USD/JPY shorter dollar recovery

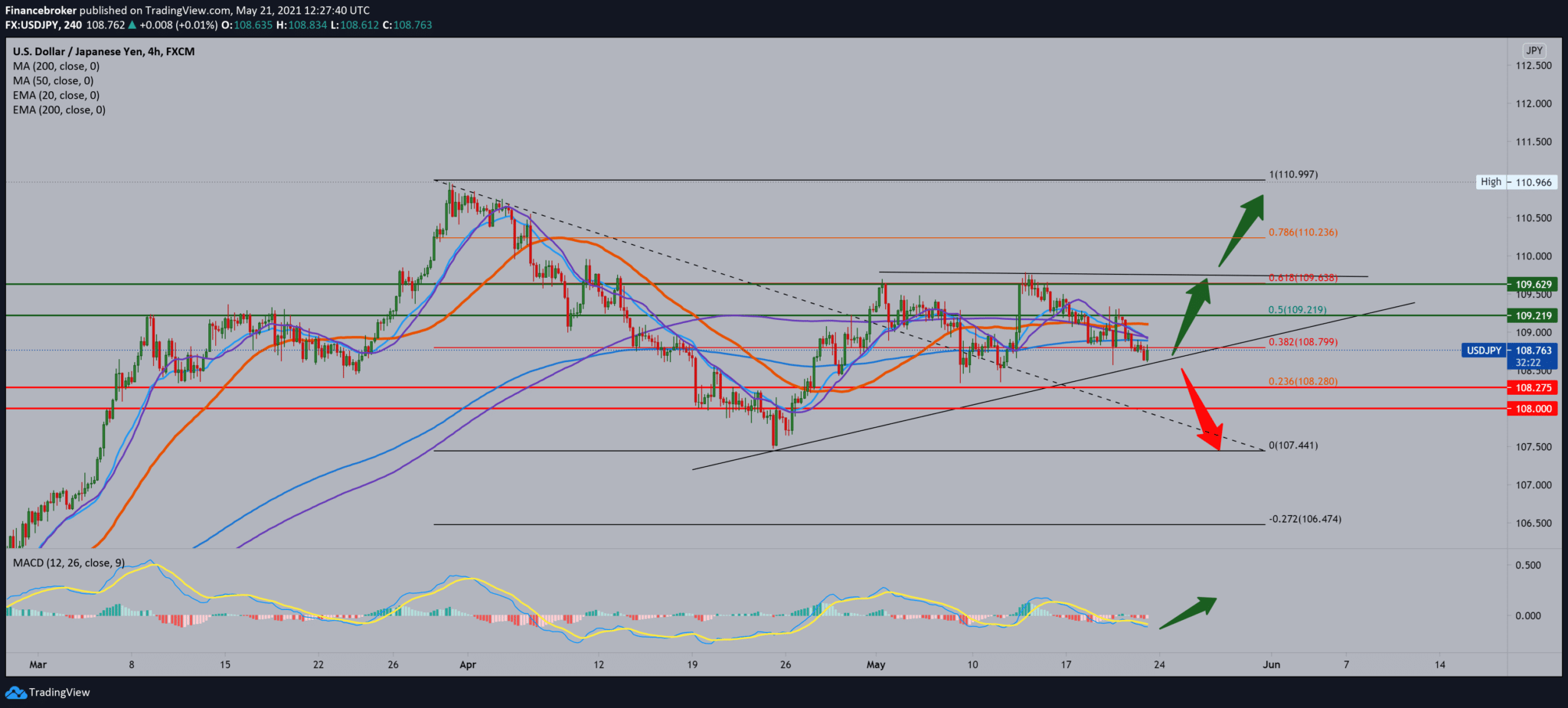

In the last month, the dollar has managed to make some gains against the Japanese yen. After descending to 107.50, we make a pullback to 61.8% Fibonacci level at 109,650, and then we find ourselves inside consolidation. We find support at 108,500 at 38.2% Fibonacci level. We could also draw a smaller trend line that can serve as a potential support line.

The bullish scenario is to see here now the deduction from these supports, and again we move towards 61.8% Fibonacci level, trying to break that resistance zone and move towards 110.00.

The Bearish scenario had a break below the support line and a drop and tasting of 23.6% Fibonacci levels to 108,200, with a view to the previous low at 107,500. All moving averages are on the bearish side, while the MACD indicator is also on the bearish side, but the signal slows down, and there is a chance that we will get a bullish signal if the dollar strengthens.

For the USD/JPY currency pair, we can single out the following economic news and statements of officials:

Data released by the Ministry of Labor on Thursday morning shows that the requirements for unemployment in the USA decreased by slightly more than expected in the week ending on May 15. The data showed that initial unemployment claims in the U.S. fell to 444,000 last week, compared to a revised 478,000 claims the previous week. Economists expected the unemployment demand to fall to about 450,000 in the week ending May 15.

Significantly higher than the expected reduction in the number of unemployed makes that number the lowest since the week that ended on March 14, when it dropped to 256,000.

Japan fell further in deflation, as total consumer prices fell 0.4 percent year-on-year, the interior and communications ministry said on Friday – after falling 0.2 percent in March. The core CPI, which excludes volatile food prices, was stable at -0.1 percent a year.

Japan’s manufacturing sector continued to expand in May, albeit at a slower pace, according to the latest Markit Economics survey on Friday, with a record PMI in production of 52.5. That is less with 53.6 in April, but it is still above the line of shooting or falling. The growth of production and new orders decreased in the last research period. Producers remained confident in hiring additional staff as job creation continued for the second month in a row. Positive sentiment rose in May, with the level of optimism being the strongest since the survey was questioned in July 2012.

-

Support

-

Platform

-

Spread

-

Trading Instrument