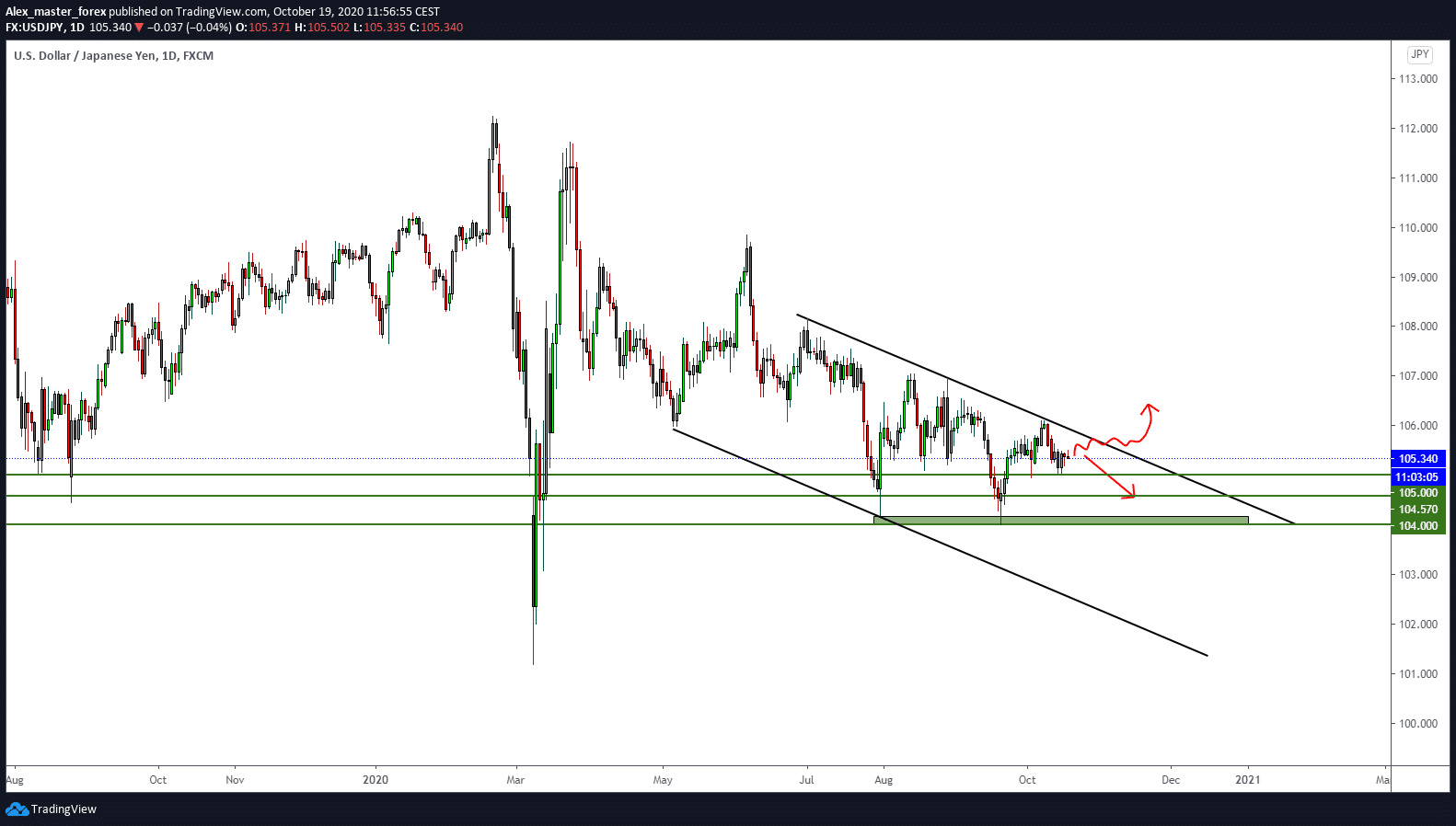

USD/JPY pressure on the dollar is pushing this pair down

Looking at the chart on a daily basis, we see that all of this is a continuation of the declining consolidation. There are no sudden shifts but the pair is going down, it is expected to slide below 105,000.

There isn’t any major market-moving economic data due for release on Monday. Hence, the key focus will be on a scheduled speech by the Fed Chair Jerome Powell. Apart from this, the broader market risk sentiment will play a key role in influencing the USD / JPY pair and produce some meaningful trading opportunities.

As for the crown in Japan, the number of infected is starting to grow, which could negatively affect the Japanese yen.

We can expect to continue upwards only when this pair will keep above 106,000.

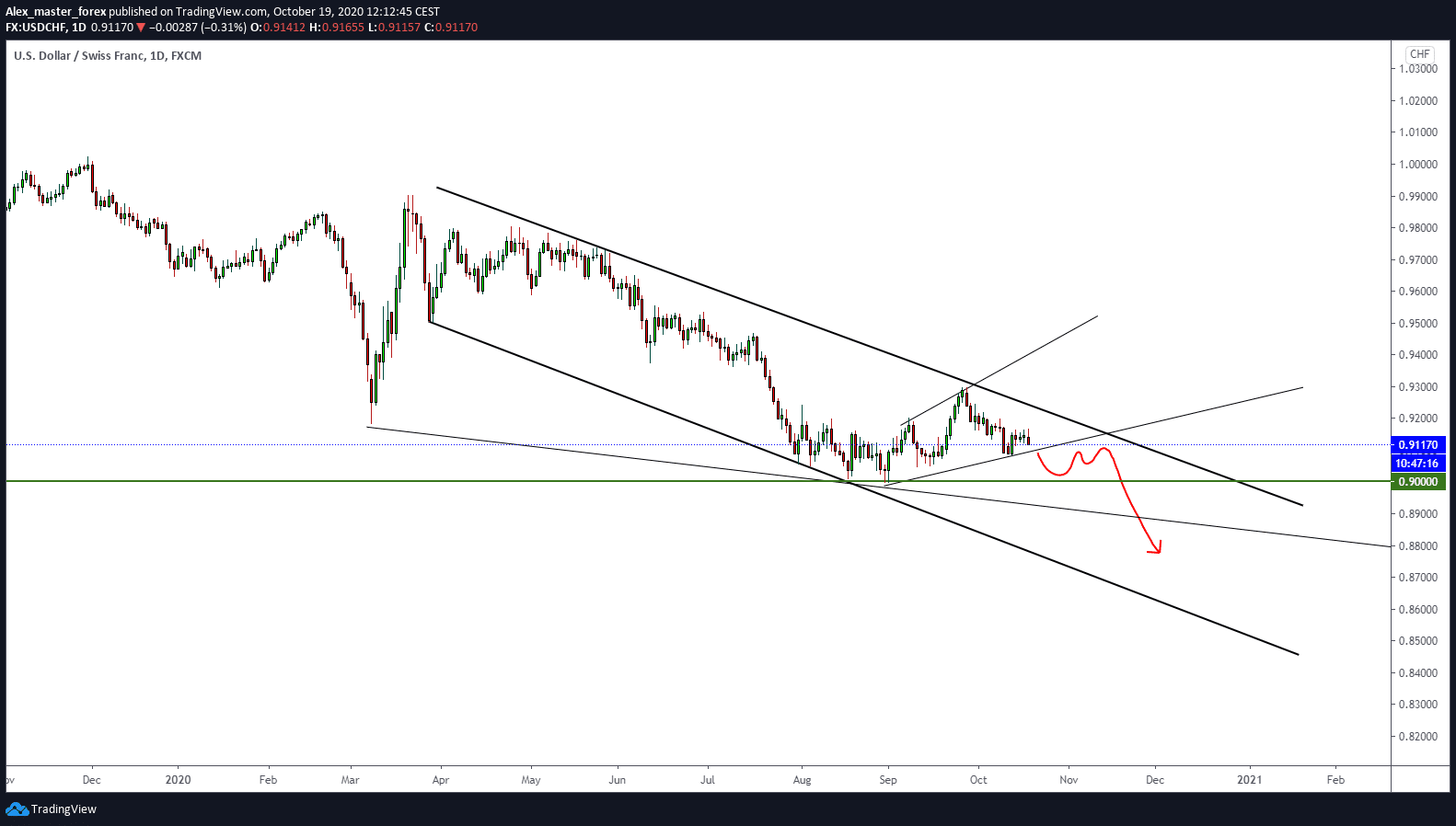

USD/CHF bearish black cloud

The pressure on the dollar continues, with an increase in the number of people infected with the coronavirus and without the financial package that Trump wants to put on the market, but without success, he is pushing the dollar into the red. The Swiss franc is generally stable, while the number of infected people has been constantly growing in the last month, marking a new record in the number of infected people. The day is without news until tonight the focus will be on the Barnier- Frost meeting and the Fed Chair Jerome Powell’s speech.

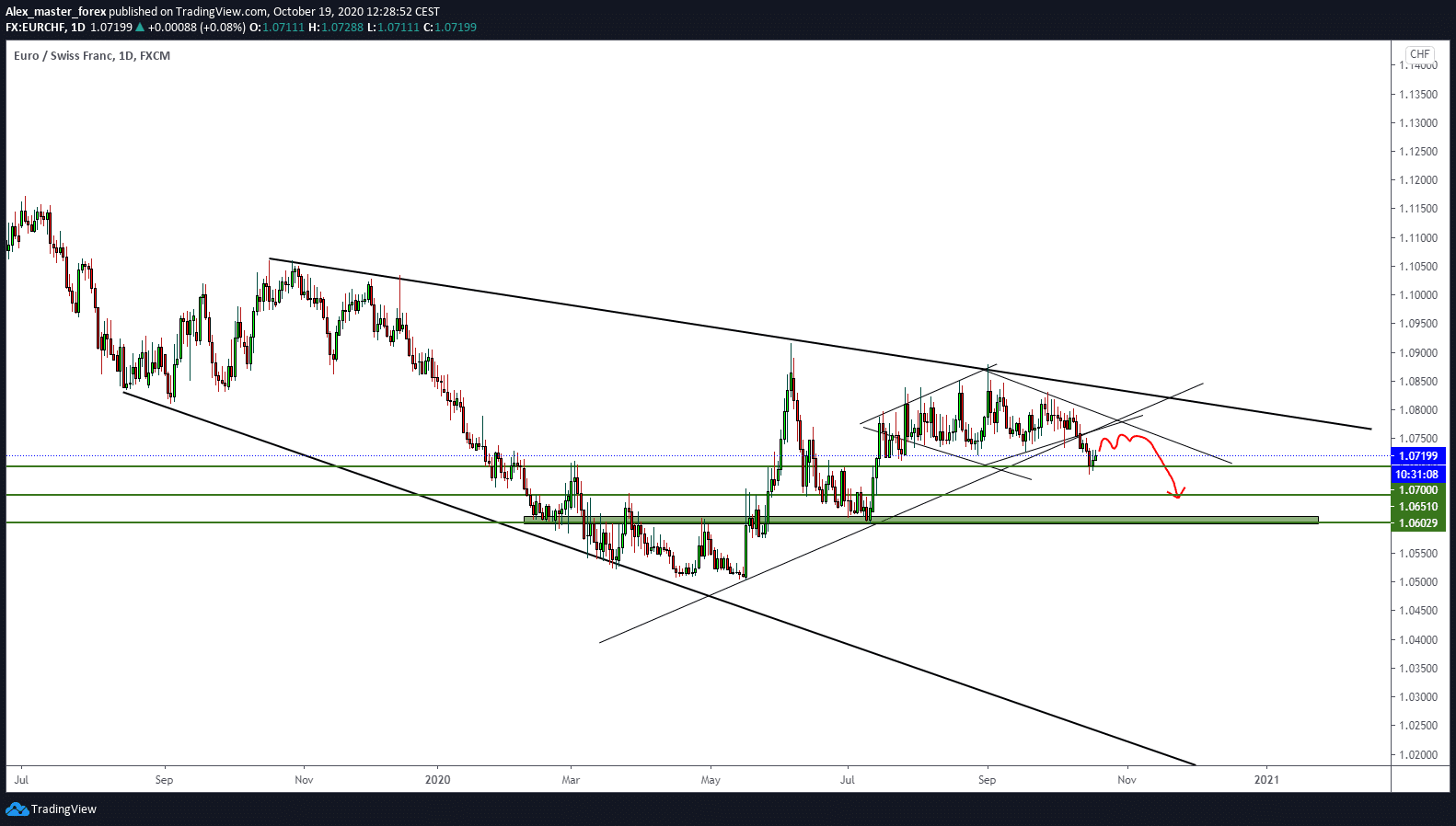

EUR/CHF bearish scenario

Looking at the chart on a daily basis we will see that the pair has dropped out of consolidation and it is now possible to retest on break consolidation and trend line before continuing to fall.

The corona has seen a rise in cases across Europe, but the Swiss franc as a safer currency has an advantage over the euro.

Also Check: Market News and Charts for October 19, 2020

The European Central Bank (ECB) governing council member, Robert Holzmann was out with some comments in the last hour, saying that more easing may be necessary if the coronavirus crisis worsens. There is no need for more easing yet. Later in the day, we will have more statements from the European Central Bank, which they will be and how they will affect, we’ll see.

-

Support

-

Platform

-

Spread

-

Trading Instrument