Stock Market Forecast: Risk-On Is Back!

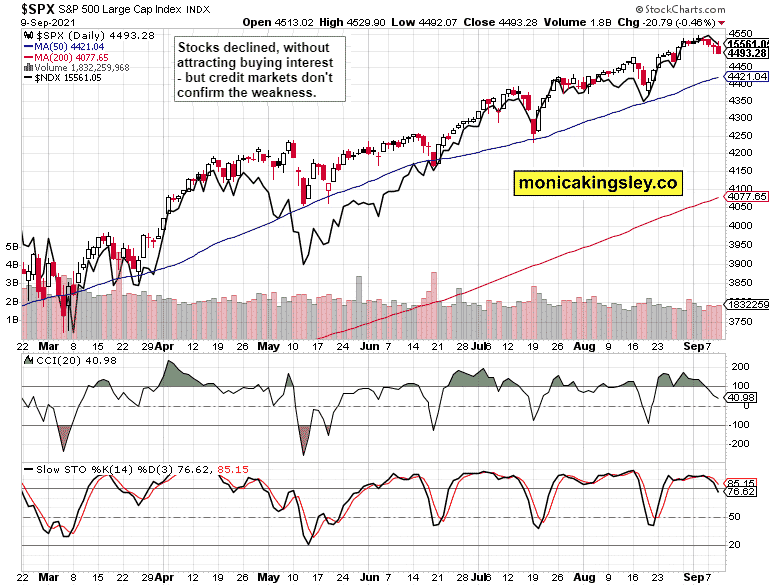

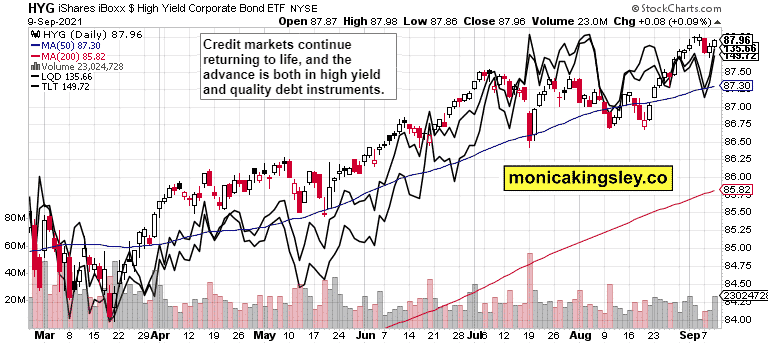

S&P 500 decline was at odds with the credit markets doing fine yesterday – it looks to me the bears mustered all the strength they could. And that wasn‘t too much, really – this week‘s woes look to be over, and VIX is ready to decline once again, which means that both tech and value can look forward to higher prices.

Keeping in mind yesterday‘s big picture:

(…) did you notice the degree of bearishness that such a measly downswing elicited? Given where the Fed and Treasury are in monetary and spending plans, nothing has changed – the debt ceiling drama is still out of the markets‘ focus alongside pretty much everything else, including Evergrande and similar fears. Who could have forgotten the late Jan GameStop, or then Archegos? And the markets keep rising on the staircase liquidity wave interrupted by a fresh stimulus here and there:

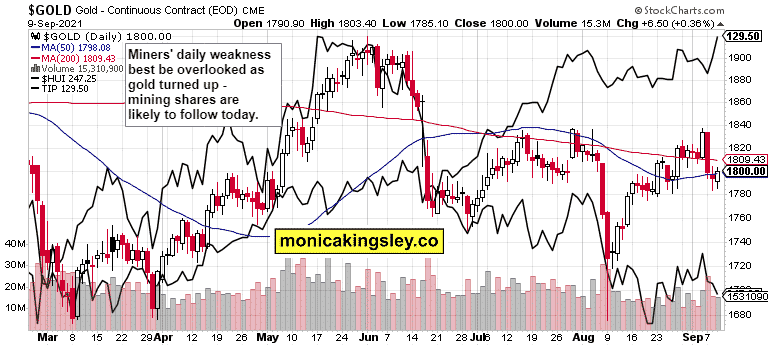

I‘m looking for a solid close across the paper and real assets and for cryptos to join in next week. As for precious metals, the miners to gold ratio (HUI: GOLD) isn‘t breaking to new lows. Gold and silver are waiting for the right catalyst. The downside is limited and outshined by the upside potential.

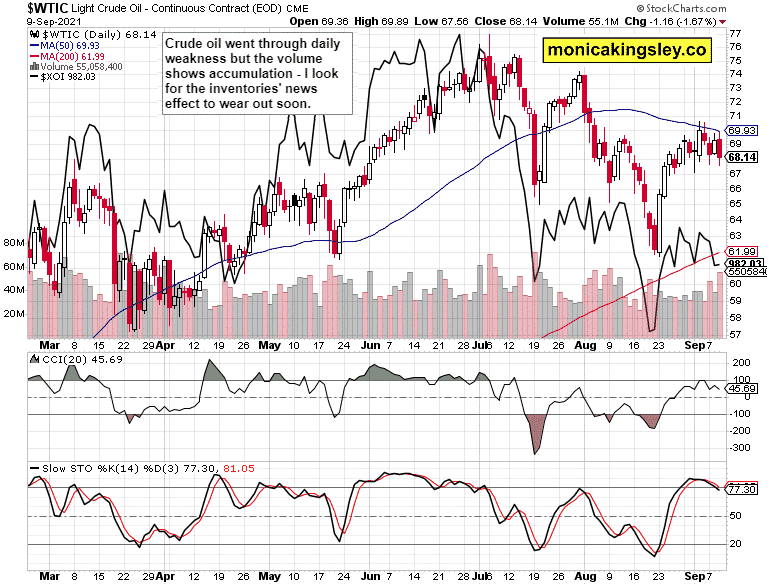

Anyway, time to lock in significant open profits in oil and copper while letting them grow!

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

S&P 500 and Nasdaq Outlook

The S&P 500 downswing appears stronger than it internally is at the moment – we have likely seen the lows for quite a few trading sessions ahead.

Credit Markets

The credit market continues turning up, which is the most encouraging element for me in looking for a full-fledged return to risk.

Gold, Silver, and Miners

Gold and silver are stable in the very short run and can surprise on the upside – yesterday‘s stabilization is merely a starting point. As real rates go more negative, look for attention to shift to this tailwind for higher precious metals prices.

Crude Oil

Crude oil confirmed how volatile it could be as the U.S. inventories report facilitated selling, but the high volume hints at accumulation. I continue leaning bullish.

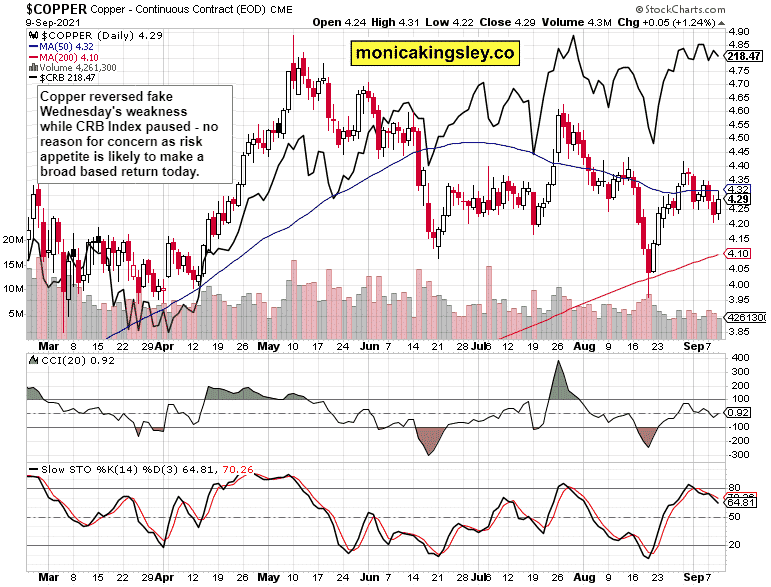

Copper

Copper and CRB Index exchanged directions yesterday, and I am looking for a good day in both later today – even if in the context of real economy deceleration.

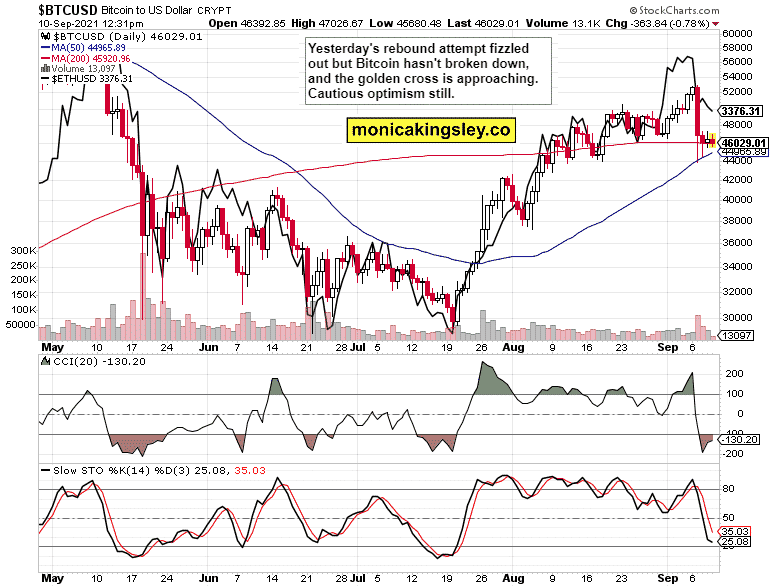

Bitcoin and Ethereum

Bitcoin and Ethereum are modestly down today but not breaking down. The serious upswing attempt looks to have to wait for next week.

Summary

Risk-on is likely to gain the upper hand shortly, yet another weak selling wave is drawing to its end. Crucially, the dollar is rolling over, and that bodes well for both real and paper assets.

Thank you for reading today‘s free analysis, which is available in full at my home site. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for all the five publications: Stock Trading Signals, Gold Trading Signals, Oil Trading Signals, Copper Trading Signals, and Bitcoin Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

Oil Trading Signals

Copper Trading Signals

Bitcoin Trading Signals

www.monicakingsley.co

[email protected]

* * * * *

All essays, research, and information represent analyses and opinions of Monica Kingsley that are based on availability and the latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks, and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading, and speculating in financial markets may involve a high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

-

Support

-

Platform

-

Spread

-

Trading Instrument