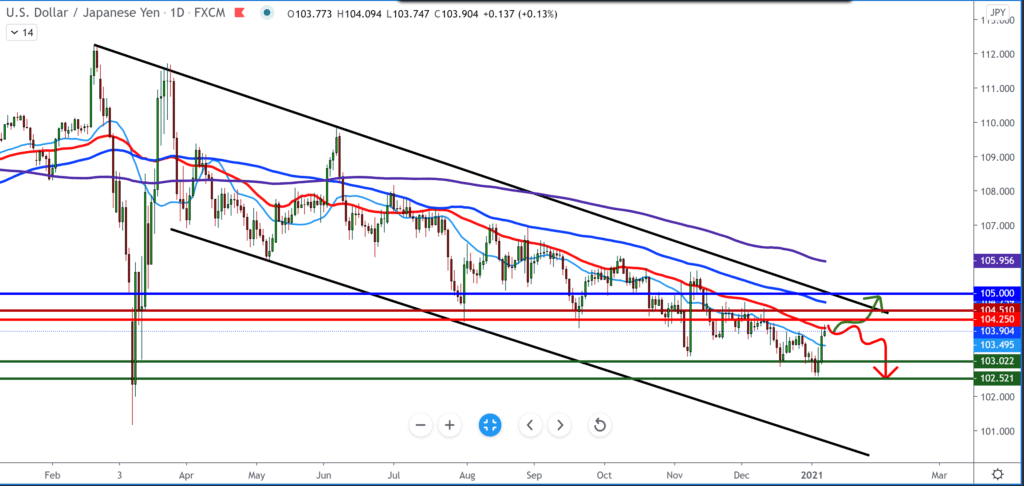

USD/JPY forecast for January 8

Looking at the chart weekly, we see a strong bearish scenario, with a pullback within the weekly candlestick. In this time frame, we see that our solid resistance is run by the average MA20 (light blue line). This week’s candlestick is bullish and will probably close. On the bullish option, if we see it at all, it will be short-lived.

On the daily time frame, we see the pair moving bearish since March last year, leaving no dollar of room to make a turnaround to the bullish side. At this time frame, the pair tested the moving average of the MA50, which proved to be a solid resistance pushing the pair down to lower levels. Yesterday we had a strong bullish candlestick, while today, the situation is different and movement within the day is very limited.

On the four-hour time frame, we see a different picture, the short-term bullish option. The pair is supported by all 4 moving averages MA20, MA50, MA100, MA200, but we are close up to the falling trend line. The pair made the jump to 104,150 and made a pullback to 103,800 with support for the MA200. If we see a break below MA200, we are looking for support at 103.50 and below that at 103.00.

U.S. futures are slightly higher ahead of Friday’s opening, as traders are diverting attention from Capitol Hill to the December business report as well. The report on jobs today will provide an interesting insight into the economy’s state as new restrictions are imposed on it. The country may not be completely locked yet, but the numbers are shocking, and new strains make the problem even bigger. The unemployment rate is also expected to be higher at 8.7%, but currently, it is not worth reading too much about it. Participation will also be important, but, in the end, the numbers in the coming months will probably be far worse and will give a much better insight into the level of support needed and the size of the task.

-

Support

-

Platform

-

Spread

-

Trading Instrument