What is Synthetic Indices Trading – Get The Information

Have you ever wondered what exactly trading with synthetic indicators entails? Why is it important that you, as a motivated and ambitious trader, understand these terms and how much benefit they can afford you in the long run?

How did it all begin in the first place? Before we answer all of these questions, let’s take you through a few key developments that led to trading with synthetic indices. Here is one crucial event that made the euro a risky asset in the market.

Euro became a risky asset in the market.

In 2015, the famous Swiss National Bank announced its decision to call off its 1.20 peg against the EURO, a piece of huge news back then. Simultaneously, the EURO became an increasingly risky asset, causing Forex traders to worry about how they would react because it caused chaos in the Forex market.

There were Forex traders who bore extremely negative balances, while some reputable Forex brokers were obligated to collapse. Both brokers and traders suffered a lot after this unpleasant event which affected financial markets directly, and what bothers them more is that that will happen more frequently in the future.

Huge financial crisis

Besides this event, humanity witnessed a huge financial crisis in the last twenty years, from plunging oil prices to the Coronavirus pandemic. Since it all hugely affected the global financial markets, it’s not surprising that people consider them risky.

However, is there a chance of trading alone, without any affection from these major events? Yes, you can, and it’s able to do so with synthetic indices trading! Let’s get to know what it is.

Synthetic Indices Trading – what is it exactly?

Synthetic indices are extreme indices that imitate real-world market movement, however, with a twist. They aren’t affected by global events. These indices are strictly based on random number generators, have constant volatility, and are free of liquidity and market risks.

In other words, synthetic indices are simulated by world news and events. However, they’re showing off as real financial requests grounded on the “cryptographic number creator.”

It’s crucial to remember that these synthetic indicators are controlled and checked by an independent judge, so they aren’t allowed to be manipulated.

Why do traders choose to trade Synthetic Indices?

Many traders in the market are wondering why they should seriously consider trading these Synthetic Indices. Before all, trading them is extremely popular with ambitious traders because they offer two crucial things:

- Leverage trades

- Tight spreads.

If you’re interested in trying to trade synthetic indices, it’s always good to consult the internet about the right place to trade them. Depending on your trading style, risk relish. It’s always advisable to try trading proprietary synthetic indices with the usage of the three following types:

- Multipliers

- Options

- CFDs.

How to trade synthetic indices the best?

If you wish to get a deeper understanding of how to trade synthetic indices the best, here are the simple steps for doing so:

- Open a demo account with a reputable broker and practice a lot without any risks of losing real funds.

- Once you’ve gained enough experience, open a real account and start small. Make a deposit, and start with synthetic indices trading and other markets.

- After doing so, properly withdraw all your funds via any recommended withdrawal methods.

The main advantages of synthetic trading indices

Without knowing what the main advantages of synthetic trading indices are, not many traders would want to try and trade them. Here are the top advantages of it that you need to be aware of before even considering trading them:

- Since you’re aware of the potential risks from the very start of trading, you’ll be well-prepared for margin calls. These calls usually happen once the balance of traders’ accounts gets below their margin concerns. The result is that traders’ positions could end up closing automatically. Traders could fix their situation by closing positions or depositing funds to grow their equity.

- Traders can trade synthetic indices non-stop, without exceptions, even on holidays.

- There are only a few requirements to start trading.

- There’s a huge possibility to benefit from deep liquidity and rapid order execution, which is extremely attractive to them, regardless of the amount.

Diverse levels of volatility indexes

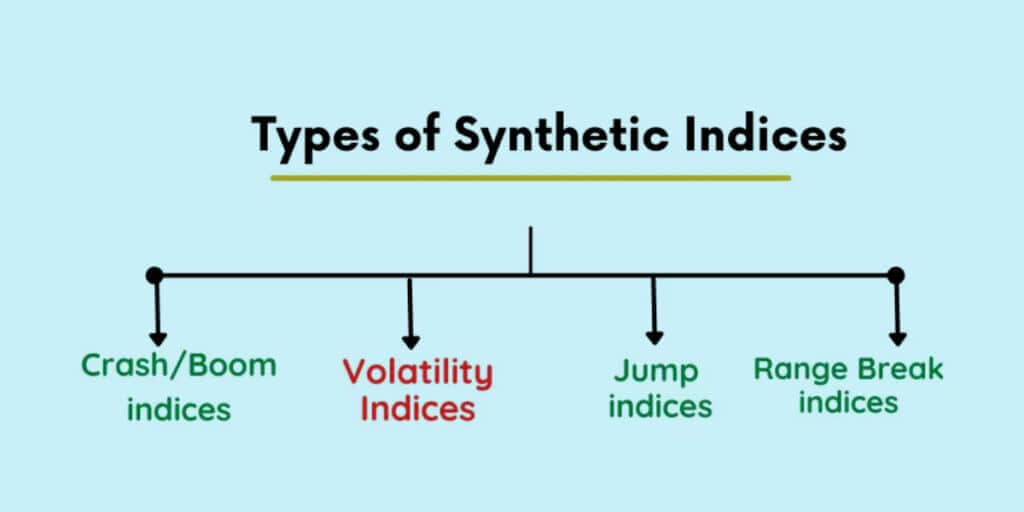

Another key element to remember regarding the benefits of synthetic indices trading is that there are diverse volatility index levels. Here are the different levels of volatility involved with this type of trading:

- Volatility 10 Index: Volatility is kept at 10%. It’s fantastic for low price swings or fluctuations.

- 25 Index

- 50 Index

- 75 Index

- 100 Index: The volatility is held at 100%, so there are huge price swings, excluding significant price gaps. Here we have continuous indices that have deep liquidity.

What is Index Trading?

Generally speaking, index trading refers to buying and selling of a particular stock market index. Usually, investors speculate on the index’s rising or falling price, which defines whether these investors will be selling or buying.

Indexes usually represent the group of stock’s performance so that traders won’t be purchasing any real underlying stock. Instead, they’ll purchase the average performance of one particular group of stocks. Since the price of shares for different companies within a single index increase, the index value will simultaneously grow.

On the other hand, if the price falls, the value will decrease. Keep in mind that synthetic trading indices online means that you’ll be trading with two main types:

- Index Futures CFDs

- Index cash CFDs

Difference between the cash market and futures

When considering trading these synthetic indices, it’s crucial to note that the main difference between cash markets and futures is that cash markets don’t include expiry dates. Nonetheless, the futures market has an expiry date called a “rollover.”

Remember that a futures contract refers to the agreement between seller and buyer regarding the price that is needed to be paid by the buyer at the predetermined date in the future.

How can you learn to trade synthetic Indices?

In case you’re ambitious to learn more about synthetic indices trading and become an expert, you can find reputable online courses. When choosing the right online course for synthetic indices trading, it’s crucial that you learn the following:

- What synthetic indices trading represents in general

- How to make smart trade decisions in the synthetic index market

- How to effectively plan your trades with the utilization of entry and exit rules

- The best way to manage all your positions effectively.

Developing great risk management habits

You’ll develop great risk management habits by learning how to make informed and smart decisions. Here is what a solid knowledge base includes:

- Get acquainted with the financial markets’ purpose and all the risks that follow real money investments.

- Exposure to tech-analytical strategies that result in mastery.

- Exploring and taking advantage of Casino houses wisdom to use their strategies for agreeing to passive income.

- Different types of financial vehicles include money-growing models and money-making models.

- A great method of sizing the position to manage traders’ risk is the best. It’s all done with the proper assistance to save a greater part of the invested capital while simultaneously increasing it, etc.

Who should consider learning synthetic indices trading?

So, anyone eager to improve their overall trading experience and grow their funds passively via trading synthetic instruments should seriously consider learning synthetic indices effectively. However, don’t forget that synthetic trading indices aren’t a quick rich-scheme formula, and nothing huge and successful cannot be done overnight.

What are synthetic instruments exactly?

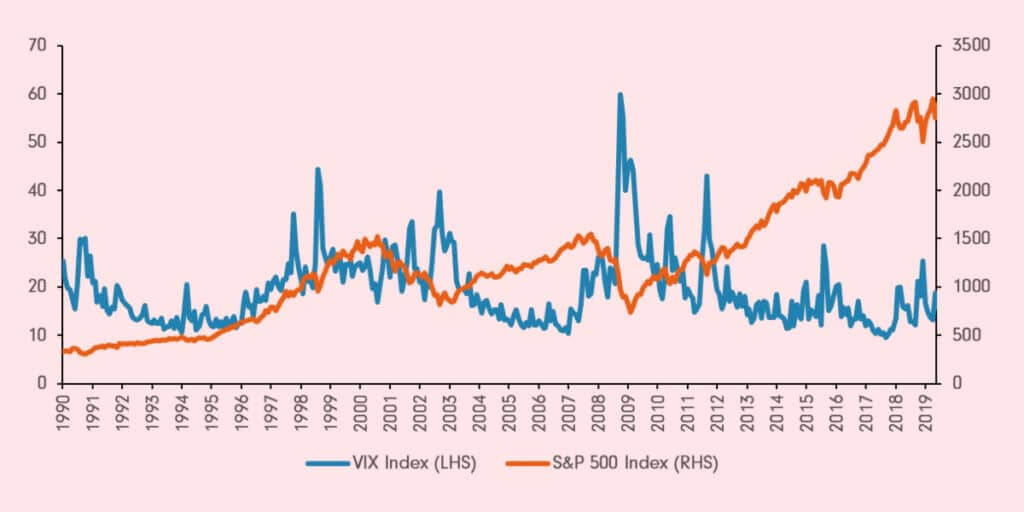

Synthetic instruments represent particular sets of financial derivatives. They’re referred to as “financial derivatives” because they’re derived from the original CBOE volatility index, i.e., “VIX.” This particular volatility index tracks the execution of the famous S&P 500 Index.

However, contrary to the original volatility index, synthetic indices aren’t programmed to follow any financial asset. The famous “Deriv_com” company primarily developed it to enable ambitious investors to trade the volatility index without understanding the fundamentals.

Relatively new financial asset

Remember that the synthetic index, which also considers the synthetic VIX and numerous other simulated instruments, represents a relatively new financial asset. Finding a legitimate course where you’ll learn the best to trade all these assets easily is crucial.

Summary

Synthetic Indices Trading is a method of trading that allows traders to simulate real-world market movement without being affected by global events. Synthetic indices are based on random number generators and are free of liquidity and market risks.

They are controlled and checked by an independent judge, ensuring they cannot be manipulated. Many traders trade synthetic indices because they offer leverage trades and tight spreads.

To trade synthetic indices the best, traders should open a demo account with a reputable broker and practice before opening a real account and starting small. The main advantages of synthetic trading indices include being well-prepared for margin calls, constant volatility, and the ability to trade without being affected by global events.

It is also important to note that synthetic indices are not real assets and therefore do not have underlying assets. Additionally, synthetic indices trading has become increasingly popular among traders as it provides an alternative to traditional trading methods that may be affected by global events and market risks.