Supply Line and Support Line

Chapter 10

As soon as you observe the emergence of a widespread above, on high volume, passing through the top of a trend channel (supply line) and goes higher the following day, then expect that there would be higher prices.

Effort versus results – you will get the corresponding result from those things which you had put efforts into. As a widespread up-bar, on high volume (effort), amid coming near, however avoiding to pass through the supply line, with the following day down (no results from effort), exhibits that one can be looking out for a reaction (downward move) within the trend, or at the very best a sideways movement.

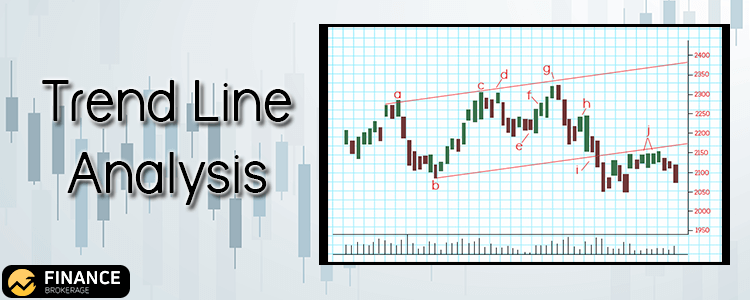

By selecting two highs and intervening low (points at A, B, and C), trend lines were drawn. Closely, the trend line at point (d) becomes helpful. With the old top at point (c) and moving upwards passing through a resistance area, you need to observe an increase in volume, not low volume. Right now, you are aware that the upper trend line should not be infiltrated at this point.

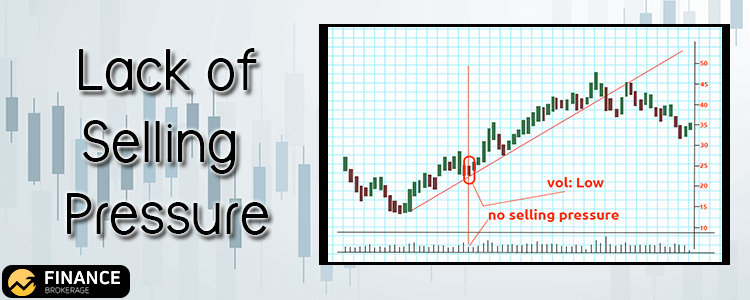

The point (e) allows the market to react. Take note that for every down-day is on low volume – selling price is not available. If there is an absence of selling pressure, the tendency is that the market will go above. There’s an up-thrust at point (f). Normally, there is no up-thrust in strong markets. There would be an average volume on this up-thrust thus; the markets will continue to go upwards for two days.

Notice that the price spread at point (g) has tightened and misses the mark to reach the upper trend line. Unless there is market bullish at this point, the spread would appear wide and above, possibly gaping above and penetrating the upper trend line. Take note that we already observed a sign of weakness in the background at point (f). The price made a sharp decline the next day on high volume. Then, there was a decline of two days of wide spreads on high volume (selling pressure). All financial markets are made to allow you to lose money to the professionals, making the markets dither above and below within any trend. This will place you under some sort of pressure.

Professional operators execute ruthlessly to remain in business or else everybody would be victors. The market is increasing at point (h) however; the amount of volume is low. The market is unable to go above on low volume following the existence of weakness indicators in the background. Also, we are in the middle of the trading range on the trend line’s portrayal.

There’s a serious sign of weakness at point (i), as a widespread down on high volume indicated it, as the price comes near the lower trend line. Notice the process as to how the prices are immediately declining through the lower resistance area. Upon the drop in the price below the trend line, the market is presently oversold and will transform into a resistance line to higher prices. You have to witness the wide spreads with increased volume in order to infiltrate resistance upwards. Every up-day is on low volume at points (j). An effort is completely non-existent at point (j) to pass through the lower trend line; hence, we are confident to expect lower prices.

Movement Approaching Support

As the price approaches closely to the lower trend line (Support line) in a down-move, any low volume appearing will signify that the trend line is expected to hold for that particular time. That is because an effort to change the trend is non-existent. You will need to push through resistance at the support line.

Unless the volume is high, with a widespread down, amid the movement of price approaching near the lower trend line, a broken trend line due to the extra effort is likely to appear.

Unless the price is coming from the top of a trend line, approaching near the trend line, on low volume, we would likely to see that the trend line will hold due to effort’s absence.

A resistance area is represented by the support line. A selling price is needed by the resistance area to penetrate the support line.

A resistance area is represented by the support line. A selling pressure is needed by the resistance area to penetrate the support line. Remember that low volume would signify that there is minimal selling hence; the line is expected to hold.