USD/CNH Bearish, USD/CAD Another Test Support Zone

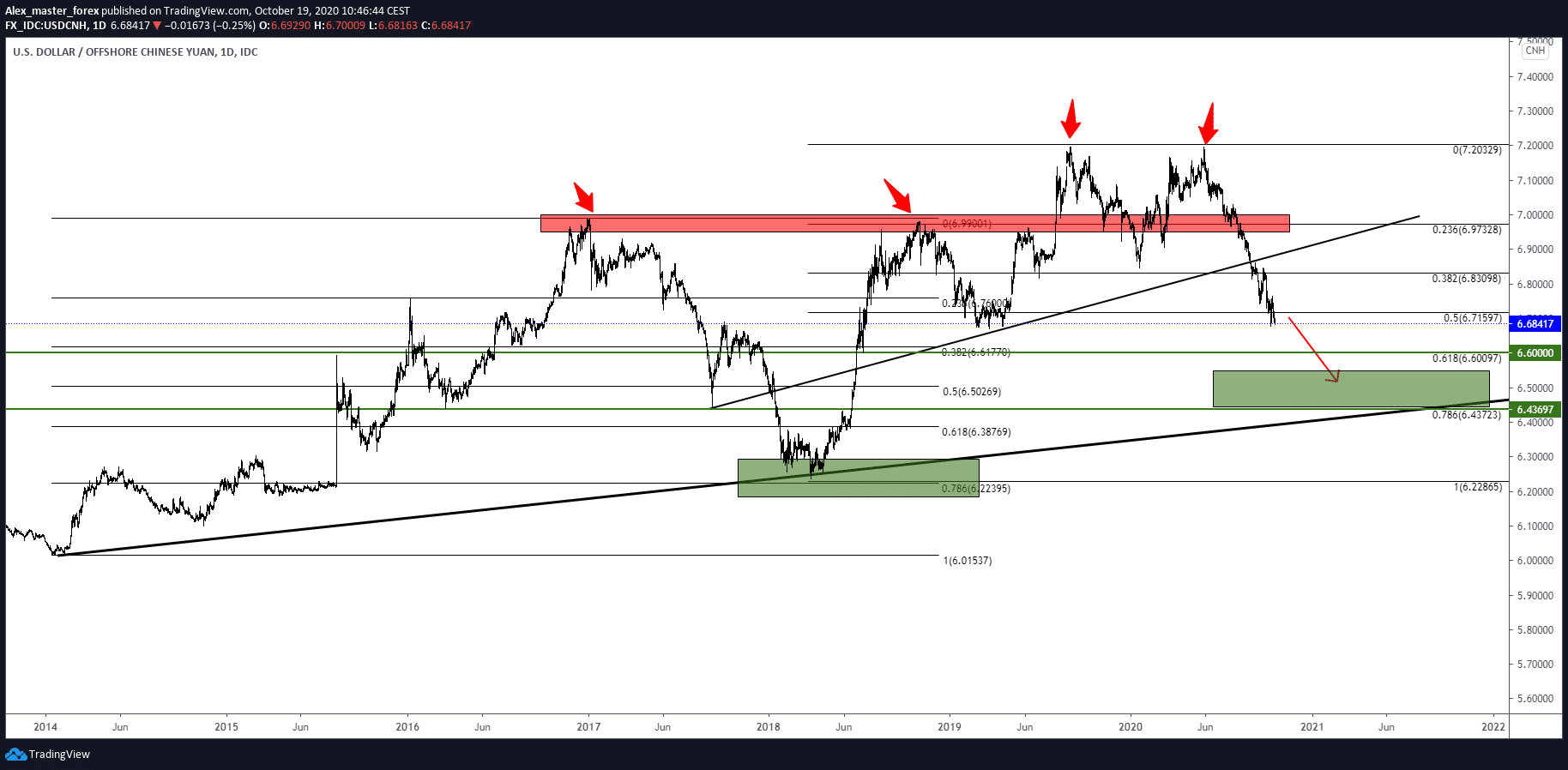

USD/CNH bearish

Looking at the chart and following the bottom trend line and fibo levels we have a rejection at 78.6, and the probability that we will see a rejection at a similar position again. Upstairs we have 4 peaks and always pull-back after them, and the mini support trend line has been broken. the current movement of the dollar is seen as part of the consolidation phase and the USD could trade between 6.6850 and 6.7850 over a period of time, and even up to 6.45000 in the next month or two.

Coronavirus cases in America continue to rise, plus the aid package has not yet been realized, and it all sits together on the backs of the dollar, while the Chinese yuan has no such pressures.

Corona cases are almost non-existent and China is recovering very well. There are still risks ahead such as renewed external weakness and of course renewed virus cases. Indeed, lockdowns in many major economies may weaken demand for Chinese goods. Also some high frequency Chinese data are beginning to lose momentum, suggesting that the pace of recovery may be slow. China reported that its economy grew by 4.9% year on year in the third quarter of 2020, worse than expected. However, the gross domestic product hindered the growth of imports, which is a sign of growing consumption in the second largest world economy.

The Chinese economy depends on demand from other places, and an increase in the number of COVID-19 cases in Europe may slow growth.

For now, the dollar continues to fall, and the Chinese yuan is rising.

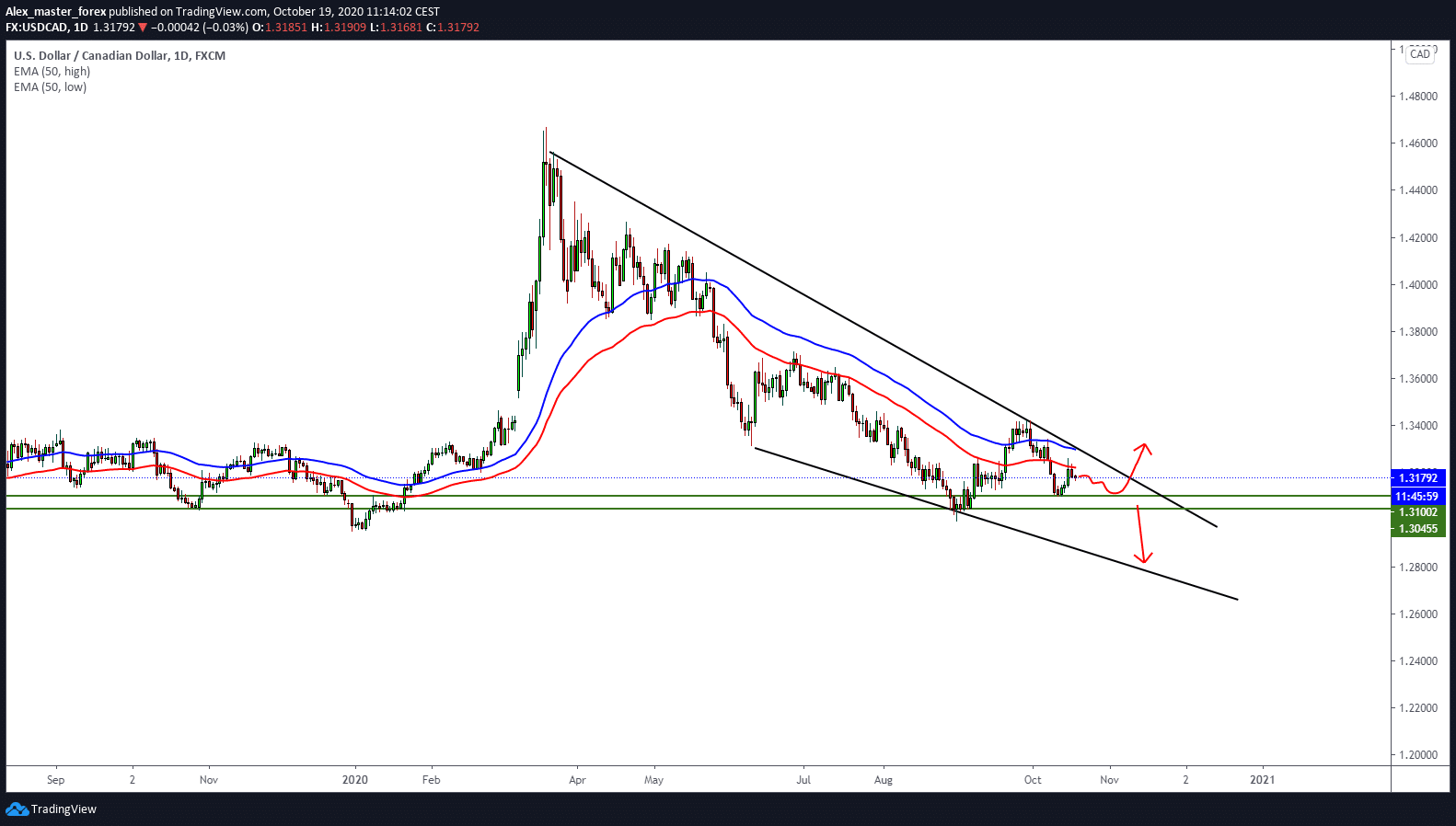

USD/CAD another test support zone

During the London session the dollar loses strength while the smaller currencies use it, in this case the Canadian dollar. Viewed in this way, it is possible that USD / CAD is once again testing the support zone around 1.30500-1.31000.

“The drift lower is the product of two forces. First, the long-running retreat of the US Dollar in the wake of the March panic has not been replaced by a new scenario. Given the lack of competing ideas, the decline continues. Second, the main support of the dollar, aside from the occasional technical intervention, is still the risk-off trade. ”

There is no significant economic news today until tonight when FOMC members talk when we can expect market volatility.

-

Support

-

Platform

-

Spread

-

Trading Instrument