Technical Analysis – studying the market movement

In forex trading, understanding the characteristics of each currency pair is necessary to win in a trade. Within the next experienced trading post, you’ll learn to do technical analyses that will help you level up. Now let us have an introduction to point out the main pointers you’ll further learn within our experienced trader’s post.

Technical Analysis

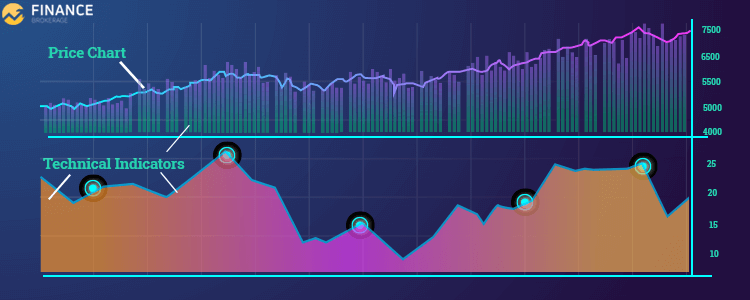

Technical analysis is all about understanding how the financial markets act on various global aspects affecting them. A trader can look at price changes on different time frames, may it be hourly, day-to-day or week-to-week. These price changes are displayed in a graphic form trader called chart. Traders hence call it “chart analysis.”

A chartist analyzes only those price charts. That makes them different from a technical analyst who also studies indicators affecting the market, forcing prices to change.

A technical analyst does take all relevant market information. Believing they are reflected or discounted in the price except shocking news relating to an act of God (natural disasters). Natural disasters have been disregarded quickly by a technical analyst.

Pre-empts fundamental data

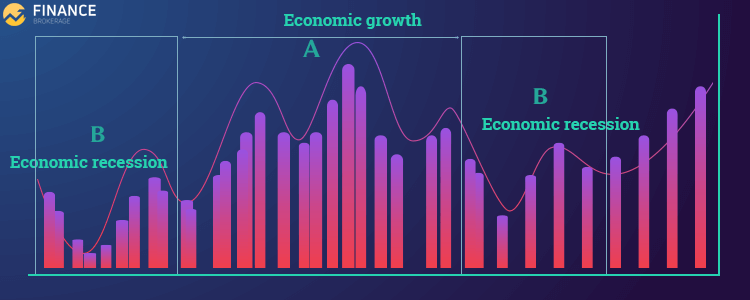

Fundamental analysts do believe in the idea of a cause and effect, applying them between the main factors and price movements. Meaning, when the headline news is positive, there’s a high possibility that the prices would rise. Likewise, when the headline is negative, there’s a huge possibility that the price would fall. But the long-term analysis of the price movement within the markets around the globe would show that much correlation present only in short-term timeframe with a limited extent.

The forex market itself could also be the best predictor of the future trend. Mostly, the market prices start to rise in a bull trend during the economy is still in recession (the B positions on the graph above) like for example, there is no cause for an uptrend. Likewise, the market prices start falling in a new trend during the economy is still growing (the A position on the graph above) without providing the main reason to sell. There might be some time lag for several months where the fundamental trend follows the forex market trend. Additionally, this idea isn’t only applicable to the forex market and the economy but to the stock market trends and those individual/private companies.

Technical analysis is used to specify trend changes within the market which also affects the price movement. Previous market movements will show signs and or characteristics of how the market reacts to various factors happening around the world.

In our next experienced traders’ posts, we’ll talk about the forex market’s various moods being an optimist and or being (greed vs. fear).