Stocks, Gold, and Commodities Meet the Fed

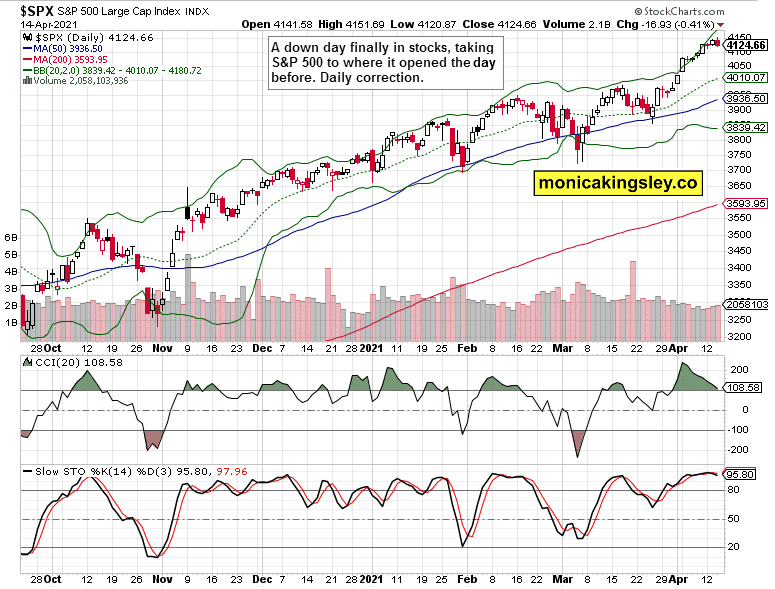

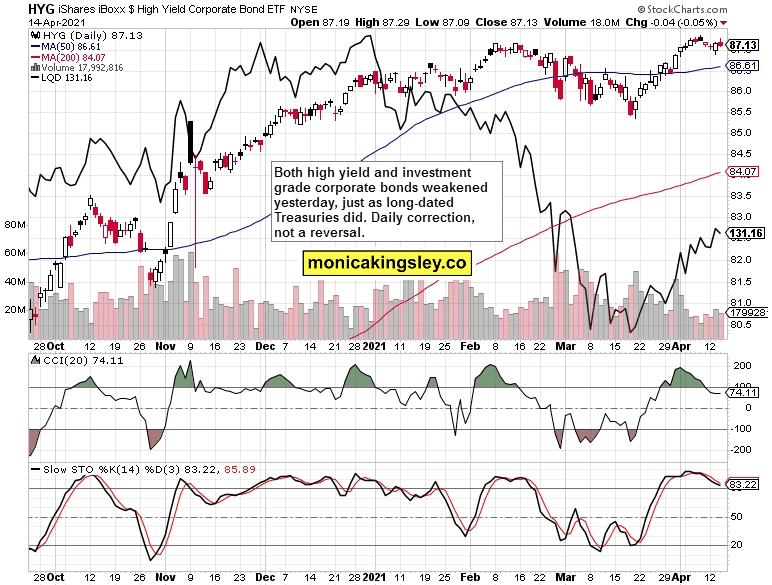

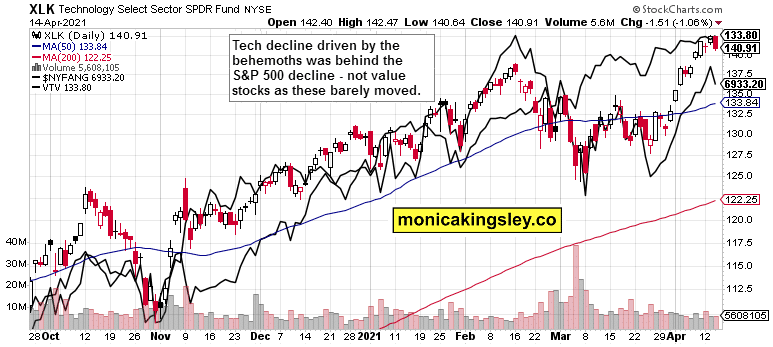

S&P 500 in the red – unprecedented. Don‘t pin your hopes too high for a (sharp) correction though. Yes, this time stocks listened to the weakening corporate credit markets, and the daily retreat in long-dated Treasuries inspired some profit-taking in tech. Quite some run there as yields stabilized, which has turned XLK from very stretched to the downside of its 50-day moving average, to the upside extreme. Tesla also followed suit but I doubt this is a true reversal of tech fortunes.

As stated yesterday:

(…) That‘s the result of the sea of liquidity in practice, and the avalanche of stimuli. The 1.50% yield scare on 10-year Treasuries is long forgotten, and technology welcomes every stabilization, every retreat from even quite higher levels, and value stocks barely budge. No real rotation to speak of and see here, move along.

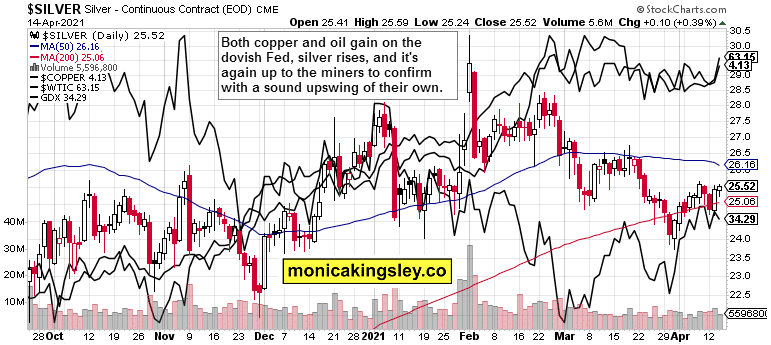

CPI inflation is hitting at the moment, and its pressure would get worse in the coming readings. Yet the market isn‘t alarmed now as evidenced by the inflation expectations not running hot – the Fed quite successfully sold the transitory story, it seems. Unless you look at lumber, steel, or similar, of course. None of the commodities have really corrected, and the copper performance bodes well for the precious metals too.

Fed

The Fed mightily confirmed the message yesterday, which is what commodities loved. Inflation has free reign, all it has to do is to take advantage of it. And if I look at rising oil filtering into higher gasoline and food prices, the real inflation will keep on biting (even though black gold is excluded from CPI calculations).

I don‘t expect these recent observations to change much, especially since we got the daily breather yesterday – but 3, let alone 2 red candles in a row? I haven‘t seen that in stocks for quite a while:

(…) No denying that the stock market is in a strong uptrend, but it got a bit too stretched vs. its 50-day moving average – a consolidation in short order would be a healthy move, but the CPI readings above expectations don‘t favor one [on Tuesday].

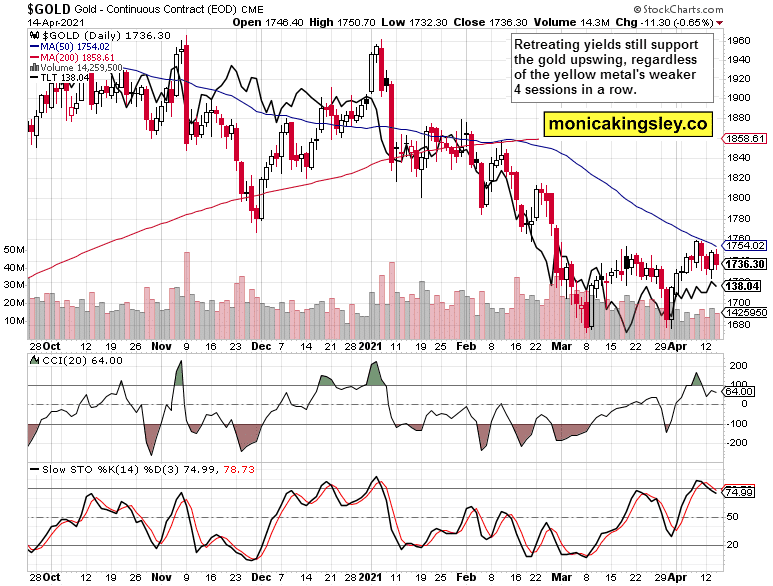

Precious metals didn‘t swing higher immediately, but I expect them to take the commodities‘ cue next. When Powell says the Fed isn‘t thinking about selling bonds back into the market, and that he learned that real rates aren‘t probably rising much any time soon. It appears to be a question of time before inflation expectations squeeze the nominal yields some more, which is what gold would love.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

S&P 500 Outlook

Daily downswing on marginally higher volume that doesn‘t shift the perspective towards a corrective territory in the least. The correct question instead is probably whether the S&P 500 upswing reasserts itself the next day or the day after.

Daily downswing on marginally higher volume that doesn‘t shift the perspective towards a corrective territory in the least. The correct question instead is probably whether the S&P 500 upswing reasserts itself the next day or the day after.

Credit Markets

Both high yield corporate bonds (HYG ETF) and the investment-grade ones (LQD ETF) reversed to the downside yesterday, and long-dated Treasuries didn‘t have a good day either. The reversals cannot be trusted as I look for the upswing in both to continue.

Technology and Value

Tech (XLK ETF) driven by $NYFANG (lower black line) and then also Tesla (TSLA), were the key underperformers yesterday. Value stocks kept moving higher, and higher SPX prices are more likely next in this no real rotations to speak of the environment, courtesy of all the extra liquidity.

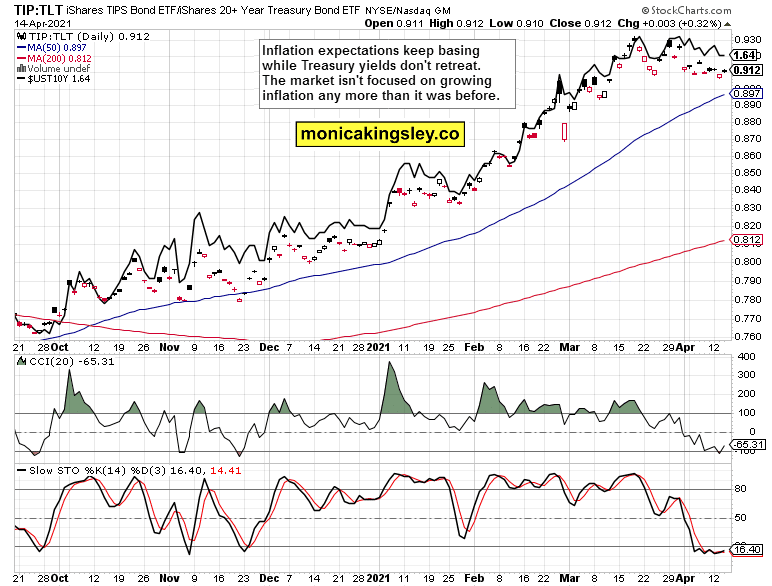

Inflation Expectations

Yields are not rising, but aren‘t yet retreating either. Have the rising inflation expectations been banished? I‘m not convinced even though they aren‘t running hotter in the wake of PPI and CPI figures, which are bound to get worse next – if copper and oil are to be trusted (they are). Remember that the Fed‘s stated mission, for now, aims to let inflation run to make up for prior periods of its lesser prominence.

Gold in the Limelight

Nominal yields are gradually taking the pressure off the yellow metal as the miners keep outperforming gold. Seniors (GDX ETF) would lead gold by breaking above their recent highs convincingly (solidly above $35 on rising volume and bullish candle shape), as the tide in the metals has turned. The unavoidable inflation data bringing down real rates would do the trick.

Silver, Copper, and Oil

While silver recovered intraday losses, both copper and oil surged on the Fed reaffirmations. In fact, the table became set for miners and both precious metals to move higher.

Summary

What a fast S&P 500 correction, how did you like it? The bulls have yet again reversed the setback in today‘s premarket session, and the slow grind higher keeps going on.

Gold and miners are likely to take a cue from the surging commodities and grow emboldened by the nominal yields retreat. Patience is necessary before the nearest resistances in both assets are taken out with conviction.

Thank you for having read today‘s free analysis, which is available in full at my personal site. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for both Stock Trading Signals and Gold Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

www.monicakingsley.co

[email protected]

* * * * *

All essays, research, and information represent analyses and opinions of Monica Kingsley that are based on the availability and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes. It should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks, and options are financial instruments not suitable for every investor.

Please know that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she is not responsible or liable for any decisions you make. Investing, trading, and speculating in financial markets may involve a high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

-

Support

-

Platform

-

Spread

-

Trading Instrument