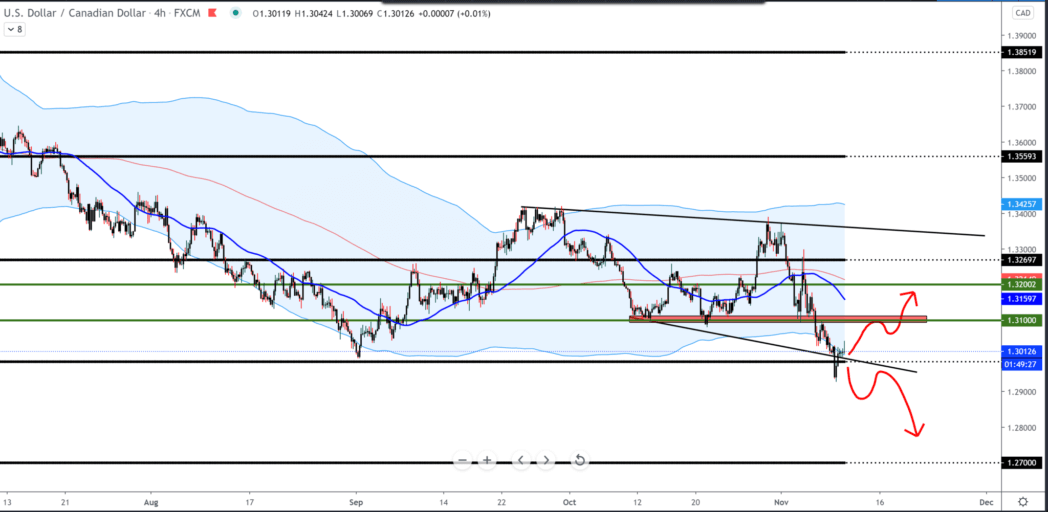

USD/CAD forecast for November 10, 2020

The USD/CAD pair found current support just above 1.30000, returning within the Bollinger bands. If the last candlestick closes inside the Bollinger bands, there is a high probability that the price will go up. It is best to wait for confirmation.

The US dollar index fell to 92.64, losing 0.20% per day as risk tones increased. The refund criteria recorded the hardest jump in the last 12 weeks of the previous day, as traders cheered for Pfizer-BioNTech, which came out with a success rate of 90% (COVID-19).

The suspension of Chinese vaccine trials joins the US sanctions on the Beijing diplomat due to the Hong Kong issue, which initially caused risks. The cautious mood received additional support from the American reluctance to European tariffs on goods worth 4 billion dollars.

Yesterday’s jump in oil helped the Canadian dollar strengthen and lower the pair to below 1.29300 in the European session, after which the dollar strengthened in the American session.

This afternoon, from the important news, we have the economic news JOLTs Job Openings – a survey conducted by the US Bureau of Labor Statistics to measure job vacancies. It collects data from employers on their companies’ employment, job creation, employment, recruitment, and separation.

The forecast is that the data will be slightly better than the previous ones. After that, we have a speech by the Federal Reserve Governor Randal Quarles.

The election news will continue to bring headlines. Approved or disputed results will lead to uncertainty and likely risk aversion.

Top developments from other major economies (British GDP, RBNZ statement, Chinese CPI, etc.) can encourage intra-daily volatility among major dollar pairs.

Strict locking measures in the European region may limit USD losses relative to European counterparts.

-

Support

-

Platform

-

Spread

-

Trading Instrument