USD/CHF forecast for January 5

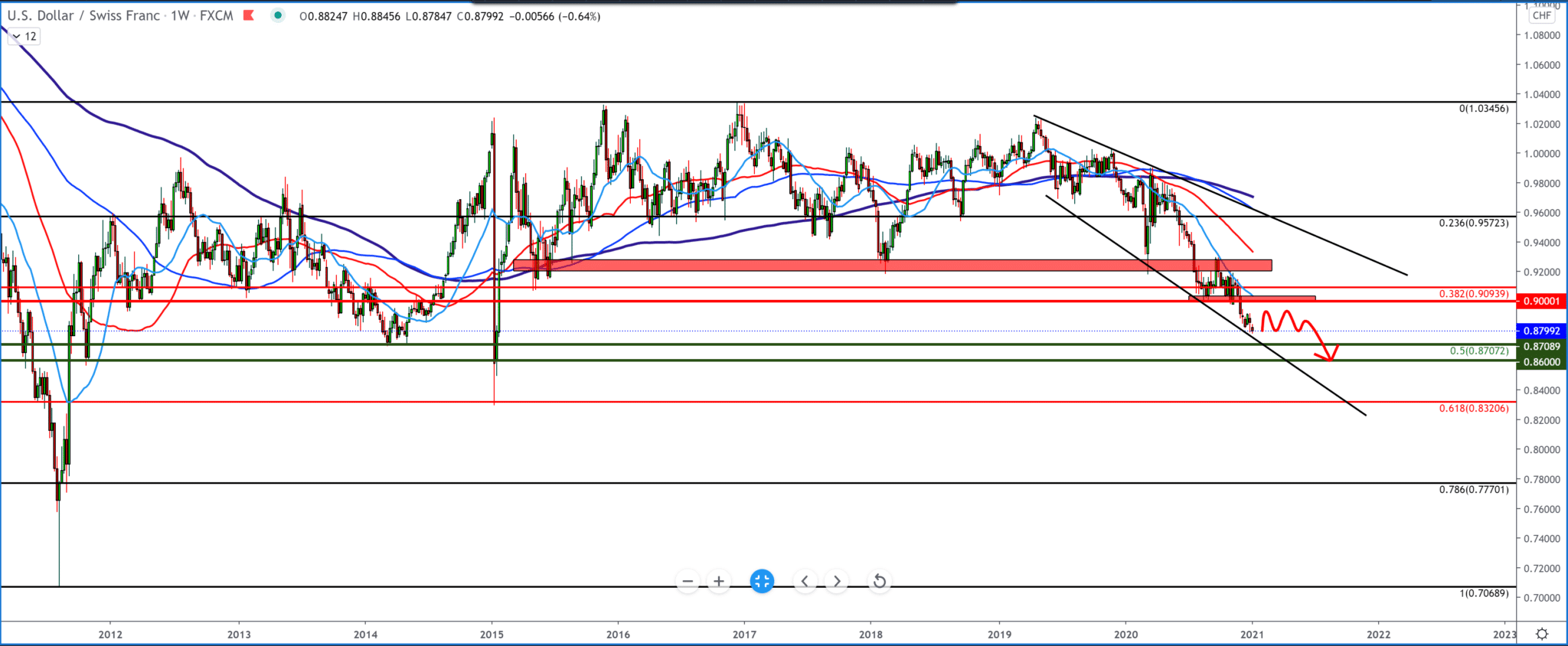

Looking at the chart on the weekly time frame, we see that the trend is strongly bearish and that if we are looking for some support, we can look for it at technical levels following potential consolidations. The pair is now at 0.88000, and a pullback is possible but as a short-term view to 0.89000, and a maximum of 0.90000 as a psychological resistance level. Of the moving averages, for now, the MA20 (bright blue line) can be useful, which is the first obstacle to the bullish option and the first resistance to the continuation of the bearish scenario. The pair can seek support at a Fibonacci level of 50.0% at 0.87000. Generally bearish scenario with a small possible pullback.

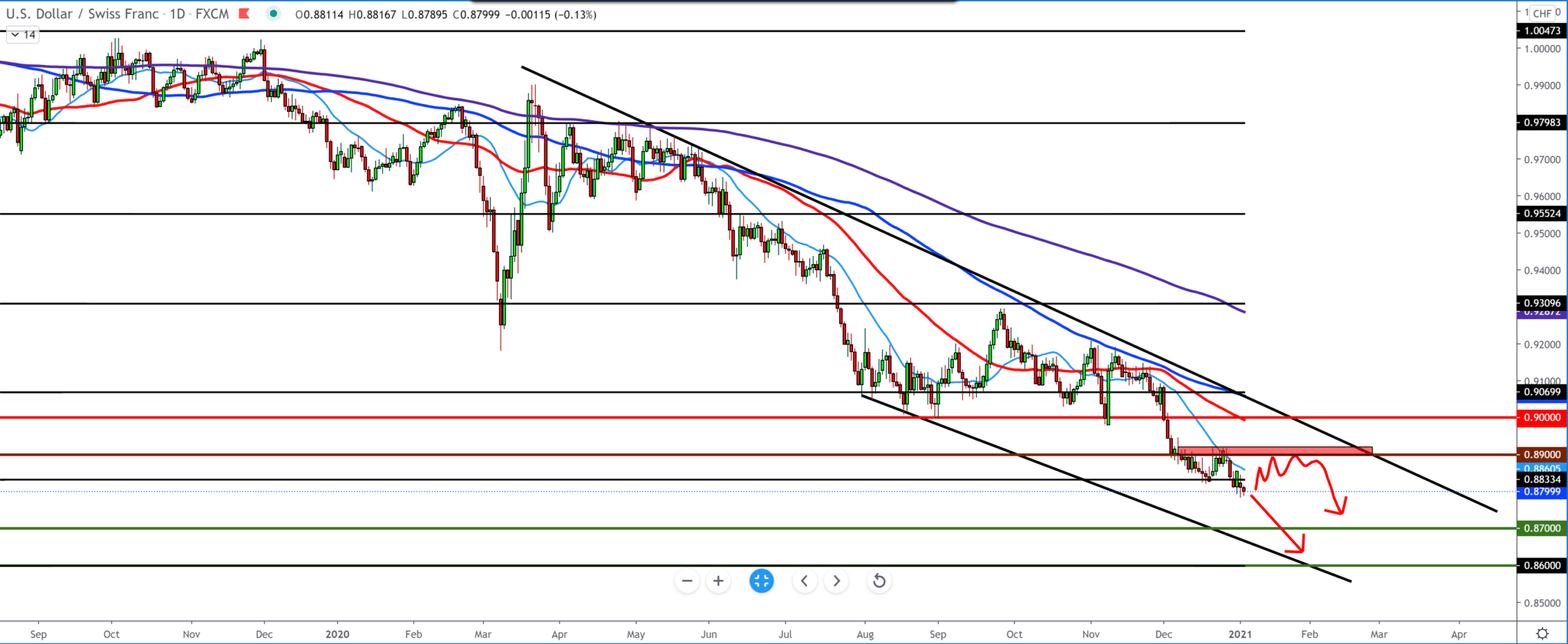

On the daily time frame, we see a large descending channel in which the pair moves with certain lateral consolidations. The previous big support was at 0.91000, but the dollar did not hold up and dropped to the current 0.88000. We had a smaller pullback to 0.89000, and there the pair encountered resistance from the first moving average MA20 (light blue line). Here, too, the bearish scenario is strong, and we will likely see a continuation of the same.

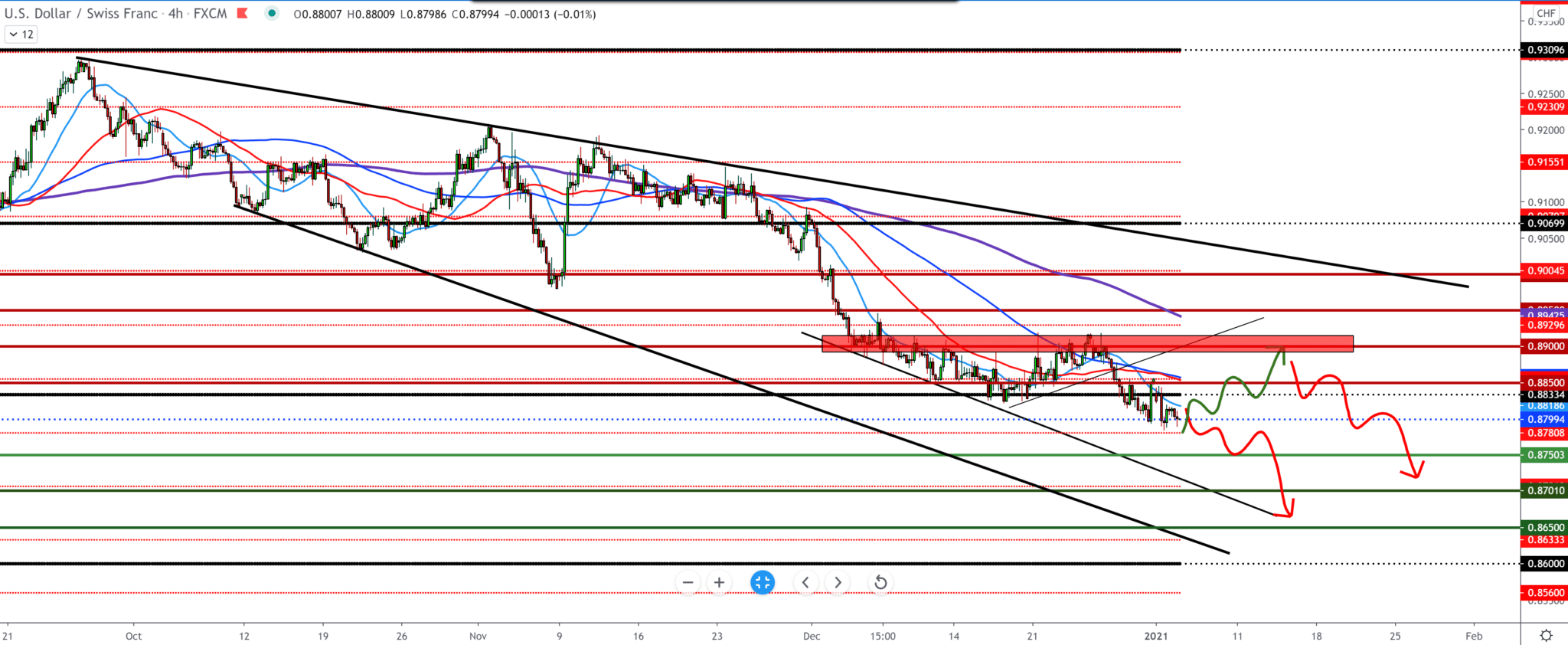

In the four-hour time frame, we see that the pair has found support at 0.87800 and that we can now expect consolidation in that zone of 0.87500-0.89000. The technical trend is still bearish, but as always, we can expect a shorter pullback to reach a better sell position. From the top, we need to pay attention to the moving averages that are moving according to the chart, and for now, they are a technical indicator of obstacles to the bullish option.

-

Support

-

Platform

-

Spread

-

Trading Instrument