Stock Market Forecast: Tough Choices Ahead

S&P 500 declined on poor PPI data, with financials virtually the only sector closing in the black. Rising yields and risk-off credit markets, that‘s the answer – markets are afraid of a more hawkish Fed than what they expect already. While the central bank will strive to project a decisive image, I‘m looking for enough leeway to be left in, and packaged in incoming data flexibility and overall uncertainty. Good for them that the fresh spending initiative hasn‘t yet passed.

Still, I‘m looking for the Fed to be forced during 2022 to abruptly reverse course, and bring back the punch bowl. Treasuries look serene, and aren‘t anticipating sharply higher rates in the near term – not even inflation expectations interpreted higher PPI as a sign that inflation probably hasn‘t peaked yet. This isn‘t the first time inflation is being underestimated – and beaten down commodities (with copper bearing the brunt in today‘s premarket) reflect that likewise. Only cryptos are bucking the cautious entry to the Fed policy decision, and decreasing liquidity, in what can still turn out as a lull before another selling attempt.

I think that the overly hawkish Fed expectations are misplaced, and that the risk-on assets would reverse the prior weakness – both today and in the days immediately following, which is when the real post-Fed move emerges. Odds are that it would still be up across the board. Yes, I‘m looking for the Fed speak to be interpreted as soothing – as one that would still result in market perceptions that the real bite isn‘t here yet, or doesn‘t look too real yet. Big picture is that public finances need inflation to make the debt load manageable, and that ample room to flex hawkish muscles isn‘t there (as retail data illustrate).

As I wrote in yesterday‘s summary:

(…) Risk-off mood is prevailing in going for tomorrow‘s FOMC – the expectations seem leaning towards making a tapering / tightening mistake. While headwinds are stiffening, we haven‘t topped yet in stocks or commodities, but the road would be getting bumpier as stated yesterday. Select commodities and precious metals are already feeling the pinch late in today‘s premarket trading, but there is no sending them to bear markets. Get ready for the twin scourge of persistent inflation and slowdown in growth to start biting increasingly more – just-in producer price index (9.6% YoY, largest ever) confirms much more inflation is in the pipeline, and the Fed would still remain behind the curve in its actions.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

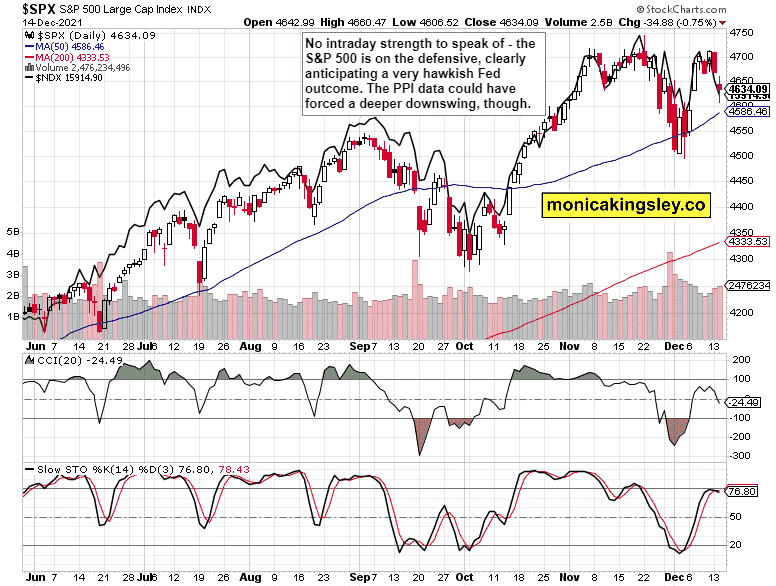

S&P 500 and Nasdaq Outlook

S&P 500 had a weak day, but the dip was being bought – there is fledgling accumulation regardless of deteriorating internals, and tech selloff continuing.

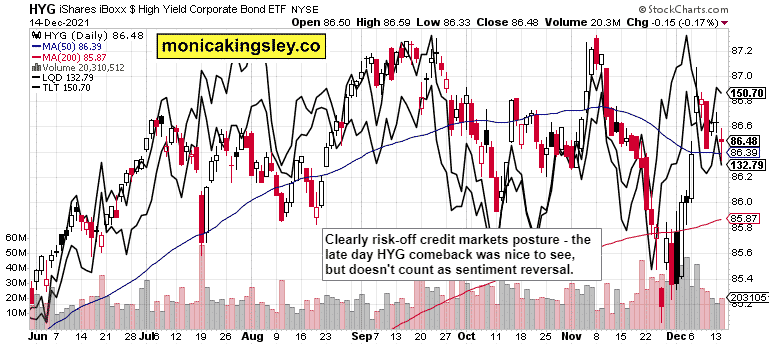

Credit Markets

HYG even staged a late day rally – bonds are in a less panicky mood, not anticipating overly hawkish Fed message. And that‘s good for the markets that sold off a bit too much.

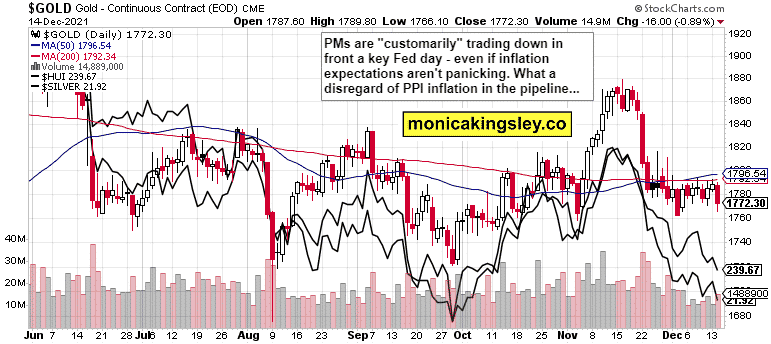

Gold, Silver and Miners

Precious metals downside appears limited here, and today‘s premarket downswing has been largely erased already. Much catching up to do on the upside, just waiting for the catalyst.

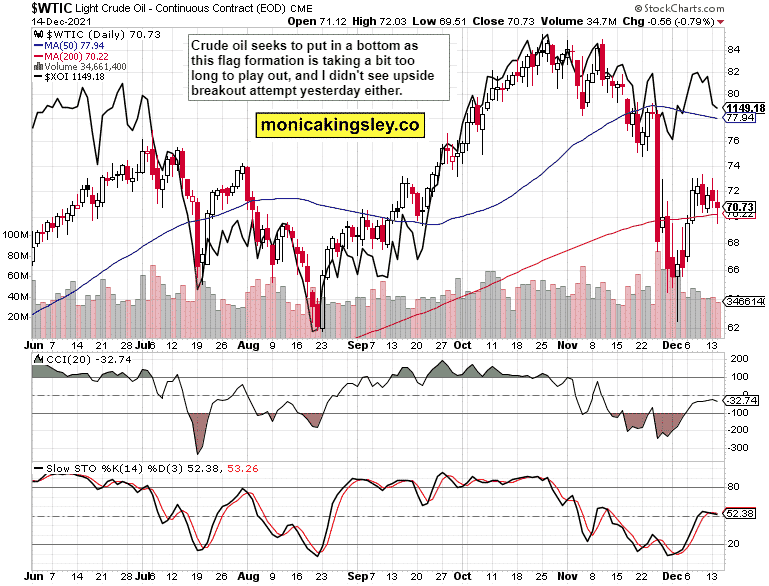

Crude Oil

Crude oil is on the defensive now – the weak session yesterday didn‘t convince me. I‘m though still looking for higher prices even as today‘s premarket took black gold below $70. Still not looking for a flush into the low or mid $60s.

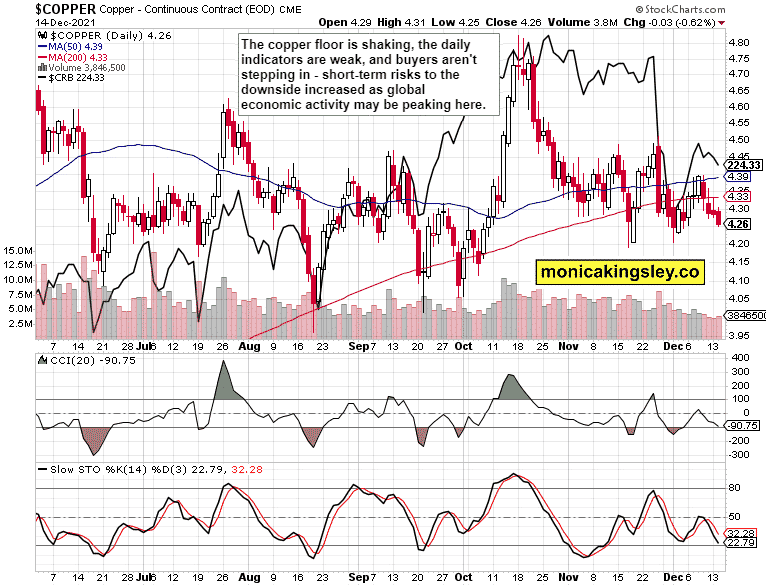

Copper

Copper upswing didn‘t materialize, and worries about the economic outlook keep growing. The sideways trend keeps holding for now though, still.

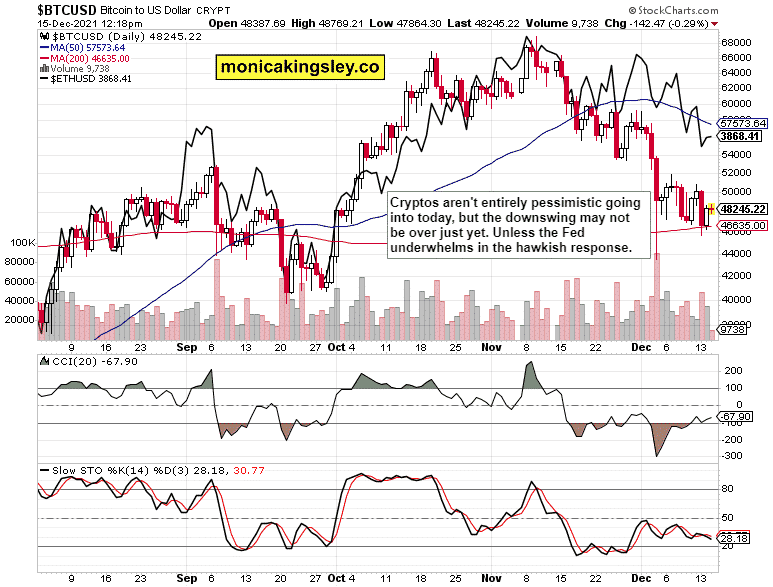

Bitcoin and Ethereum

Bitcoin and Ethereum bottom searching goes on, yesterday‘s downside target was hit, but the bottom (at $46K BTC or $3700s ETH) might not be in just yet. Cryptos remain in wait and see mode.

Summary

Bears aren‘t piling in before today‘s FOMC – the Fed‘s moves will though likely be interpreted as not overly hawkish. Given more incoming signs of slowing economy, the window of opportunity to tighten, is pretty narrow anyway. Why take too serious a chance? Yes, I‘m looking for the weakness in real assets to turn out temporary, and for stocks not to be broken by inflation just yet – as argued for in the opening part of today‘s analysis.

Thank you for having read today‘s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for all the five publications: Stock Trading Signals, Gold Trading Signals, Oil Trading Signals, Copper Trading Signals and Bitcoin Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

Oil Trading Signals

Copper Trading Signals

Bitcoin Trading Signals

www.monicakingsley.co

[email protected]

* * * * *

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

-

Support

-

Platform

-

Spread

-

Trading Instrument