Tokyo Shares Fall as Fears of Omicron Gains

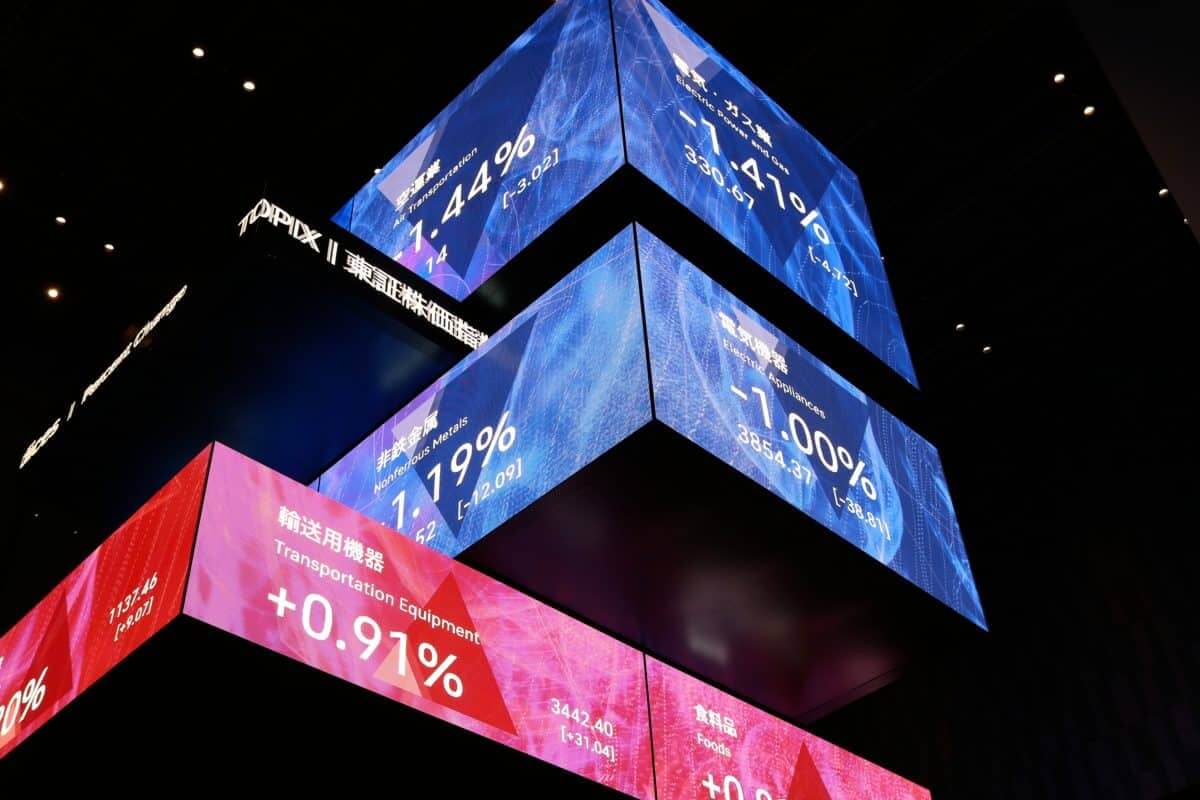

Tokyo shares fell on Monday. The rise of Omicron variant infections has shaken the market sentiment worldwide. It further deepened the uncertainty about the impact on the recovery of the global economy. The Nikkei Stock Average was up 0.37 percent at a total of 106.13 points at 28,676.46. Also, The Topix index closed at 1,977.90, down 8.88 points, or 0.45 percent.

The Decliners were led by electricity, non-ferrous metal, gas, and information and communication issues. The U.S. dollar remained in the lower range of 114 yen. Investors mainly faced the New Year holidays.

Shares fell amid a lack of new trademarks. Several markets are locked on Friday for the Christmas holidays. The market moved in a narrow range in the hostile areas most of the day. This was caused by a record number of COVID-19 countries, including France and the U.S., forcing airlines to cancel flights. The strain was spotted in Japan.

According to Nomura Securities strategist, investors were concerned that global economic recovery would slow down. Cases of the Omicron strain currently outnumber the Delta in the U.S. However, there was no noticeable increase in countries such as China since January.

However, the fall was limited due to the demand for semiconductor-related stocks. Investors expected more data on the Omicron option. Tokyo Electron rose 2.1 percent. Advantest saw a 0.8 percent gain. Watami fell 1.2 percent. Kushikatsu Tanaka Holdings fell 1.0 percent.

Stocks and Omicron Fears

SoftBank Group lost 3.0 percent; after saying that Credit Suisse was preparing to take legal action against it to repay the funds related to the dissolution of Greensill Capital. Nitori Holdings fell 6.5 percent; After Friday, the retail chain of furniture and interior stores posted operating profit for the first nine months of this business year, including November, compared to the previous year. In the first section, the declining issues outweighed the advances from 1,455 to 635. The volume of the significant part increased to 777.48 million shares on Friday.

Asian Shares

U.S. Airlines has canceled or delayed thousands of flights over the past three days; due to a shortage of COVID-19-related personnel. Several cruise ships had to cancel stops after an explosion on board.

In Asia, China recorded the highest daily increase in local COVID-19 cases in 21 months. Infections have doubled in Xian, the country’s latest COVID-19 hotspot. The Shanghai benchmark weakened 0.48%. The Blue Chips Index fell 0.22%. At the same time, real estate shares have risen; since the People’s Bank of China pledged to promote the healthy development of the country’s real estate market.

Hong Kong, Australia, and the U.K. are closed on Monday. Omicron cases are on the rise in the U.S. and Europe. The history of 2022 Global Recovery is still on the way. Trading on Wall Street will resume on Friday after the holiday. U.S. stocks closed record highs on Thursday because Omicron could lead to a milder level of illness; Even when it is highly contagious, and its growth is quite noticeable. Emini futures point to a 0.05% increase in S&P 500 on reopening.

U.S. Treasuries saw demand in Tokyo trade. 10-year revenue fell to 1.4824%. This was higher than the 1.5% increase on Thursday. In foreign exchange markets, the weak tone of the U.S. dollar continued; Although it was reversed in the Federal Reserve when policymakers announced a three-quarter rate increase next year.

The dollar index was approximately unchanged at 96,142. West Texas Intermediate futures for U.S. crude dropped $72.87 a barrel, 92 cents. The contract was not signed on Friday due to the U.S. market holiday. The price of Brent crude oil fell to $75.94 a barrel, a total of 20 cents; That sustained a 71-cent decline on Friday.

-

Support

-

Platform

-

Spread

-

Trading Instrument