The GBP/USD pair on October 30, 2020

GBP/USD limit 1.28750 to continue below. The last round of trade negotiations between the EU and Great Britain, which continues today in Brussels, did not have any news flow. European Commission President Ursula von der Leyen said talks were well advanced, but that fisheries and equal issues remain, and until they are resolved, progress is likely to stall.

The Prime Minister of the United Kingdom, Boris Johnson, is expected to meet with Ms. Von der Leyen next week to break the current stalemate. The number of new infections in Britain continues to rise, putting pressure on the foot. Boris Johnson still does not dare to close the borders of Great Britain; the closures are local by regions.

House prices in the UK rose for the fourth month in a row, and the annual growth rate reached a five-year high in October, according to a survey by the Nationwide Building Society on Friday. Adjusted house price inflation accelerated to 5.8 percent, the highest rate since January 2015, from 5.0 percent in September. Economists expected growth of 5.2 percent. Yesterday’s report on Gross Domestic Product for USD was very positive and gave strength to the dollar along with the global risk of the lockdown of many countries due to the increased number of newly infected coronavirus virus.

Congress has postponed a financial aid package that was supposed to be passed to support the economy to mitigate the coronavirus’s effects after the election, which gave investors a signal to invest in the dollar at least for a short time.

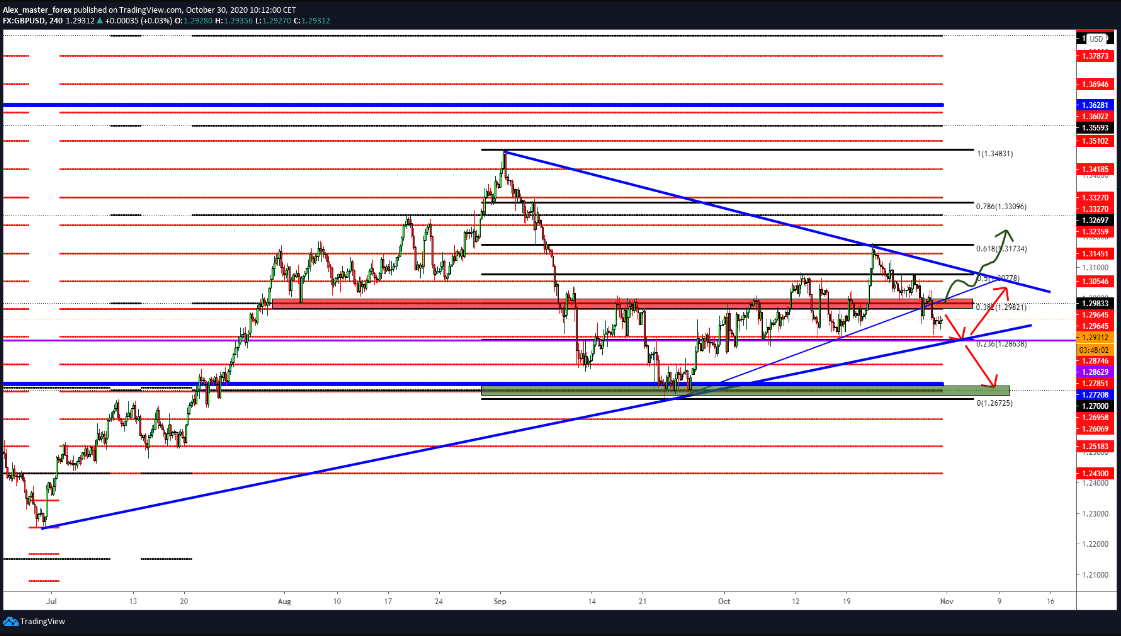

Looking at the chart, we will see that the pair GBP/USD made a pullback to the Fibonacci level of 61.8% and headed down, burying the limit of 1.30000 and continuing below 1.29000 soon. We can expect some better support around 1.28600-1.28750. If coronavirus and Brexit continue to pressure the pound, it is possible to see a drop to 1.27000-1.27200.

Some nice picture for GBP/USD is the pullback above 1.29800-1.30000, consolidation and continuation above the trend line.

-

Support

-

Platform

-

Spread

-

Trading Instrument