The Russian ruble and EURUSD continue to weaken

USDRUB and new U.S. sanctions

Traders are struggling to spread cautious optimism in early Asia as U.S. President Joe Biden gives his first speech on the state of the Union (SOTU) early Wednesday. U.S. President Biden said: “The United States will join its friends in banning Russian flights from using American airspace. Market sentiment worsened the day before as Russia refrained from accepting Western pressure for peace with Ukraine. The 40-mile-long troop and the bombing of civilian buildings were some of the critical downsides.

President Biden’s prepared statements showed that the American leader would say on Tuesday that the West was ready for Russian President Vladimir Putin’s invasion of Ukraine and that his administration was ready to fight inflation.

On the same line were the comments of officials from the International Monetary Fund and the World Bank, and U.S. Treasury Secretary Janet Yellen. The International Monetary Fund and the World Bank noted: “The war in Ukraine is creating significant spillover effects in other countries, commodity prices are rising, and risk is further boosting inflation.”

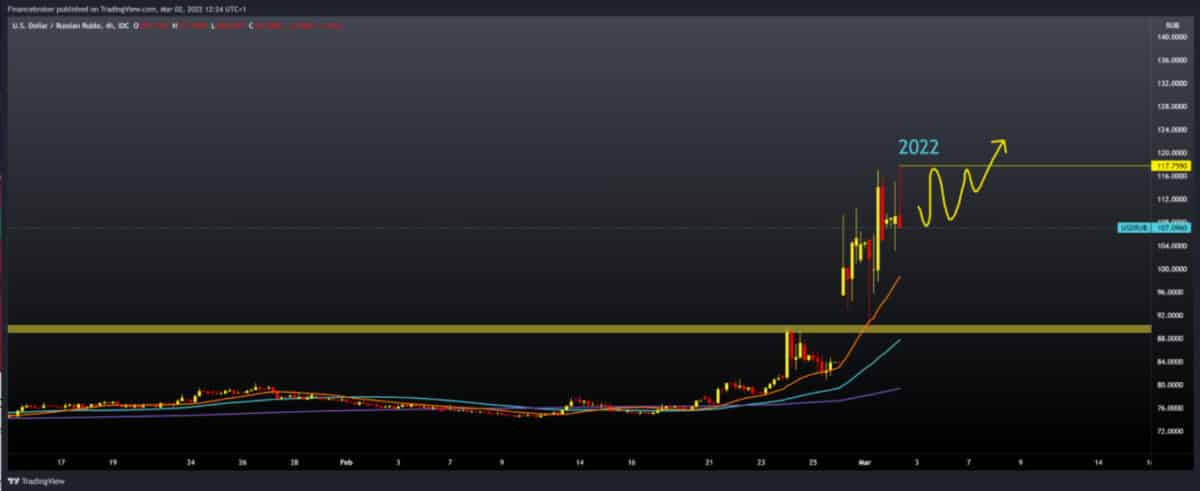

The exchange rate of the Russian ruble fell to a new historical low this morning, reaching 117,759 for one U.S. dollar. Now USDRUB is hovering around 107,000 and is in a slight retreat. Our support is at 100,000 with the MA20 moving average, but we can expect continued increased volatility on this pair and a new turn and movement above 110,000.

EURUSD chart analysis

Pair marks a new minimum this year. Going down to 1.10580, last week’s support zone at 1.11000 didn’t hold up. We are now moving around 1.10900, consolidating and looking for better support at the current level. Bearish pressure on the euro is great because the crisis is happening in the European backyard, and for now, there are no indications that the end is near. Russia continues to invade Ukraine, leading to supply disruptions and new pressures on inflation that will increase due to rising oil and gas prices. The price of a cubic meter of gas jumped again and climbed above $ 1,700, and oil recorded new nine-year highs above $ 110 per barrel.

Bullish scenario:

- We need new positive consolidation and growth of EURUSD above 1,11500.

- Then we can expect a further continuation towards 1.12000, where we get additional support in the MA20 moving average.

- The next potential resistance awaits us in the zone around 1.13000.

- Our MA50 is at 1.12500, while our MA200 is around 1.13000.

- The EURUSD break above might climb to 1.14000 and then to this year’s resistance zone at 1.15000.

Bearish scenario:

- We need a continuation of this negative consolidation and a further withdrawal of EURUSD below 1.10500.

- Our first lower support is at 1.00000, and we were there for the last time in June 2020 during the Coronavirus pandemic.

- If the euro’s decline continues, our next potential support is 1,09500, then 1,09000.

Market overview

Inflation in the eurozone accelerated further in February and reached a new record, boosted by energy prices, and a Eurostat estimate showed on Wednesday.

Inflation rose to 5.8 percent in February from 5.1 percent in January. Inflation is projected to grow to 5.3 percent.

Core inflation, which excludes energy, alcohol, food, and tobacco, rose to 2.7 percent from 2.3 percent in the previous month.

Among the components of inflation, energy recorded another sharp increase of 31.7 percent. This was followed by a 4.1 percent increase in food, alcohol, and tobacco prices. Prices of industrial products without energy increased by 3 percent, and costs of services increased by 2.5 percent.

Further jumps are very likely in the near future due to the war in Ukraine. Still, the European Central Bank will probably refrain from clear commitments on the monetary path next week because the economic uncertainty is huge, said Bert Colijn, an ING economist.

-

Support

-

Platform

-

Spread

-

Trading Instrument