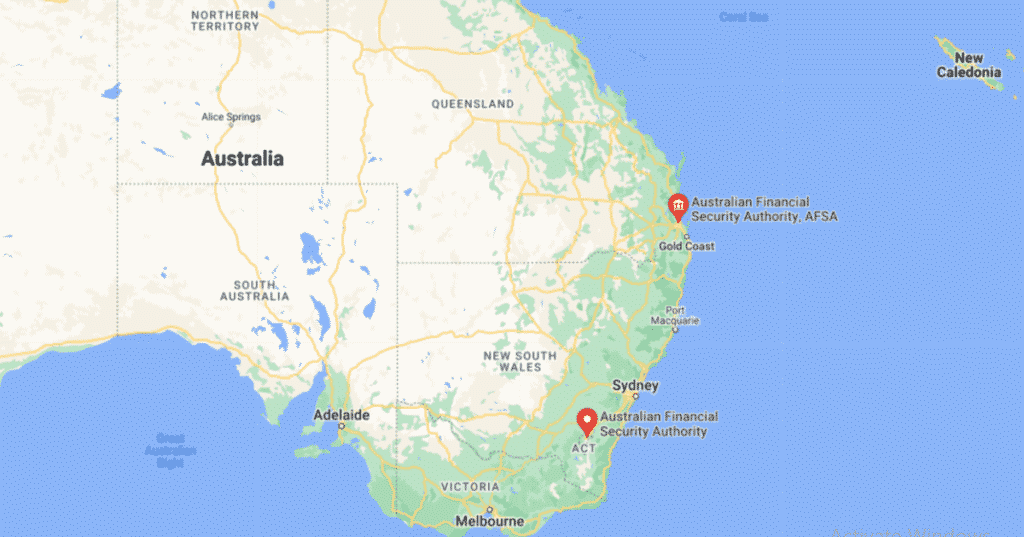

Australian financial security authority address

If you are already involved in a trade or the world of investing,

there are many situations to seek the address of the Australian financial security authority. You can send any documents or forms online. Please see the postal addresses below if you need to send something via post.

Australian Financial Security Authority

GPO Box 1550

Adelaide SA 5001

and

Australian Financial Security Authority

GPO Box 821

Canberra ACT 2600

For

- Bankruptcy applications

- Bankruptcy by sequestration order forms

- Temporary debt protection (TDP) application,

- debt agreements

- application of bankruptcy and personal property securities laws

State office postal addresses

- Returning the electronic payment application form

- Form authorizing payments or refunds by Electronic Funds Transfer

Finance Officer

National Offices

Australian Financial Security Authority

GPO Box 821

Canberra ACT 2601

Adelaide

Australian Financial Security Authority

GPO Box 2604

Adelaide SA 5001

Brisbane

Australian Financial Security Authority

PO Box 10443

Adelaide St

Brisbane QLD 4000

Melbourne

Australian Financial Security Authority

GPO Box 2851

Melbourne VIC 3001

Perth

Australian Financial Security Authority

GPO Box 2604

Adelaide SA 5001

Sydney

Australian Financial Security Authority

GPO Box 548

Sydney NSW 2001

The roles of the Australian Financial Security Authority AFSA

Australian Financial Security Authority Protects investors.

Investors must receive protection against any manipulation and any misleading or fraudulent practice, such as insider trading, non-compliance with the priority rules, and the misappropriation of client assets.

The most important way to ensure investor protection is the obligation to publish all the information on which the decisions are based, investors.

Investors can thus better perceive the gains and risks potential resulting from their investment and best protect their interests.

High-level, internationally recognized auditing standards are a key element of the Australian Financial Security Authority’s obligation.

The minimum level of own funds, which the Licensee and Authorized Persons must maintain upon departure and throughout their activity. They must be fixed in such a way as to allow securities firms to be in a situation that will allow them to honour the requests of their counterparties at any time and, if necessary, to liquidate their activities without incurring any loss for their customers.

Moreover, the supervision of market intermediaries must ensure the protection of investors by setting minimum standards for each stakeholder.

Investors must receive fair and equitable treatment from market intermediaries following ethical standards. A complete system inspection system must be established, and programs ensure the follow-up and the respect of the laws and regulations.

Investors in financial markets are particularly vulnerable to possible abuses perpetrated by intermediaries and other stakeholders, while each investor has only recourse possibilities relatively limited by himself.

In addition, the complexity of corporate actions such as fraudulent arrangements requires rigorous application of financial laws. Furthermore, with each violation of the law, the investors must be protected by strict application of the law.

Investors must be able to benefit from impartial procedures (courts or other dispute resolution procedures) or mean ensuring the recovery and compensation for damages caused by any unlawful act.

The effectiveness of the monitoring and enforcement of laws and regulations depends on close cooperation between the Australian Financial Security Authority and international level instances.

Ensuring that markets are fair, efficient and transparent the necessary approval by regulators of market and system operators trading and stock market rules helps ensure market fairness.

Fair markets go hand in hand with investor protection and, in particular, with the prevention of reprehensible practices. The market structure should not be likely to favour some participants over others unjustifiably. Furthermore, the regulation in place must detect, neutralize and punish any manipulation of the market and any other fraudulent practice.

As much as possible, regulation should assure investors that they enjoy fair access to market facilities and information relating to the market and prices. It must also promote market practices to ensure fair processing of orders and a reliable pricing process.

In an efficient market, useful information circulates widely and without delay. So, it is reflected in the pricing process. Regulation should promote market efficiency.

Australian Financial Security Authority provides transparency.

Transparency can be defined as the relative availability of information from the market (both before and after the negotiation of an operation) to the public in real-time.

Information before the negotiation of a transaction concerns access to firm purchase and sale offers, allowing investors to know relatively reliably whether a transaction is possible and at what price.

Information after the negotiation of a transaction relates to the prices and volumes of all transactions already concluded. So, regulation must ensure transparency at the highest level.

Australian Financial Security Authority Reducing systemic risks

In cases where, despite these measures, a financial failure occurs, its impact should, as far as possible, be reduced by the regulation in place and, if possible, confined to the failing institution.

The market intermediaries must therefore maintain a level of funds adequate equity and comply with other prudential requirements.

Additionally, if necessary, an intermediary must be able to liquidate his business without incurring a loss for its customers and counterparties or systemic damage.

Risk-taking remains an essential element of any market activity, and regulation should not unnecessarily hamper legitimate risk-taking.

On the contrary, regulators must enable and promote effective risk management by ensuring that requirements relating to the minimum level of capital and other prudential rules are sufficient to deal with appropriate risk-taking, absorb certain losses and control excessive risk-taking.

It is therefore essential to have an efficient clearing and settlement process and be subject to adequate monitoring and using effective risk management tools.

Moreover, the processing of failures must benefit from effective and safe devices in terms of legal. This question goes beyond the framework of financial laws and calls on the cessation of payment provisions of a jurisdiction.

Events occurring in another jurisdiction or internationally may constitute factors of instability.

The responses provided by the regulators to market dysfunctions must aim to restore market stability both nationally and internationally, which implies a climate of cooperation and exchange of information.

Australian Financial Security Authority – The regulatory environment

The Australian Financial Security Authority should facilitate capital formation and economic growth. Furthermore, the regulation must consider the need to recognize the advantages of competition in markets.

Regulation is necessary for achieving all three objectives. However, it should be borne in mind that any inadequate regulation may constitute an undue burden on the market and hinder its growth and Its development.

Moreover, one can identify general characteristics inherent ineffective regulation and consistent with healthy economic growth: absence of unnecessary barriers to entry and exit from markets and products, access to the market must be open to any type of participant who meets the imposed admission criteria,

- in the development of the policy governing the markets, the supervisory bodies’ regulation must take into account the possible implications of these requirements,

- regulatory constraints must apply equally to all those who make or agree to make a financial commitment specific.

On a more general level, an adequate and effective legal, fiscal and accounting framework must be established to enable financial markets to function. So, the laws and financial regulations cannot exist independently of other laws and obligations that account in force in a particular jurisdiction.

Independence and responsibility

The regulator is operationally independent of political interference or outside commercial influence in the exercise of its functions and its powers. Moreover, it must be solely responsible for using the powers and resources at its disposal.

In fact, this independence is necessary for the availability of the regulator of a source of steady income.

In some jurisdictions, specific aspects of the regulatory policy are subject to consultation with the government, a ministry or any other authority, or even in some cases, they must approve.

The circumstances in which such consultation or approval is required or permitted shall be clear. The process must be sufficiently transparent or subject to review to guarantee its integrity. In general, it is not suitable, in such circumstances, to include decision-making authority over day-to-day technical matters.

Liability involves:

- a regulator that operates independently of sectoral interests,

- a system of public accountability of the regulator,

- a system allows judicial review of the regulator’s decisions.

When liability is assumed through a government entity or any other external authority, the confidential and commercially sensitive nature of most of the information made available to the regulator must be respected. Such information needs protection from disclosure or misuse by the installation of safeguards.