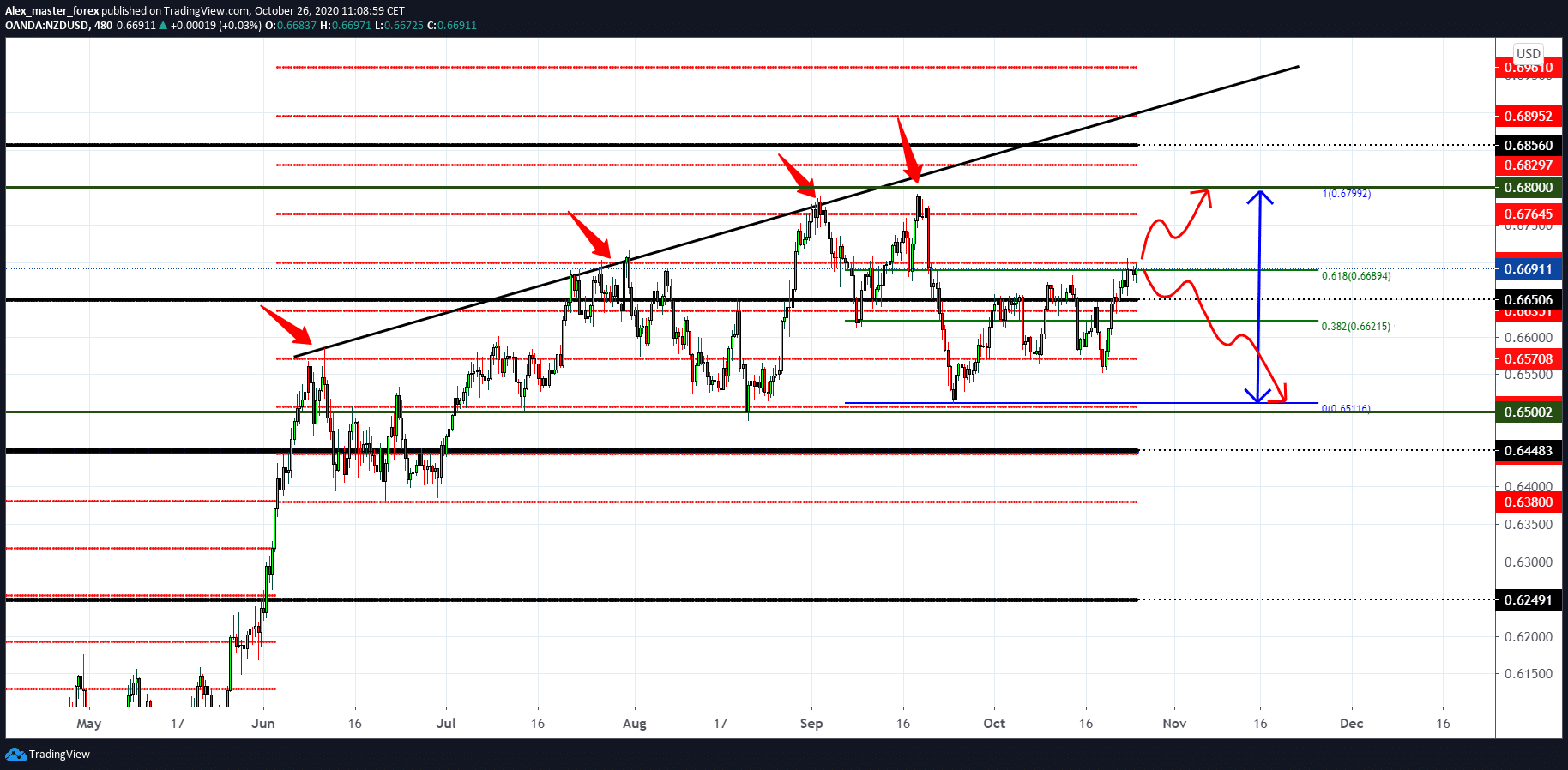

NZD / USD long-term view with limits

The dollar is strengthening today because there is nothing from the financial package for economic recovery before the presidential election. If you are looking for a sell position, you should follow for on the chart to make a lower high below the previous one, which was at 0.68000. It seems Bullish is short-lived, and the dollar will blow away the NZD.

Covid-19 cases in New Zealand are at a minimum as the country is still lockdown, and last week’s economic news was disappointing, so it should be expected soon that this is reflected in the chart.

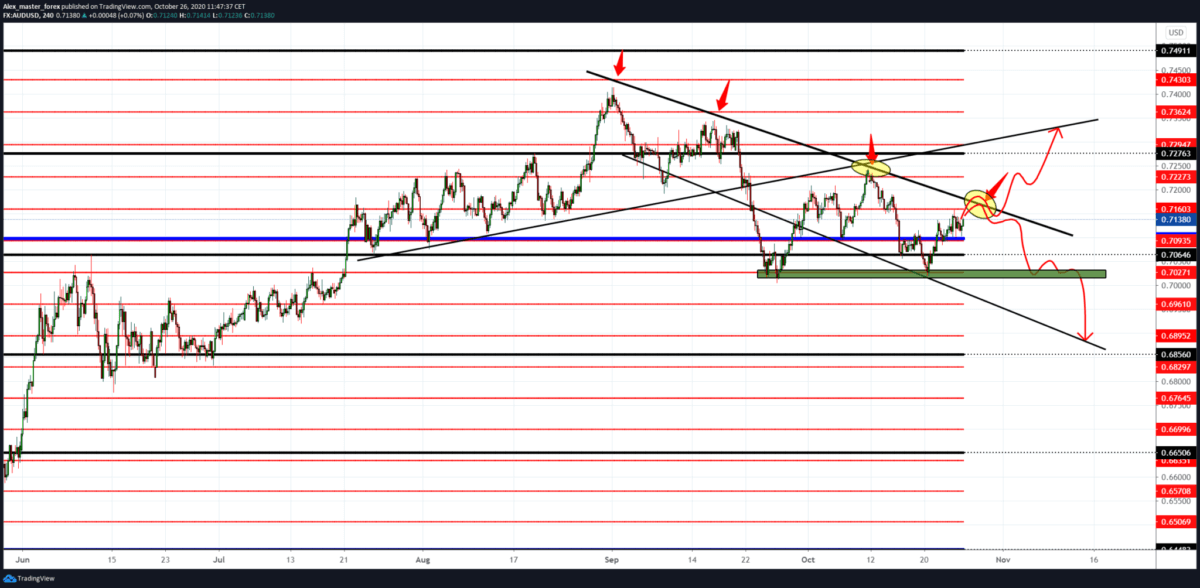

AUD/USD trend line as resistance

The dollar is currently facing resistance at 93.00, which can push the AUD / USD pair to touch the upper trend line, and whether it will form a new lower high or break the trend line, we’ll see. In the afternoon, we also have economic news from America about New Home Sales, which may give a little volatility to this pair.

-

Support

-

Platform

-

Spread

-

Trading Instrument