Swing Trader: A Complete Strategic Guide That Works (part 2)

In the first part, we’ve discussed the three swing trading strategies (Support and Resistance box, Surfing the wave, Fading the move). Now, in this part, you’ll learn about an important thing in which is critically necessary. That of which will help you manage your trade.

For this part, we’ll point out two trade management that will help you trade with confidence and conviction. One, passive management. Two, the active management. Let’s now go on with these two pointers.

-

Passive management

Then it comes to this management, you are to allow the market to hit your stop loss/target profit, or you will do nothing. Usually, traders want to set their stop loss away from the turbulence of the markets having a target profit within a flexible reach. That of which is ahead of the market structure.

Now let us look at the advantage and disadvantages of passive management.

Advantage:

To be honest, there is only one advantage seen in passive management. That is the fact that trading is more relaxed because your decisions/choices are likely “automated.”

Disadvantages:

Looking at the disadvantages, we could see two to consider. One, you’ll be unable to exit trade ahead of time even if the market is showing some signs of a reversal. Two, there is a possibility to see winning trade becoming a full 1R loss.

Remember the pointed advantage and disadvantages when working with passive management swing trading. Now let us go on to the next management strategy.

-

Active management

On this part, you’ll need to look at how the market reacts before making a decision to hold or exit the trade. Active management is critical which needs an active approach to work. You’ll be needing to manage the trades on your entry timeframe or higher. Making just a few mistakes in this part on its lower timeframe could be very painful for you especially whenever a pullback occurs.

Now let us look at the advantage and disadvantages of active trading management.

Advantage:

Similarly, with passive management, active management is seen with only one advantage which is critical. The fact is, you can minimize your loss rather than getting a full 1R loss.

Disadvantage:

As this management needs more of your time, it will be more stressful. But more importantly, you might decide to exit a trade too soon without giving it enough space and time to run.

If you are an active management type of trader, we’ll share further strategies with you that you can use. Continue reading to learn what we mean to say.

-

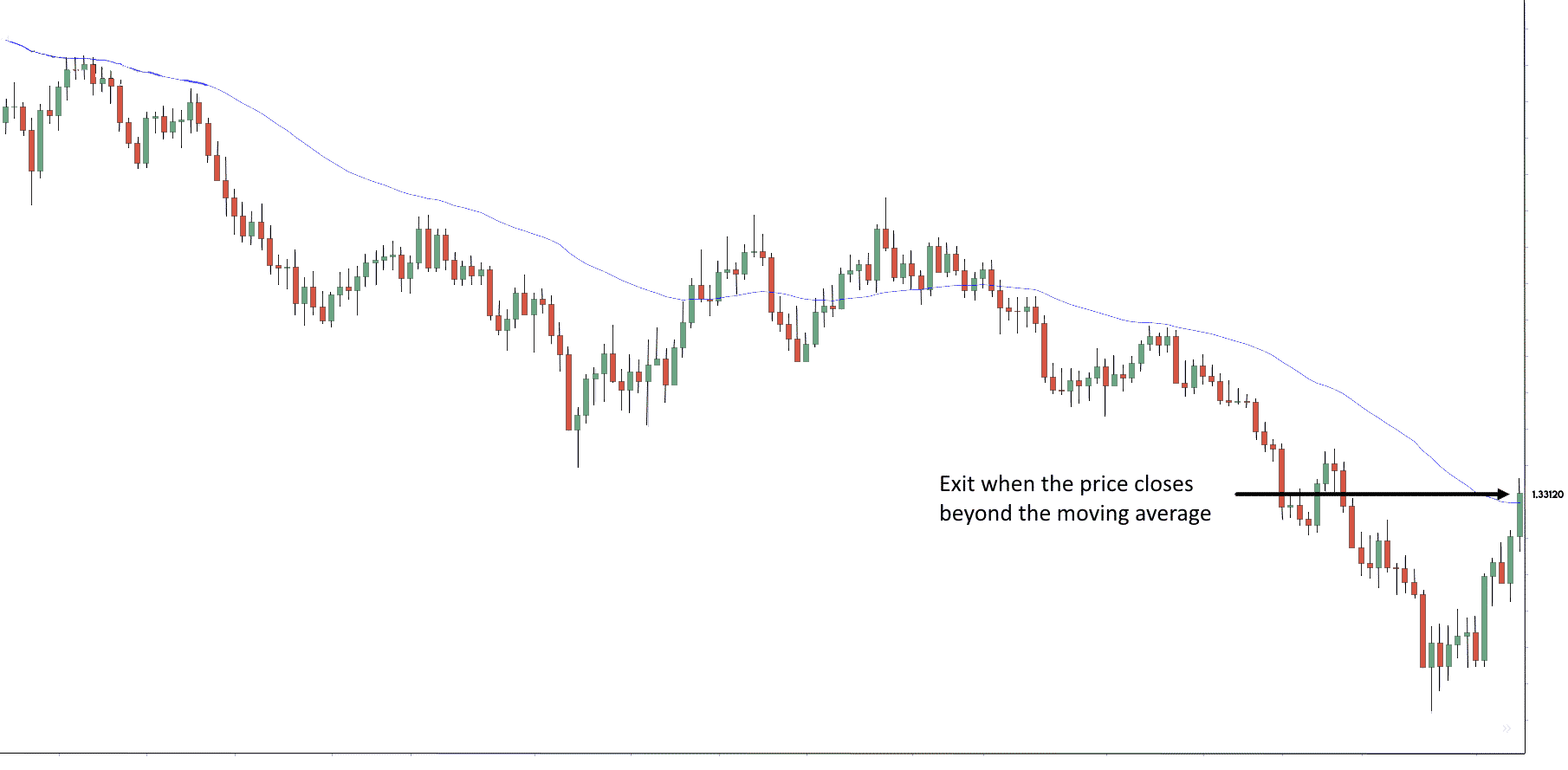

Active trading: Moving Average

The first strategy includes a moving average indicator in order to trial a stop. You need to remember holding on to a trade whenever the price doesn’t break over the moving average. Therefore, if it does break out of the moving average, exit the trade. Look at the sample chart below to further understand our point.

-

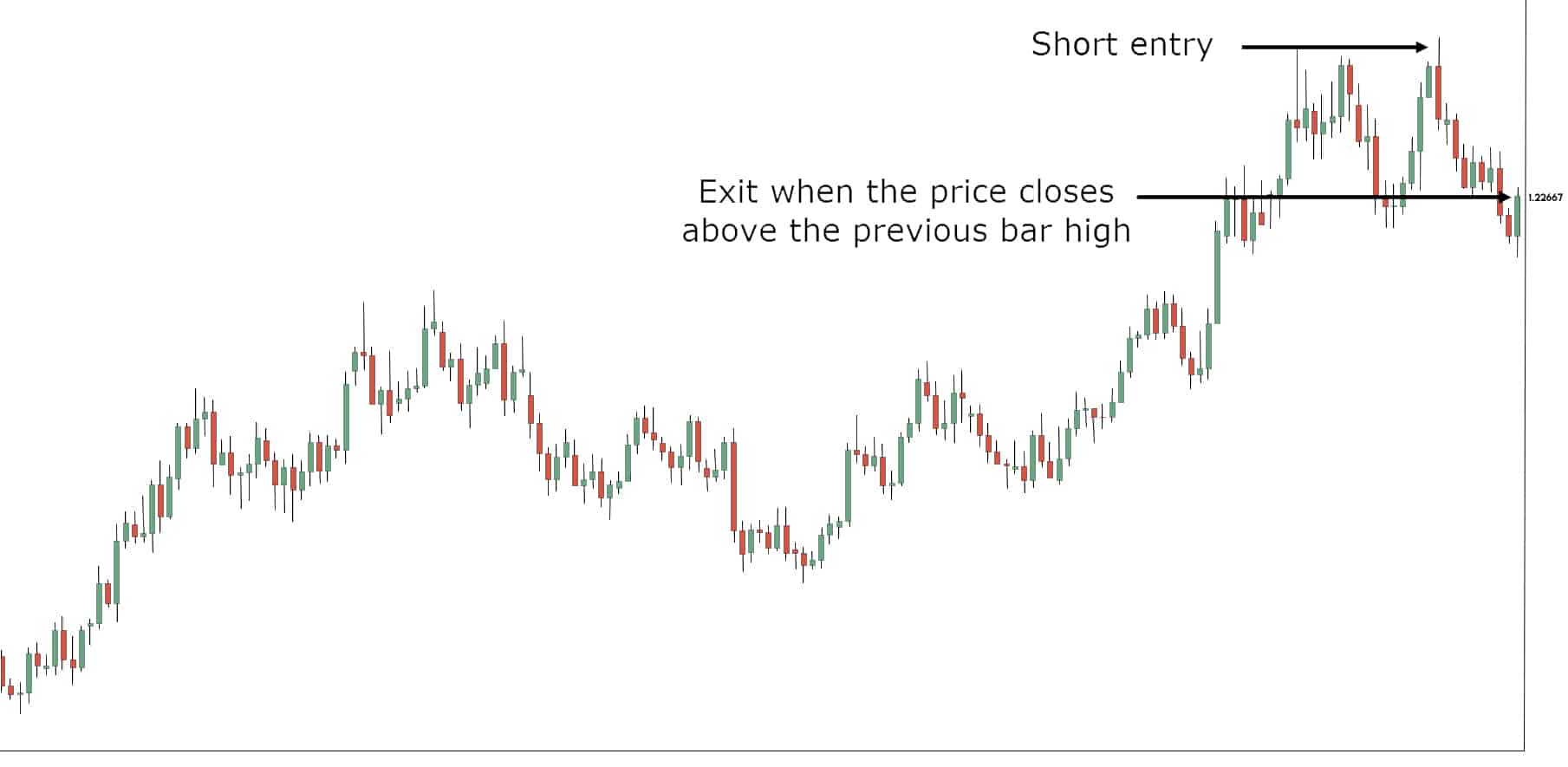

Active trading: Previous bar (high/low)

Meanwhile, this next strategy relies on the previous bar in the chart. You’ll trail the stop loss. You’ll trail it using the stop loss from the previous bar high. Whenever the market breaks and closes over it, you’ll be needing to exit the trade. Exit also in the opposite scenario. Look at the sample chart below to understand further.

-

Support

-

Platform

-

Spread

-

Trading Instrument