Stock Market Forecast: The Risk-Off Moves Returning

In line with the pressing circumstances I told you about on Jul 29 at my site, today’s report will again have to be way shorter than usual and focus only on select charts to drive all five publications’ position details.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

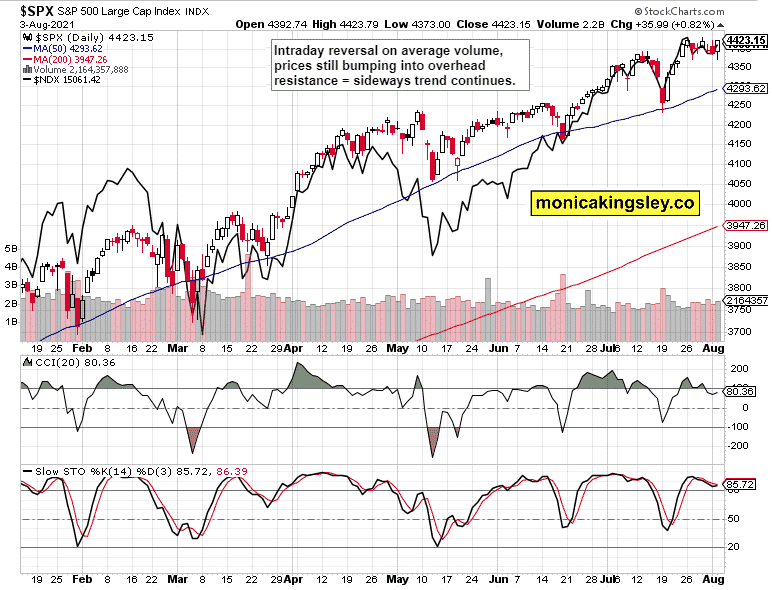

S&P 500 and Nasdaq Outlook

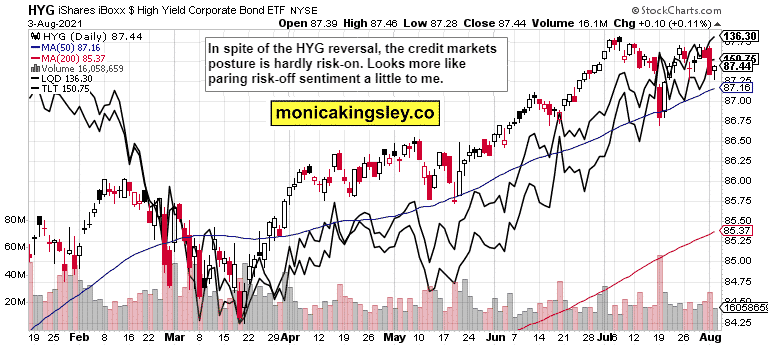

Credit Markets

Credit markets didn‘t really reverse yesterday – the risk-off sentiment remains very much on despite HYG erasing intraday losses. The stock market bulls aren‘t out of the woods in spite of the improving market breadth.

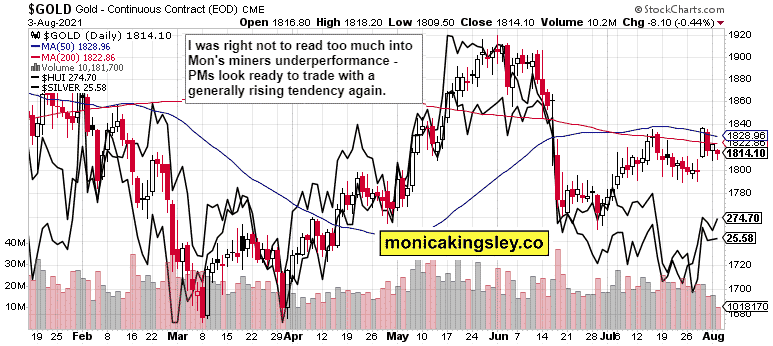

Gold, Silver and Miners

Miners‘ strong showing yesterday bodes well for both precious metals, and I‘m looking for more gains in the sector. Remember that declining real rates on account of the risk-off bond moves increase gold‘s appeal just as much as any worries about a decelerating economy or external shocks.

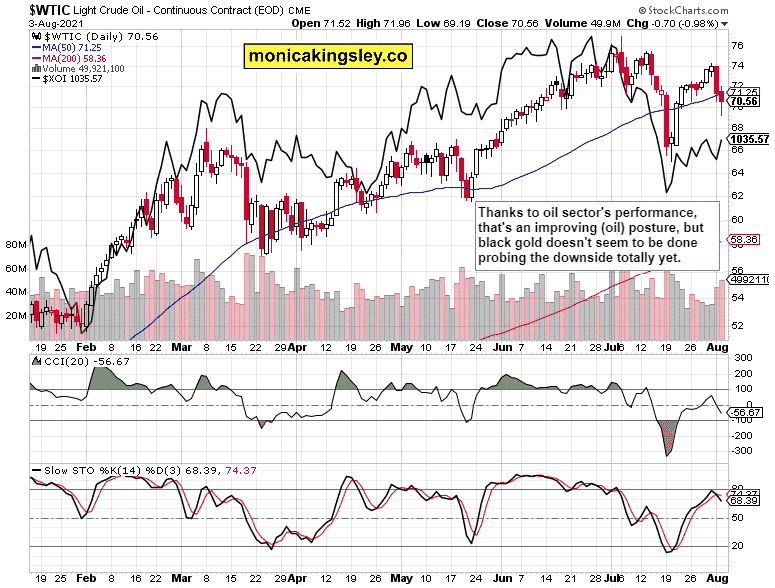

Crude Oil

Yesterday‘s downswing was partially bought, and the energy sector (great performance within the S&P 500) would point to a reversal soon. I‘m though not convinced that the bottom is in and that the bears have said their last word.

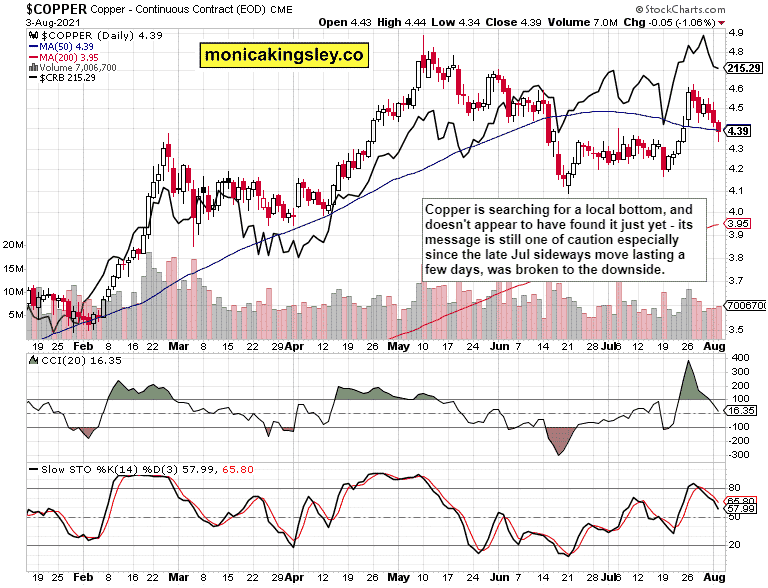

Copper

Copper has traded on a weak note yesterday and hasn‘t convincingly stabilized just yet. The volume indicating buying interest isn‘t there.

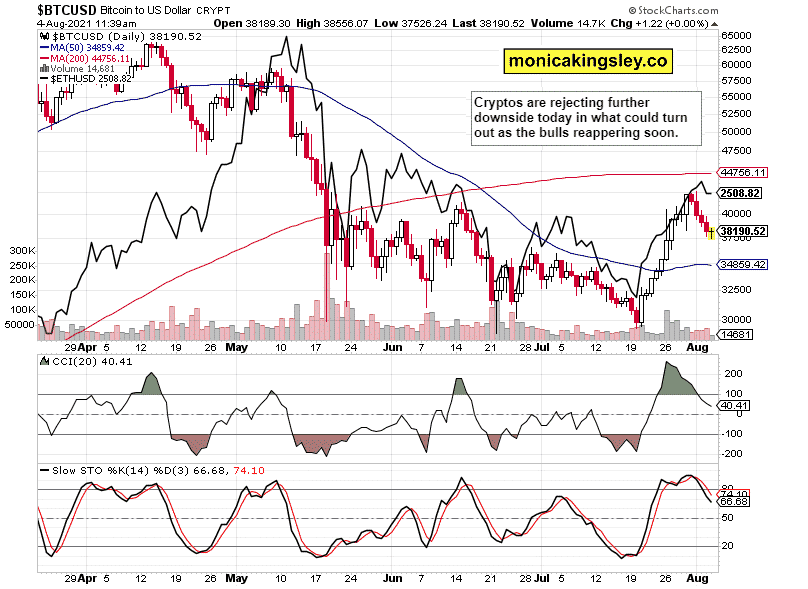

Bitcoin and Ethereum

Trading little changed, both cryptos are more than likely to go higher next, even if the indicators aren‘t yet hinting at that possibility strongly. Should they turn from here (likely in the current atmosphere, alongside PMs), that would be a promising sign for the bulls.

Summary

In place of summary today, please see the above chart descriptions for my take.

Thank you for reading today‘s free analysis, which is available in full here at my home site. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for all the five publications: Stock Trading Signals, Gold Trading Signals, Oil Trading Signals, Copper Trading Signals and Bitcoin Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

Oil Trading Signals

Copper Trading Signals

Bitcoin Trading Signals

www. monicakingsley.co

[email protected]

* * * * *

All essays, research and information, represent analyses and opinions of Monica Kingsley that are based on availability and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor.

Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible for any decisions you make. Investing, trading and speculating in financial markets may involve a high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings. She may make additional purchases and/or sales of those securities without notice.

-

Support

-

Platform

-

Spread

-

Trading Instrument