Swing Trading Basics

New to trading stocks?

You may have heard just about swing trading, but you are not sure what it is.

There are questions in your mind, such as, “Is it a strategy? Or a sort of trading?”

Worry no more! This article was designed especially for you!

If you read further, you are going to understand swing trading techniques and strategies that will put you on the path to success.

Discovering how to swing trade stocks can be difficult without the knowledge necessary to prosper. The majority of traders flunk and lose all their money in the process in their first year!

However, bankruptcy will not happen if you go through and understand all of the material in this article.

Also, you need to have a strategy and then expand the discipline to follow it.

In the end, you will succeed where others have declined.

Introduction to Swing Trading

What Is Swing Trading?

Swing trading is an approach of trading stocks that attempt to capture short term moves in the stock market.

A swing trader usually holds a stock for 2 to 5 days.

WHY?

It is because that is the perfect time frame for those that have a job and cannot “day trade”.

The time frame is also unique in that you can capture explosive moves in stock in a brief time.

REMINDER:

As a swing trader,

- You do not care regarding the fundamentals of a company.

- You do not care what type of products they sell.

- You do not even care what the name of the firm is.

Make your trading choices based on the laws of supply and demand – nothing else.

3 Main Sections On Swing-Trade

Always start with the basics and then move on to the strategy section.

When you are ready, read through the rest of the articles.

Here is a brief description of some strategies to follow:

- Beginners: Learn the basics of swing trading

In the first section, you will find out about swing trading basics. The topics contain trends, price, volume, and strength.

Without a solid understanding of how and why stocks move will drag you down. Most of many traders fall into this category.

Do not skip over this section! Understand and comprehend.

- Intermediate: Learn a simple swing trading strategy

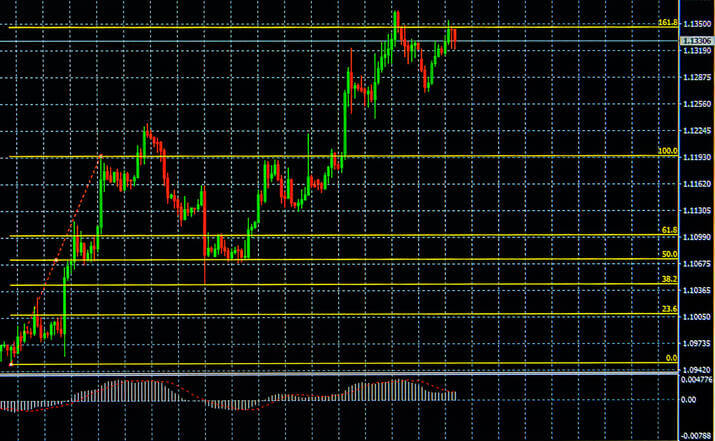

In the second section, you will understand the swing trading strategy by using charts and technical analysis.

Moreover, you will learn precisely how to trade pullbacks, market timing (yes, it is possible).

Lastly, you will find out how to manage your money appropriately, so you don’t end up like the majority of new traders – penniless!

- Advanced: Learn the advanced swing trading tactics

In the third section, you will discover swing trading tips and tricks to something positive that enhances a situation that’s already excellent.

Read more about Fibonacci retracements, look at three chart patterns, and understand how to trade multiple time frames. Plus, much more!

Conclusion

Check out some evaluations of trading tools and resources that can support you enhance your performance and knowledge.

- FXCM provides traders with a wide range of market research tools and resources that will appease the majority. Check out Financebrokerage’s review on FXCM.

Also, don’t forget to look into the top stock market books to see a list of the most insightful manuscripts.

Get started swing trading now!