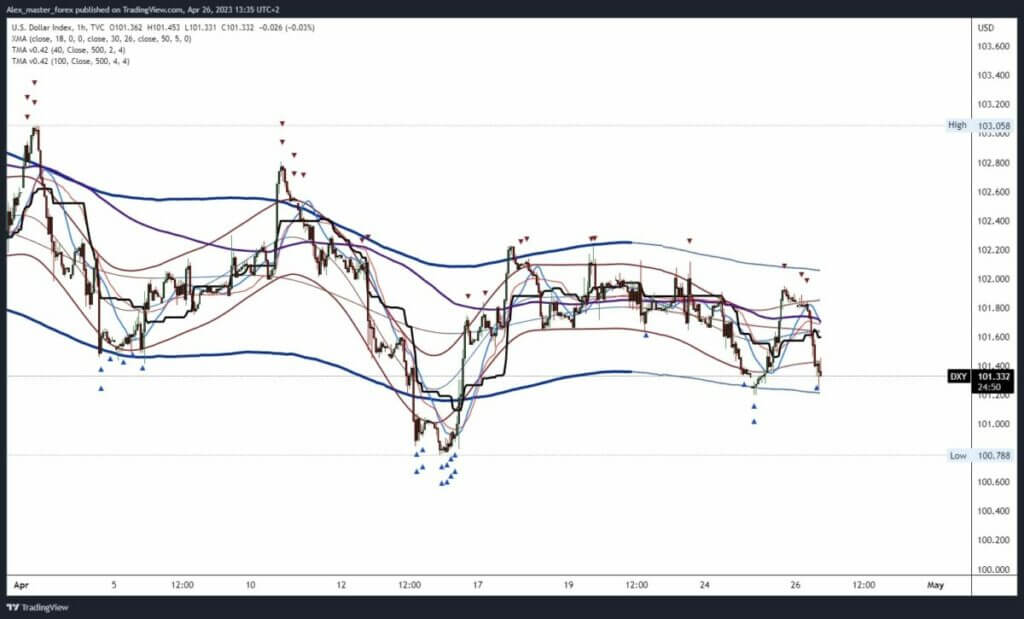

The dollar index retreats and falls to the 101.30 level

- The dollar index continues to retreat from the 101.95 level.

Dollar index chart analysis

The dollar index continues to retreat from the 101.95 level. Yesterday’s attempt to climb above the 102.00 level ended unsuccessfully. Since then, the dollar has been in retreat, which continued during the Asian and EU sessions. Today’s low dollar index is 101.20 level. For a bearish option, we need a continuation of the negative consolidation and a break below the 101.20 level.

After that, we could expect to see a test of the 101.00 support level. Last week’s low of the dollar index was at 101.78 level. Yesterday’s news from the US market failed to strengthen the US currency. Today in the US session, the following important reports await us: Core Durable Goods Orders measure the change in the total value of new orders for long-lasting manufactured goods, excluding transportation items and Crude Oil Inventories.