Texture token is in the spotlight. What about HQZ?

Texture is a new, interesting project. Its creator team believes that cryptocurrencies are the future of the financial world. Thus, it wants to give users around the globe access to many advantages that decentralized finance offers. The company chose the Solana blockchain to base its platform on. Solana has many great characteristics that are excellent for encouraging crypto adoption. And Texture will benefit from them.

This project aims to promote easy access to sustainable DeFi yields, support the development and growth of the Solana ecosystem, facilitate community-driven DeFi, and attract new users into the crypto world. All of these will ultimately accelerate crypto adoption.

The company also plans to offer transparency and security to its clients. It will explain how the mechanics of its products, along with the involved risks. Every investment contains some of the latter, and since purchasing tokens is a form of investment, users need to know what they agree on. Besides, the team hopes to earn the trust of the community with a straightforward and fair approach. It will share all challenges and solutions with its customers.

Furthermore, the Texture project aspires to offer sophisticated products which are easy to use. The DeFi world can sometimes be confusing for new users. However, this platform will ensure that people grasp all the concepts easily. It will make complex products simple for both amateurs and more experienced customers, providing a clear and intuitive UI/UX.

Besides, Texture plans to stay on the market for a long, long time. Thus, it needs a strong risk management strategy. The company aims to offer the highest possible yields to its clients, and it will deliver these via robust smart contracts. The team has great safeguard mechanics in place. Its platform will endure high volatility and other obstacles.

What is the SOL Power Yield strategy?

The company developed SOL Power Yield Strategy. This algorithmic strategy utilizes the arbitrage between deposit-on-lending platforms and yields staked SOL staking versus the cost of SOL borrowing on the corresponding lending website. When staking yields are higher than deposits, user can profitably level up their SOL staking position. Thus, they will maximize the yield on the initial deposit.

Customers can use this strategy automatically or manually. For the latter, they will need to take the following steps: stake the SOL tokens with one of the liquid staking protocols, deposit the staked coins with one of the borrow-lending protocols; and borrow SOL against a staked deposit. Users can repeat the steps several times.

Moreover, the platform gives them the opportunity to harvest any farming rewards earned with this strategy. According to the team, Solana users often implement the latter as it usually allows them to generate double-digit yields on their SOL tokens. At the same time, there is very little liquidation risk because the price of customers’ collateral should appreciate over the price of their borrowed tokens.

How does Texture use this strategy?

The Texture team decided to automate SOL Power Yield Strategy by integrating Lido for liquid staking, as well as Solend’s Main Pool for SOL borrowing and stSOL deposits. As a result, the company loops SOL into the Solend and Lido protocols several times.

First, SOL is staked with the Lido liquid staking protocol to earn yield from staking. In exchange for staked tokens, Lido mints stSOL coins. These represent the position in the staking pool. Afterward, the platform deposits the received stSOL into Solend to generate lending yield. The platform borrows a certain amount of SOL in Solend against the stSOL deposit and then repeats the steps. Besides, the company reinvests the yield earned in Solend back into the strategy to create a compounding effect.

Texture announced that customers would receive a corresponding amount of txtSOL in exchange for depositing the SOL tokens into the Strategy pool. The latter is a liquid rebasing coin that represents the client’s share of the total SOL deposited into the strategy.

The team also pointed out that its strategy has many significant benefits. It’s very efficient. Unlike manual use, when implementing it automatically, it offers much more liquidity. At the same time, users retain access to their invested funds instead of locking up their capital in the lending protocol.

In addition, investors will find out that using this strategy automatically is very easy, especially if they are executing a large number of loops. That is one of the reasons for its popularity.

What is HQZCASH, and what does it offer?

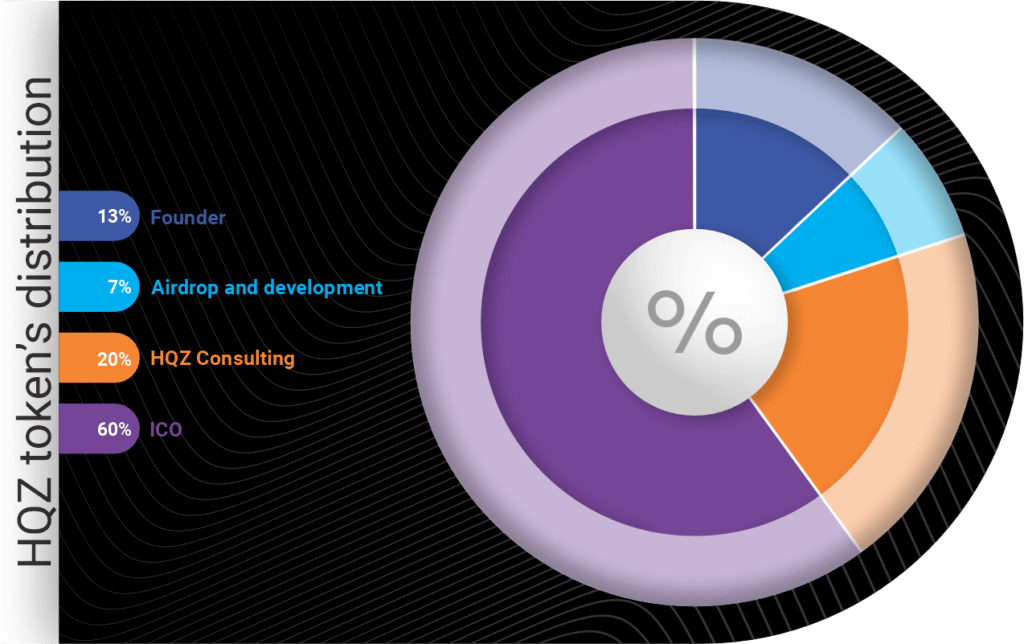

HQZCASH is another promising platform that has attracted investors’ attention lately. The company launched its ICO sale on March 17, 2021. The sale will end on March 17, 2025. Its native utility token HQZ is trending currently. The total supply of tokens is 15,000,000, but only 60% is available for purchase for the initial coin offering. The platform accepts ETH, BTC, BCH, BNB, USDT, and WAVES in exchange for HQZ coins.

The team stated that by participating in the ICO, users would get a chance to become part of the pioneers of the new NPI blockchain. The participants of the Initial coin offering will receive NPI when the blockchain opens. The company will give the same rewards to HQZCASH token holders. The latter will get 1 NPI for 1 HQZCASH, delivered to their wallets.

This team aims to create a totally new type of blockchain that will meet government requirements. Thus, it decided to name this new product New International Placement, or NPI. This project will offer full transparency. It will work with governments and financial services, but unlike other centralized companies, NPI will provide all the advantages of DeFi.

Moreover, it will implement the Oracle service, along with a new KYT (Know Your Transaction) service. The first one verifies the consistency of each block on this blockchain. That means the NPI blockchain will have a 24-hour self-auditing feature.

In addition, this blockchain will be able to deploy smart contracts listed on the NPI market cap, as well as the company’s exchange platform. That will add utility and value to the NPI token. According to the team, its blockchain will run under Masternode, ensuring cost-effectiveness and constant security for all customers.