| General Information |

|

|---|---|

| Broker Name: | SwissMarketFX |

| Broker Type: | Forex |

| Country: | St. Vincent & the Grenadines |

| Operating since year: | - |

| Regulation: | N/A |

| Address: | First St Vincent Bank Ltd Building, First Floor, Kingstown, James Street, Saint Vincent, and the Grenadines |

| Broker status: | Active |

| Customer Service |

|

| Phone: | N/A |

| Email: | [email protected] |

| Languages: | English, Polish, Czech, Slovakian |

| Availability: | 24/7 |

| Trading |

|

| Trading platform Time zone: | UTC+2 |

| Demo account: | Yes |

| Mobile trading: | Yes |

| Web-based trading: | Yes |

| Bonuses: | N/A |

| Other trading instruments: | Forex, Stocks, Cryptocurrency, Commodities |

| Education: | Yes |

| Account | |

| Minimum deposit ($): | $250 |

| Maximal leverage: | 1:1 up to 400:1 |

| Spread: | Variable or floating for Mini, Advanced, and Executive; Fixed for Prime and VIP |

| Scalping allowed: | No |

SwissMarketfx Broker Review 2021

Introduction

The forex market is a massive industry. Millions of forex transactions happen every second. Every time we want to exchange any other currency for another, we make a Forex transaction.

Trading on the Forex market has always been popular, but lately, it has become very desired. Suppose you are interested in predicting market movement, exchanging currencies, and gaining profit from it. In that case, you might have already started searching for the right brokerage company that would assist you during the process.

The more popular Forex trading gets, the more broker companies appear on the market. Today, we would like to introduce you to a very young and brand-new brokerage: SwissMarketfx.

About SwissMarketfx

SwissMarketfx broker just appeared on the market, but it has already caught our attention. It is registered in St. Vincent & the Grenadines and provides online forex and CFDs trading. As it is difficult to stand out from hundreds of other brokerages, SwissMarketfx tried its best to provide its clients with broader opportunities as they could from the very first day of their existence.

Their decent, well-designed website also provides sufficient information regarding their services.

Generally, we pin out several of the broker’s most essential features and services and describe them in detail to give our reader a fair idea regarding the company.

In our SwissMarketfx review, we will guide you through the broker’s website and evaluate its features.

Regulation

From the trader’s view, we consider the regulation privilege one of the most crucial features. It is not an easy decision to trust your hard-earned money to any company. Thus, regulation and safety terms and conditions are basically the easiest ways to gain a trader’s trust.

Acquiring regulation is a long-term procedure for many companies. Thus some brokers can’t claim it quickly. However, speaking of SwissMarket, they have managed to gain trust from MiFID II.

MiFID II stands for The Financial Instruments Market Directive. It has been adopted by the European Parliament and the Council and was enforced on January 3, 2018. It supervises the financial instrument market that provides investment services and activities within the EU and Europe. The main goals of MiFID II are to coordinate the management of financial markets, improve efficiency, enhance financial transparency, increase competition, and provide better consumer protection in investment services. According to MiFID, investment companies can freely offer their services within the territory of another member country or a third country, provided that the investment company authorizes such services.

Authorized companies fully comply with the European requirements for transparency and good conduct and are therefore allowed to provide cross-border services.

SwissMarketfx fully complies with the applicable requirements of MIFID II. Thus, if the European Parliament and Council can trust a company, it already means that you are in “good hands.”

Safety of Funds

The next question that might arise in your mind is how safe your funds are with the broker. What if the company goes bankrupt?

SwissMarketfx has already thought about the issue. The broker puts all the traders’ money in segregated bank accounts, meaning that your money and company’s funds are separated, and even after the bankruptcy, your funds will stay safe.

Besides, all the trading accounts on SwissMarketfx supports high-tier SSL encryption, which means that all the data gathered on your account is 100% protected and secured from any third-party involvement.

Trading Platform

SwissMarketfx broker has its own trading platform. While some brokers provide MT4/MT5 trading platforms (most famous trading platforms), others prefer their own, private-generated proprietary trading platform.

SwissMarketfx’s trading platform supports customizable spreads, user-friendly interface and tools, educational database and community advice, risk management, portfolio making, and continuous planning assistance. With such broader opportunities, the company tries to appeal to all kinds of traders’ needs, starting from beginner and ending to pro.

You can easily find the most suitable account type, spreads, and customizations for you.

Demo Account

However, if you still are unsure whether you want to deposit money and use the trading platform you haven’t practiced before, SwissMarketfx.com also supports a demo account.

The demo account is absolutely free. It only exists to give the interested traders possibility to try out the website and trading experience. These are the services that a free demo account trading platform supports:

- All features available regardless of the chosen device

- Highly intuitive interface

- Built-in trading tools

- Customizable controls and outlook

- Market analysis assistant

- Major OS and browser compatibility

- No installation needed for mobile devices

- One-click trading options

- Development in line with traders’ feedback and preferences

- Swift trading management

Mobile Trading

Mobile trading is also available on SwissMarketfx. Whether you are an android user or an iOS user, you can install the suitable software and start trading anytime, anywhere.

Mobile trading supports the trade On-the-Go innovations. The mobile-based platform comes with mobile compatibility updates and complete portable device optimization.

You will have all-device access to your trading account, with guaranteed safety and security.

Trading Assets

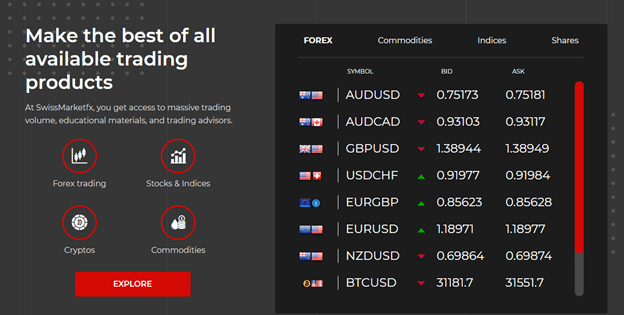

The following essential feature is the trading assets offered by the brokerage. We mentioned the SwissMarketfx broker is a forex & CFDs broker.

While beginner traders might prefer a single trading product and the strategies for that specific market, diversifying the portfolio and experiencing a wide range of asset trading is also an intelligent step. Thus, SwissMarketfx supports several other digital assets to trade with. These are Forex, Crypto, Stocks, Indices, commodities.

Trading Accounts

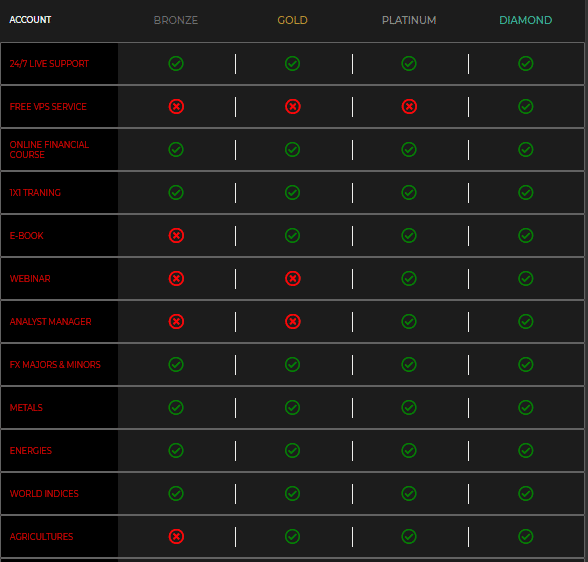

On SwissMarketfx.com, we found several account types with different features. However, we couldn’t identify the prices of the accounts as the website doesn’t say it. Thus, we will show you the account types and what they can support:

Generally, there are basic trading account types: Bronze, Gold, Platinum, and Diamond.

Below, we will point out their services:

Bronze:

- 24/7 live support: Yes

- Free VPS Service: No

- Online Financial Course: Yes

- 1X1 Training: Yes

- E-Book: No

- Webinar: No

- Analyst Manager: No

- FX Majors & Minors: Yes

- Metals: Yes

- Energies: Yes

- World Indices: Yes

- Agricultures: No

Gold:

- 24/7 live support: Yes

- Free VPS Service: No

- Online Financial Course: Yes

- 1X1 Training: Yes

- E-Book: Yes

- Webinar: No

- Analyst Manager: No

- FX Majors & Minors: Yes

- Metals: Yes

- Energies: Yes

- World Indices: Yes

- Agricultures: Yes

Platinum:

- 24/7 live support: Yes

- Free VPS Service: No

- Online Financial Course: Yes

- 1X1 Training: Yes

- E-Book: Yes

- Webinar: Yes

- Analyst Manager: Yes

- FX Majors & Minors: Yes

- Metals: Yes

- Energies: Yes

- World Indices: Yes

- Agricultures: Yes

Diamond:

- 24/7 live support: Yes

- Free VPS Service: Yes

- Online Financial Course: Yes

- 1X1 Training: Yes

- E-Book: Yes

- Webinar: Yes

- Analyst Manager: Yes

- FX Majors & Minors: Yes

- Metals: Yes

- Energies: Yes

- World Indices: Yes

- Agricultures: Yes

Payment & Refund Policy

Although SwissMarketfx.com hasn’t revealed what payment methods they support, they provide sufficient info regarding the refund policy.

Their refund policy says that the money will be returned in the same currency to the same account or credit card where the funds were initially deposited.

However, note that if the customer does not provide the company with bank account details to refund by wire transfer, the company can cancel the refund request within five working days.

Besides, the refund request might cost some fees. The company might charge a commission for deposits in trading accounts and return them to customers, including wire transfer fees.

Note that each wire transaction costs 25-50 euros, and it will be deducted from the wire transfer.

Traders should submit their refund applications through the company website. Withdrawal methods also are not mentioned on the website, but if you have any further questions regarding the payment system, you can feel free to contact their customer service.

Customer Service

SwissMarketfx’s customer service looks pretty dedicated as they work 24/7. The broker accounts for a new company, but it already supports four different languages: English, Czech, Polish, and Slovak.

The company is located at Saint Vincent and the Grenadines, First Floor, First St Vincent Bank Ltd Building, James Street, Kingstown.

You can reach them through their email address: [email protected]

Besides, you can fill in the message box on their website and leave a question. You will need to write your name, last name, email address, and the issue at hand. After you leave the message, you will receive the answer in your email within minutes.

It is a wide-known method for companies to secure their client’s privacy.

Conclusion

In the SwissMarketfx review, we tried to demonstrate all the essential details every brokerage needs to own. With these features, they stand out and gain trust and success for themselves and their clients.

Overall, we consider SwissMarketfx a reputable and trusted company with its easy-to-use website and platforms.

The broker supports their client’s privacy and security. However, it doesn’t guarantee your 100% success while trading with SwissMarketfx as the industry itself consists of high risks of money loss and damage. SwissMarketfx has a risk management tool to prevent your loss maximally. Though, no broker company can take full responsibility for your trading experience. Please keep in mind that you will trade at your own risk.

-

Support

-

Platform

-

Spread

-

Trading Instrument

Awesome trading options

Awesome trading options. MOst are profitable. Services and signals are both great.

Did you find this review helpful? Yes No

Outstanding broker

Oustanding broker services. They perform good. They offer wide range of tradable instruments.

Did you find this review helpful? Yes No

Good profit

I am lucky to have them as my forex brokers. I have been gaining a really good profit.

Did you find this review helpful? Yes No