Trust funds in Bitcoin as part of assets

Traditional hedge funds are poised to increase their exposure to Bitcoin and other cryptocurrency markets over the next five years; a new survey was found based on positive reactions from over 95% of hedge fund CEOs.

Intertrust Global, trust and corporate governance company conducted a survey of CFOs of 100 hedge funds worldwide about their intention to buy crypto-assets. About 98% answered that they expect their hedge funds to invest a good part of their assets in cryptocurrencies by 2026. The research showed that an investment of 7.2% in the cryptocurrency sector would amount to about 312 billion dollars. In addition, about 17% of surveyed CFOs admitted that their hedge fund could dispose of 10% of its assets in cryptocurrencies such as Bitcoin.

The results came when Bitcoin fell by more than 50% to 3,858 US dollars in March 2020 and almost 65,000 US dollars in April 2021, which led to possible speculation that it will continue to collapse due to overvaluation.

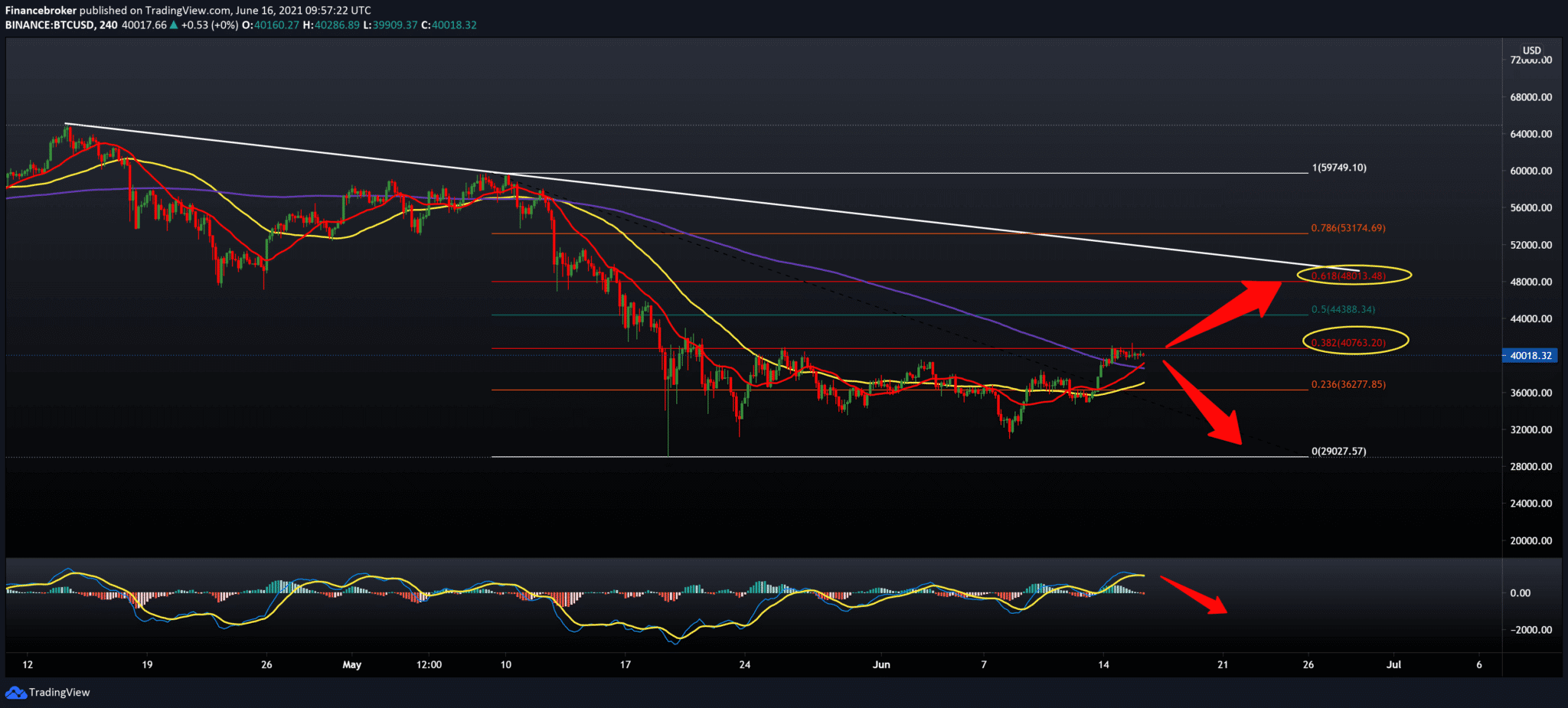

But the leading cryptocurrency backed by technical support was around $ 30,000 and returned above $ 40,000 earlier this week. Most of the profits from Bitcoin came from anti-inflationary narratives that emerged after the fall of the global market in March 2020, led by the coronavirus pandemic.

Global central banks have responded with huge financial support, the US Federal Reserve has launched a zero-loan policy, with a monthly program of buying assets of 120 billion dollars. The central bank’s decision brought down the yields on American government bonds and recorded the lowest values in its history. And the increase in liquidity in the economy, which further accelerated the trillions of dollars worth of stimulus measures, also reduced the dollar’s value in relation to its main competing fiat currencies. Plenty of investors have turned to riskier assets from safe havens such as gold, silver, and bitcoin. Bitcoin delivered the best results during the Fed’s money-printing policy.

-

Support

-

Platform

-

Spread

-

Trading Instrument