The Greed Cycle – Market Cycles Explained

Fear and greed have the potential to cause serious problems. Succumbing to fear and greed can profoundly harm investors’ portfolios. Moreover, the above-mentioned emotions could affect the stock market’s stability, etc.

So, it is important to understand the role of fear and greed. Let’s focus on the fear and greed cycle.

Let’s start with greed. It is no secret that the vast majority of traders would like to get rich as soon as possible.

There is no need to spend days or even weeks in order to find a good example when we can simply talk about the internet boom of the late 1990s.

The popularity of internet-related stocks skyrocketed in the 1990s. Many investors were eager to invest in internet-related stocks. Do you know how everything ended?

It repeated the fate of other asset bubbles.

There is no lack of people who would like to get rich in several months. However, many people don’t pay attention to various risk factors. It is vital to have a long-term investment plan.

Do you know how Warren Buffett reacted to the internet boom?

One of the most famous investors in history mostly ignored the dot-com bubble. He stuck with his approach, known as value investing.

Fear and investors

Let’s gather more information about the fear and greed cycle.

As you already know, greed has the potential to cause various issues. However, we shouldn’t forget the fear and its influence on the market.

Investors should remember that the market can become overwhelmed with greed. However, the market can also succumb to fear.

Without a doubt, fear is a powerful motivator. When stocks suffer considerable losses for a long period of time, a group of investors can become fearful of further losses. It isn’t hard to understand their situation. In order to prevent further losses, they start to sell.

However, they end up creating even bigger problems. Economists have a name for what happens when investors buy or sell just because everyone else is doing the same: herd behavior.

Just as greed is the main driving force during a boom, fear prevails following its bust.

In order to limit losses, investors quickly sell stocks and buy safer assets. They start to invest in money-market securities, principal-protected funds, as well as stable-value funds. All of them are low-risk but low-return securities.

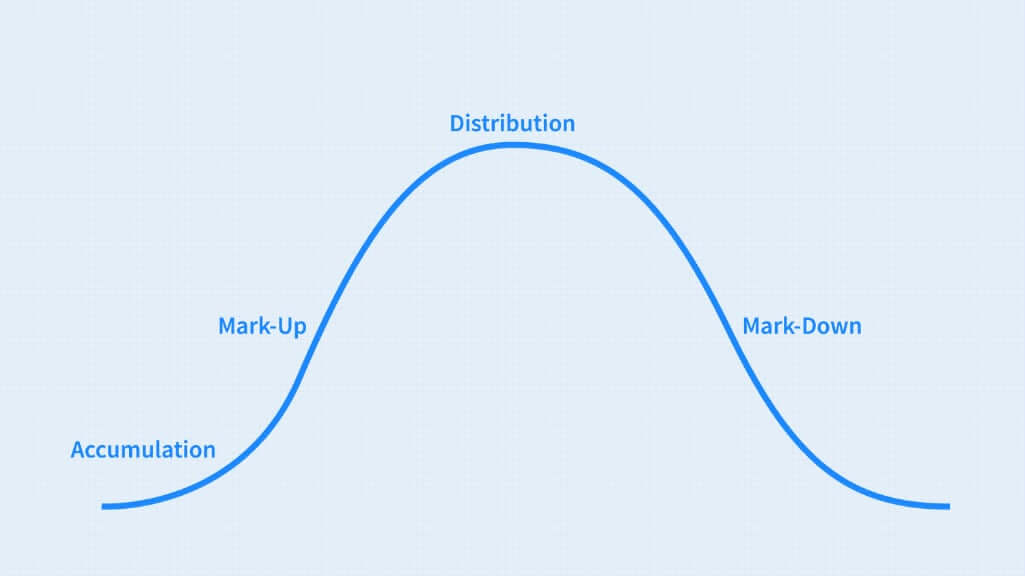

What you need to know about market cycles

Do you know how market cycles work?

New market cycles are formed when trends within a specific sector or industry develop in response to meaning innovation or new products. Interestingly, new market cycles could also form in response to the regulatory environment.

It is quite hard to identify market cycles. You need to take into consideration that market cycles are often only identifiable after they have long passed.

Interestingly, they rarely have a specific, clearly identifiable beginning or ending point. Still, the vast majority of market veterans believe they exist.

Besides, many investors pursue investment strategies that aim to profit from market cycles by trading securities ahead of directional shifts in the cycle.

You also need to bear in mind that a market cycle can range anywhere from a couple of minutes to several months or even years, depending on the market in question.

Furthermore, different careers will look at various aspects of the range. For instance, a day trader may look at five-minute bars.

Frequently asked questions

How do fear and greed influence markets?

Greed or fear has the potential to affect the markets. Let’s start with greed. As can be seen from the example of the internet boom, greed has the potential to influence investors’ decisions. What about fear?

On the fear side, sell-offs have the potential to become prolonged and depress prices well below where prices should be.

What makes fear and greed so important to market psychology?

Human beings are emotional. Unsurprisingly, many investors are struggling to control their emotions.

According to some researchers, the above-mentioned emotions have the power to affect our brains in a way that coerces us to forget about common sense as well as self-control and thus trigger change. So, it isn’t a good idea to underestimate the importance of fear and greed.

Is it possible to measure fear and greed in the case of the stock market?

There are a number of market sentiment indicators. For example, you can use Cboe’s VIX Index. Do you know how it works?

It measures the implicit level of fear or greed in the market by looking at changes in volatility in the S&P 500.

It also makes sense to take a look at the CNN Business Fear & Greed Index. It measures daily, weekly, monthly, and yearly changes in fear and greed.

The CNN Business Fear & Greed Index is utilized as a contrarian indicator that analyzes various factors in order to determine how much fear and greed there is in the market.