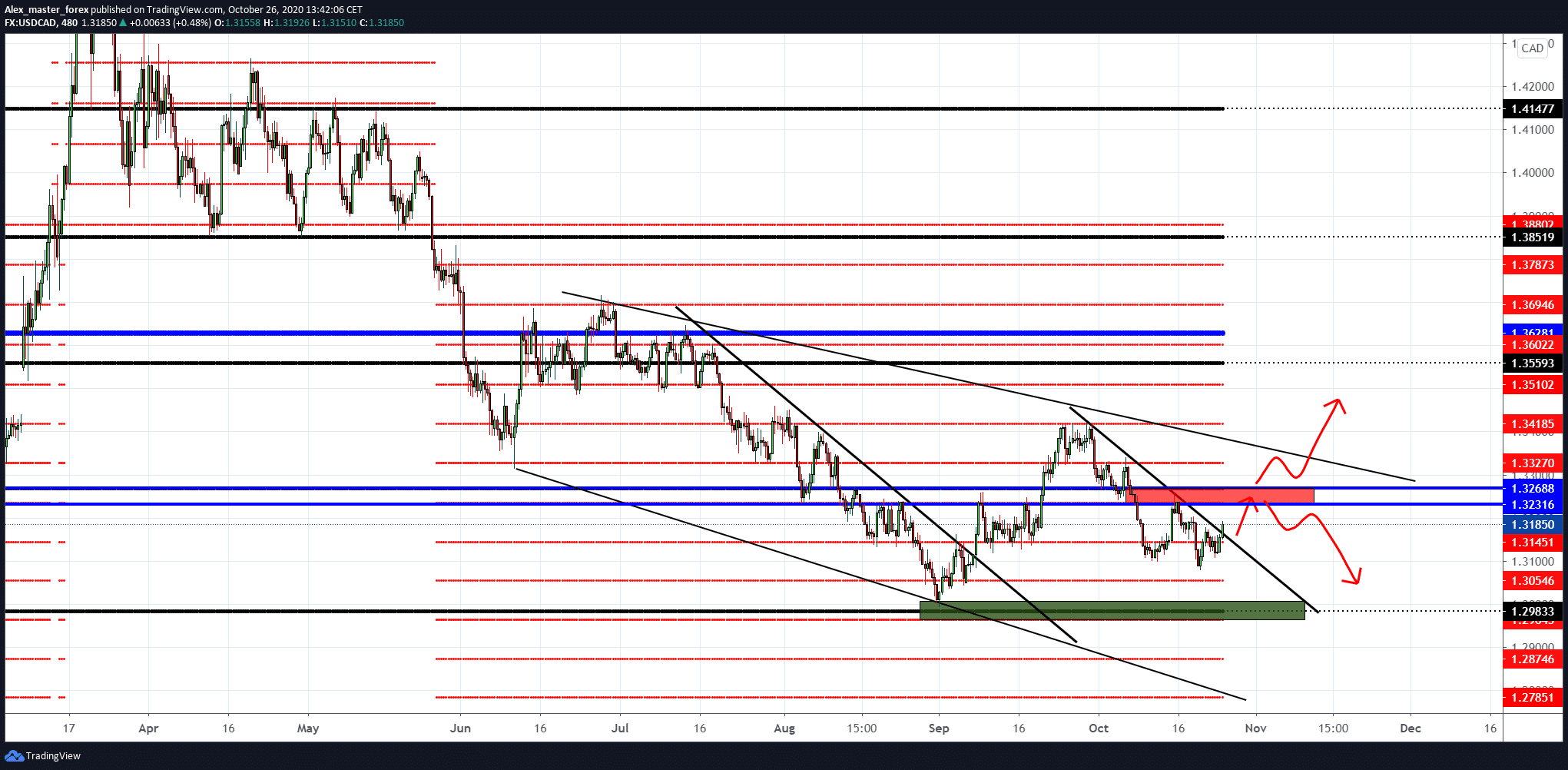

USD / CAD again above 1.32000

The fall in the price of oil due to global concerns and the rise of newly infected with coronavirus brings fear and unrest to the market, thus the growth of the dollar as the primary currency, while the Canadian dollar due to its position is in reserve. On Wednesday, Canadians have the news of the Reserve Bank of Canada on interest rates, which are estimated to remain unchanged, and from the American news we can single out Gross Domestic Product (GDP) for the third quarter, Core Durable Goods Orders and Initial Jobless Claims which will certainly have an impact on this couple.

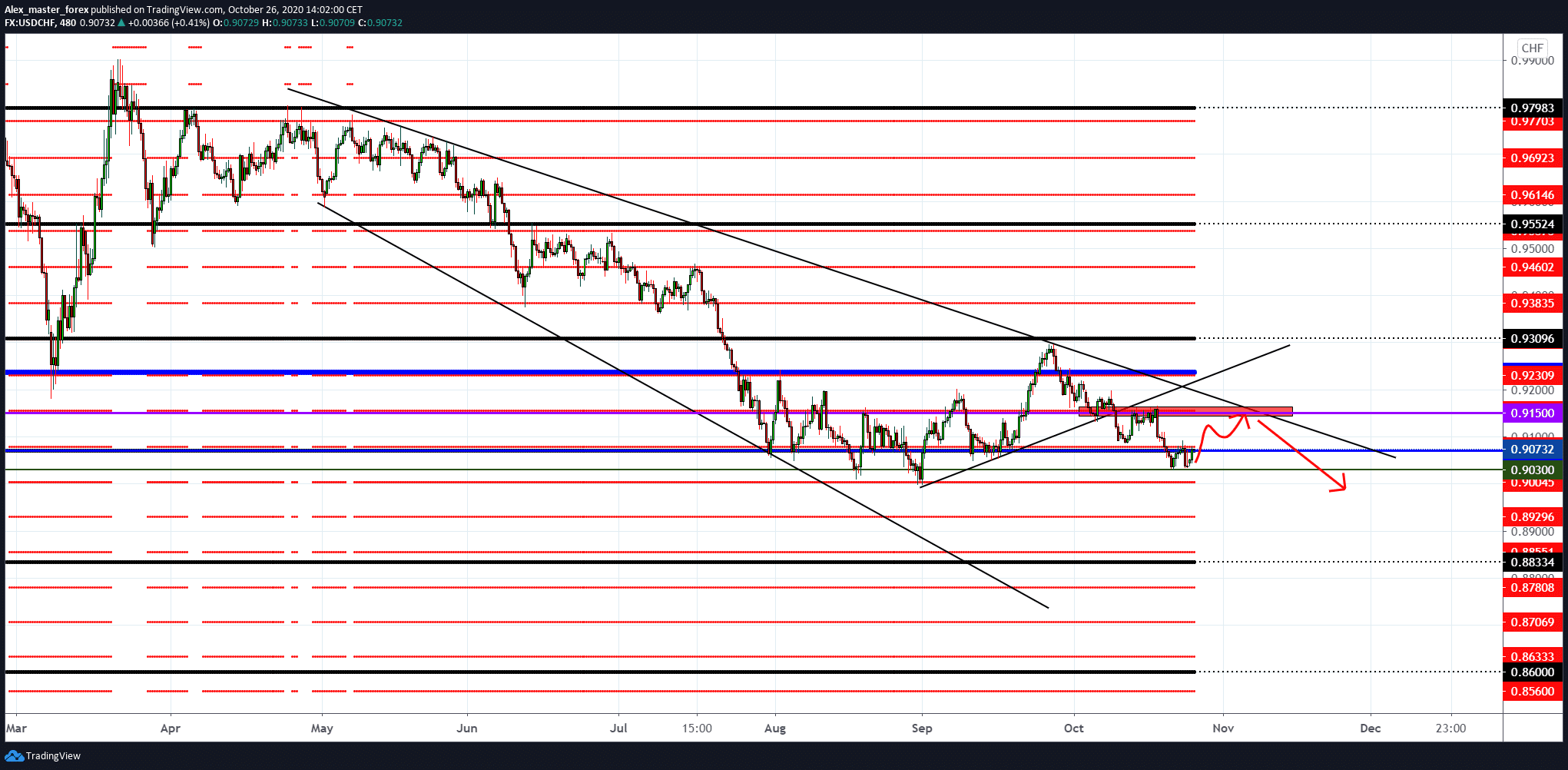

USD / CHF 0.90300 as current support

U.S. House Speaker Nancy Pelosi remains optimistic about incentive talks, although investors did not seem confident that U.S. lawmakers would be able to reach an agreement before the Nov. 3 U.S. presidential election. In the afternoon, we have a speech by the chairman of the Swiss National Bank (SNB), Thomas Jordan, about possible stimuli of the SNB on the economy during the coronavirus.

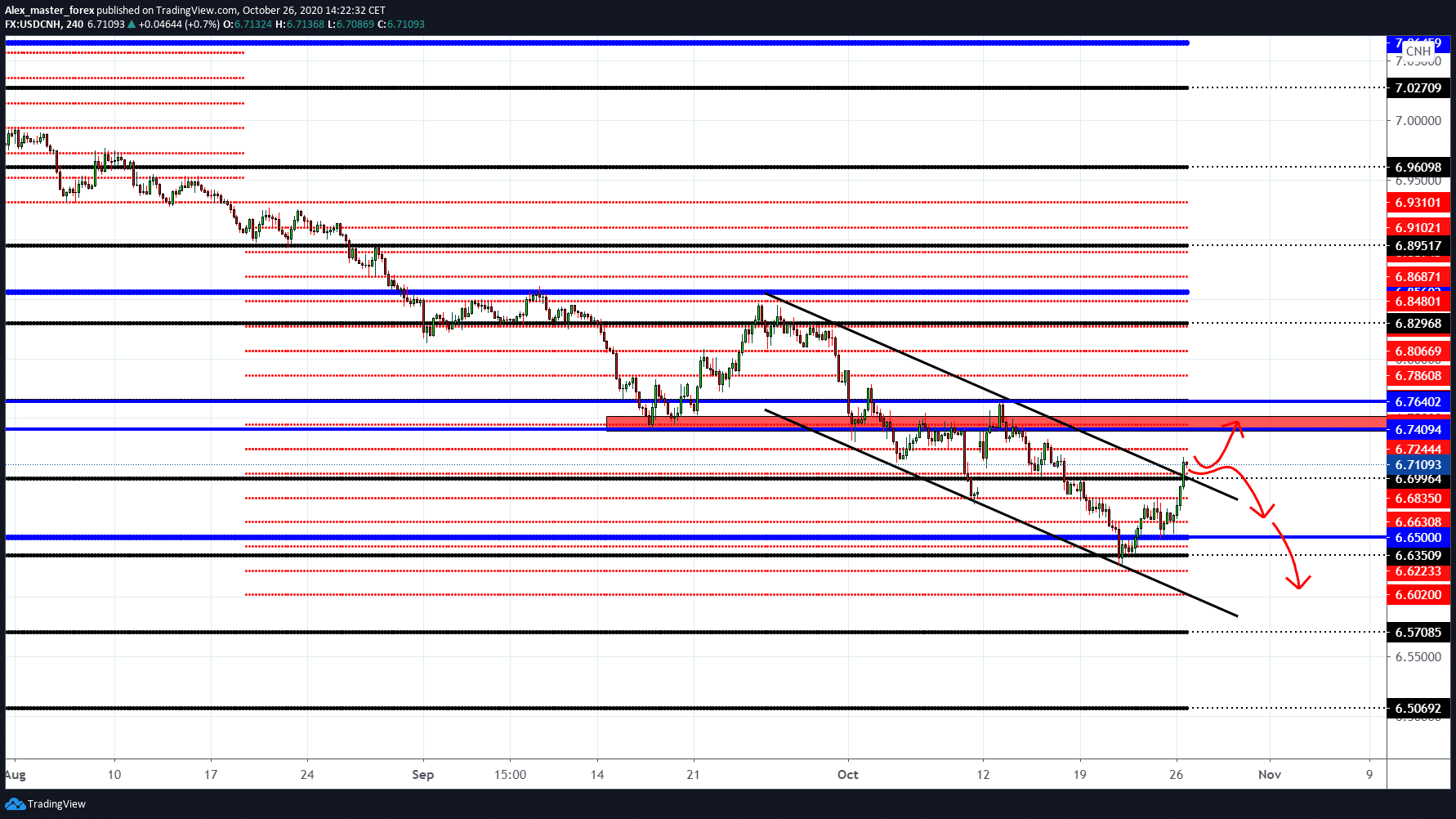

USD / CNH found support at 6.6500

-

Support

-

Platform

-

Spread

-

Trading Instrument