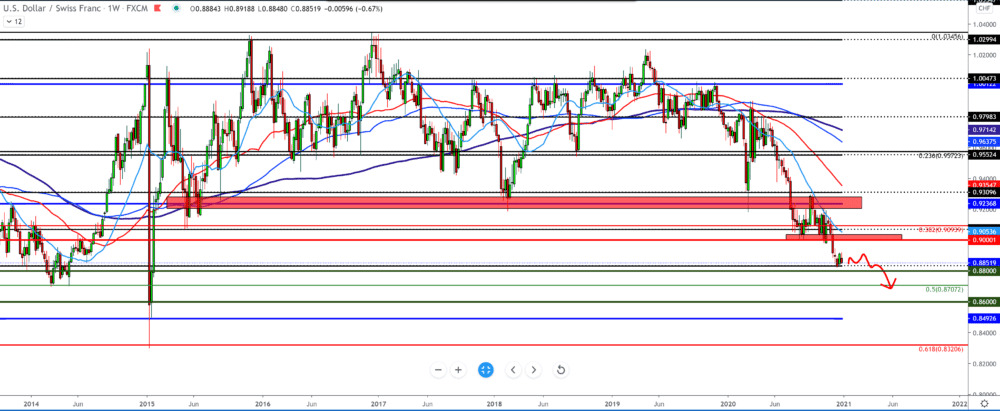

USD/CHF forecast for December 29, 2020

Looking at the chart on the weekly time frame, For the USD/CHF currency pair we see the bearish scenario’s continuation with a possible pullback as a minor respite to lower levels. The previous consolidation was around 0.90000, but the dollar did not hold up and lowered the pair to 0.88250, and technically there is a high probability that it will fall even lower to 0.87000 and then to 0.86000.

We need a good confirmation with candlesticks and a break above the moving averages for the bullish option, but none of that for now. If we see a pullback, it could only be up to 0.90000 as another retest to continue the bearish trend.

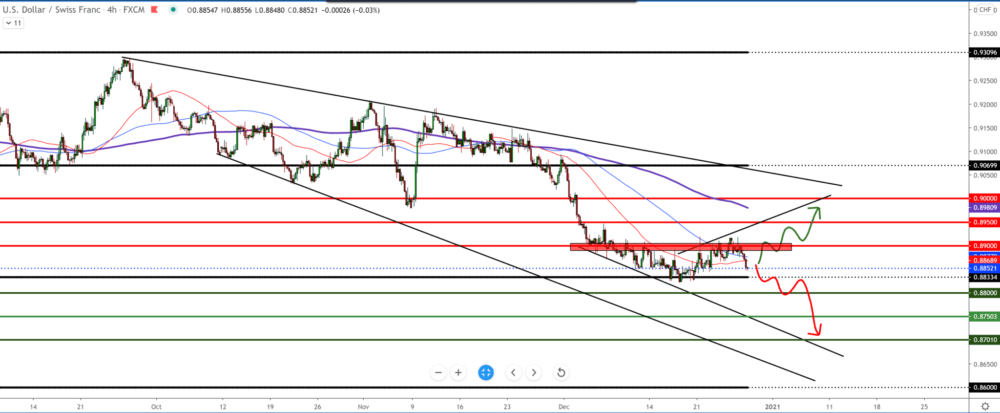

On the daily time frame, we see a large falling channel; we see that the dollar is still under great pressure and that for now, there are no signs of a potential reversal of the trend. The dollar has failed to break above 0.89000, and the USD/CHF pair tends to drop even lower below 0.88000. If we see the potential for a pullback, we can expect it up to moving averages of MA50 and MA100, which have so far proved to be good resistance to the dollar pushing it lower. The bearish scenario is still very likely.

On the four-hour time frame, we see a falling channel and support a little above 0.88000; if we are looking at the dollar globally, it is short-term, and we can expect a further continuation towards lower levels. The USD/CHF pair is currently testing moving averages of MA50 and MA100, and we can expect less consolidation by the end of the New Year holidays. If we see a pullback, it should be short-lived up to 0.90000 maximum, where the moving average MA200 is waiting for us.

-

Support

-

Platform

-

Spread

-

Trading Instrument