The Inflation Tsunami is about to Hit

Stocks went on to push higher yesterday – the pressure is building. Trends in place since last week, remain in place for this earnings rich one too. Reflation still rules, reopening trades are well underway, and inflation expectations are modestly turning up again without putting too much strain on the Treasury markets.

While Monday wasn‘t an example of a risk-on day, the markets are clearly moving there:

(…) overpowering the USD bulls yet again as the dollar bear market has reasserted itself. It‘s not just about EUR/USD on the way to its late Feb highs, but about the USD/JPY too – the yen carry trade is facing headwinds these days, acting as a supportive factor for gold prices. While these went through a daily correction, commodities pretty much didn‘t – lumber is powering to new highs, agrifoods didn‘t have a down day in April, copper and oil scored respectable gains. The market is in a higher inflation environment already, and it will become increasingly apparent that commodity-led inflation is here to stay.

Yesterday was a great day for commodities again as these scored stronger gains than tech or $NYFANG, the main winners within the S&P 500 (defensives took it on the chin – seems like we‘re about to see rates move higher again). Anyway, VIX didn‘t object as options traders piled into the clearly complacent end of the spectrum again. Both the Russell 2000 and emerging markets loved that – the best days for smallcaps are clearly ahead:

(…) the time of their outperformance, is approaching.

Gold

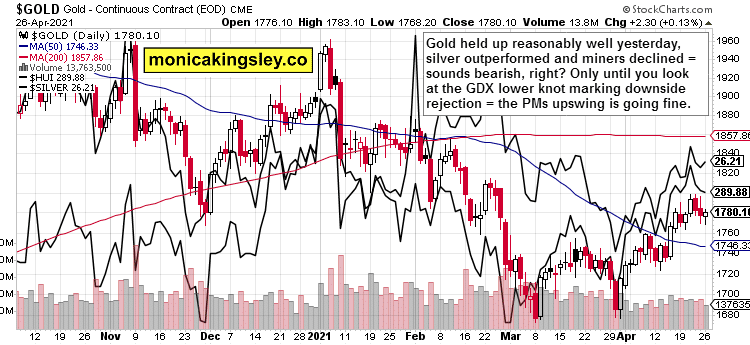

Gold miners didn‘t outperform the yellow metal yesterday while silver did – are the ingredients for a metals‘ top in place? I don‘t think so, and have actually called out on Twitter the GDX downswing as likely to be rejected and ending with a noticeable lower knot. And here we are. No changes to my Friday‘s thoughts that:

(…) The precious metals upleg has started, we‘re in a real assets super bull market, and this little hiccup won‘t derail it. The sad implication would actually drive it as capital formation would be hampered, unproductive behaviors encouraged, and potential output lowered.

Pretty serious consequences – add to which inflation as that‘s what the Fed ultimately wants, and the recipe for more people falling into higher tax brackets through illusory gains is set. Then, as inflation starts firing on all cylinders – a 2022-3 story when the job market starts overheating – the pain would be felt more keenly.

When even Larry Summers starts talking about the dangers of an inflationary wave, things are really likely getting serious down the road. On a side note, tomorrow‘s analysis will be more brief than usual and published probably a bit later as I have unavoidable dental treatment to undergo. Thank you, everyone, for your patience and loyalty – it‘s already a little over 3 months since I could start publishing totally independently. Thank you so much for all your support!

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

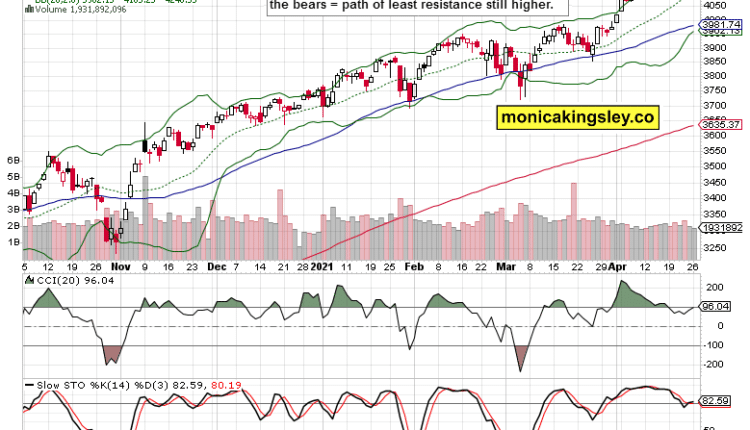

S&P 500 Outlook

The bears are certainly running (have certainly run) out of time, and the upper knot of yesterday‘s session looks little concerning to me. Tesla enjoying the Bitcoin moves, more tech earnings soon, and favorable sectoral composition of the S&P 500 advance favor the coming upswing.

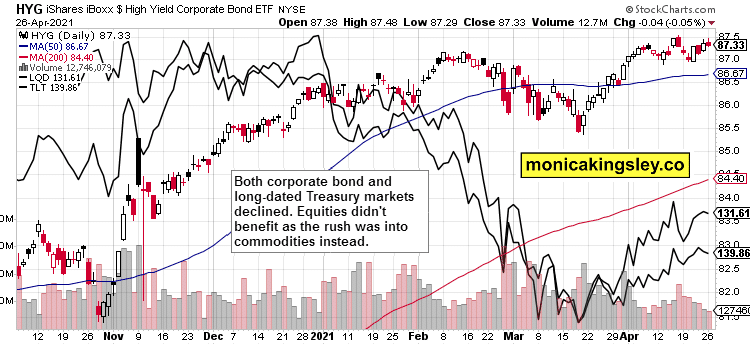

Credit Markets

Debt instruments are under pressure. It seems high yield corporate bonds (HYG ETF) and investment-grade ones (LQD ETF) have declined in a signal of non-confirmation. Moreover, they have joined the long-dated Treasuries in their downswing. I am not yet convinced this is serious enough to warrant a change in S&P 500 outlook.

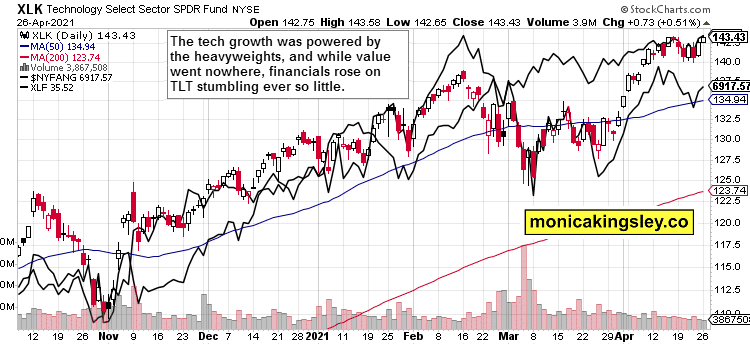

Technology and Financials

The $NYFANG strength continues, powering tech higher – and that‘s the engine behind solid S&P 500 performance. Notably, financials weren‘t waiting yesterday on other value stocks turning higher, and that‘s bullish.

Gold, Silver, and Miners

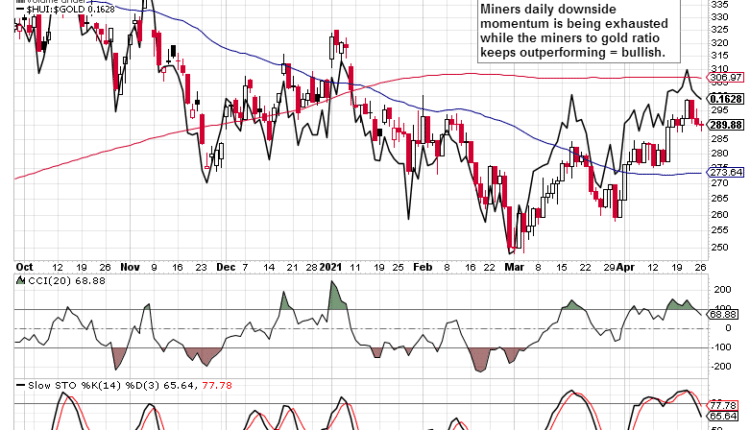

Gold caught a bid and refused to decline intraday, which almost matches the miners‘ performance. Given these two daily stands, I‘m in favor of disregarding the usual outperformance warning of silver doing considerably better.

This is the proper view of the miners and miners to gold ratio. In fact, it’s a noticeable outperformance in the latter while the former is getting ready to rise again.

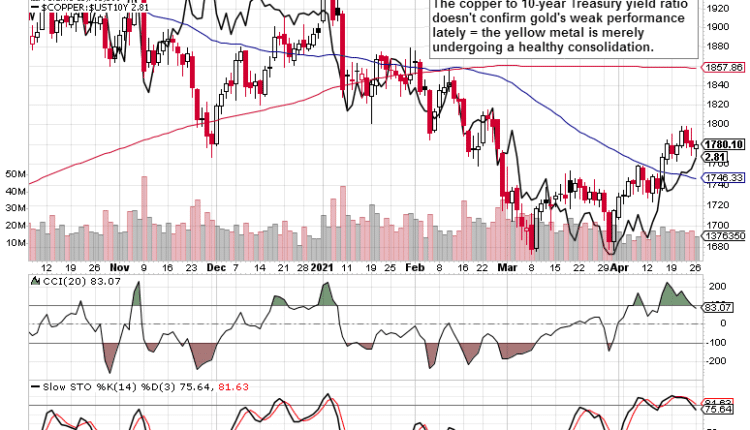

Gold and the Key Ratio

As is visibly even more true today than yesterday, the copper to 10-year Treasury yield ratio shows that the markets aren‘t buying the transitory inflation story – the rush into commodities goes on, and justifiably so. This chart is clearly unfavorable to lower metals‘ prices.

Summary

The S&P 500 keeps pushing for new all-time highs, which looks to be a matter of relatively short time only. Credit markets non-confirmation is to be disregarded in favor of strong smallcaps, emerging markets, and cornered dollar in my view.

Gold and miners are in consolidation mode, but this is little concerning to the bulls. No signs of an upcoming reversal and truly bearish plunge – the precious metals sector is likely to play catch-up relative to the commodities as its sluggish post Aug performance would get inevitably forgotten.

Thank you for having read today‘s free analysis, which is available in full at my personal site. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for both Stock Trading Signals and Gold Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

www.monicakingsley.co

[email protected]

* * * * *

All essays, research, and information represent analyses and opinions of Monica Kingsley that are based on the availability and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes. It should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks, and options are financial instruments not suitable for every investor.

Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading, and speculating in financial markets may involve a high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings. She may make additional purchases and/or sales of those securities without notice.

-

Support

-

Platform

-

Spread

-

Trading Instrument