Stock Market Forecast: Retreating Bears and Dollar Struggles

S&P 500 decline leaves something to be desired – conviction of the bears. Credit markets and the dollar have sent not so subtle signs that we‘re in the latter innings of this week‘s corrective move, and a snapback attempt in stocks is likely. That‘s even more so true in commodities – these didn‘t wait (with the exception of copper). Stocks though remain wavering, without a clear tech or value leader.

But did you notice the degree of bearishness that such a measly downswing elicited? Given where the Fed and Treasury are in monetary and spending plans, nothing has changed – the debt ceiling drama is still out of the markets‘ focus alongside pretty much everything else including Evergrande and similar fears. Who could have forgotten the late Jan GameStop, or then Archegos? And the markets keep rising on the staircase liquidity wave interrupted by a fresh stimulus here and there:

That‘s why I‘m not concerned that the day before yesterday:

(…) Precious metals, copper and oil bore the brunt of souring sentiment, with cryptocurrencies joining in the slide later through the day. But have the material facts changed, or all we got was a whiff of risk-off? September is likely to be volatile, it seasonally is, and August had been a surprisingly calm month. You know what they say about periods of lower volatility giving way to those of higher readings… Time to buckle up.

Time to buckle up indeed, as a brief ambush of the generally rising markets, is likely to come in autumn. Either the Fed tapers before Dec, forcing it effectively to happen now, or its inaction would defer it to 2022 (the downswing catalyst would then be inflation).

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

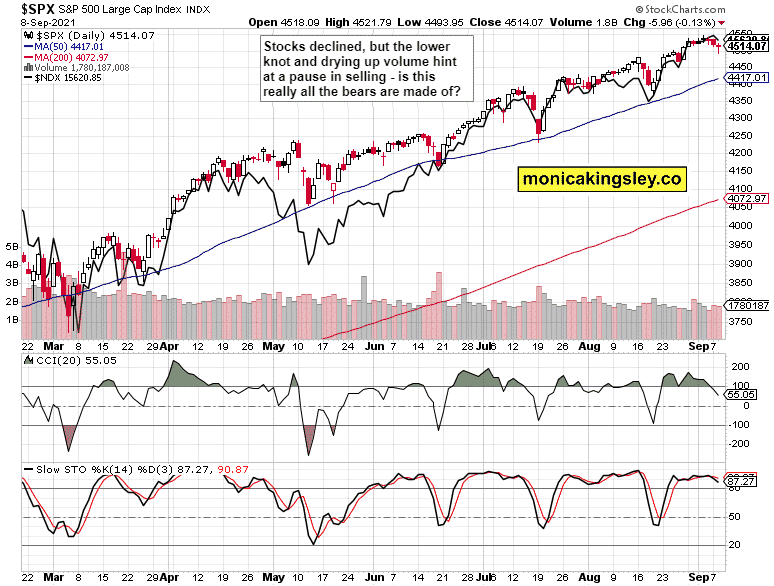

S&P 500 and Nasdaq Outlook

The S&P 500 downswing was stopped in its tracks by the intraday reversal – the bulls are likely to attempt to take prices higher still.

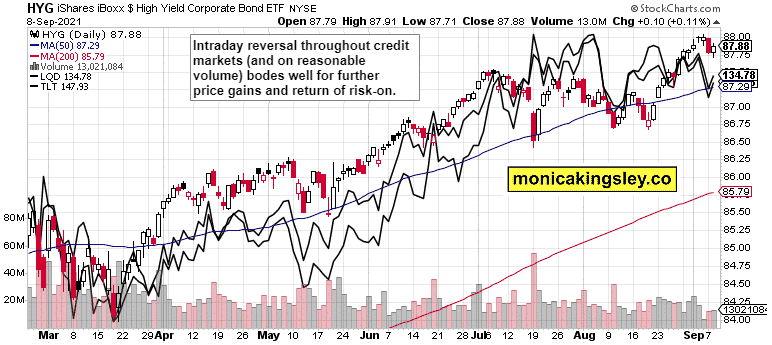

Credit Markets

Credit market slide had been arrested, and the uptick across the board is a positive sign. The bulls have something to build on.

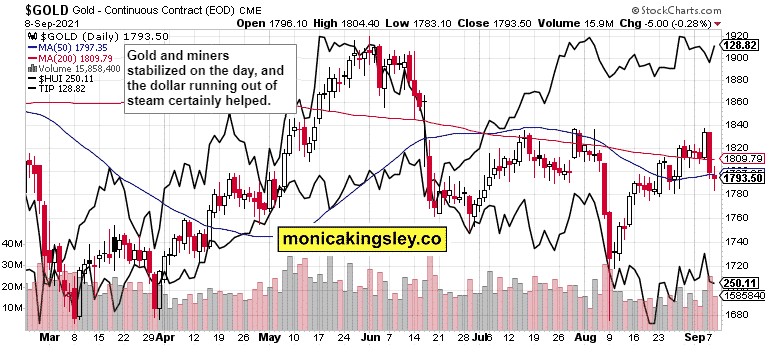

Gold, Silver and Miners

Gold and silver are stable in the very short run, and can surprise on the upside – the dual spike in the dollar and yields hasn‘t helped, but these headwinds won‘t last.

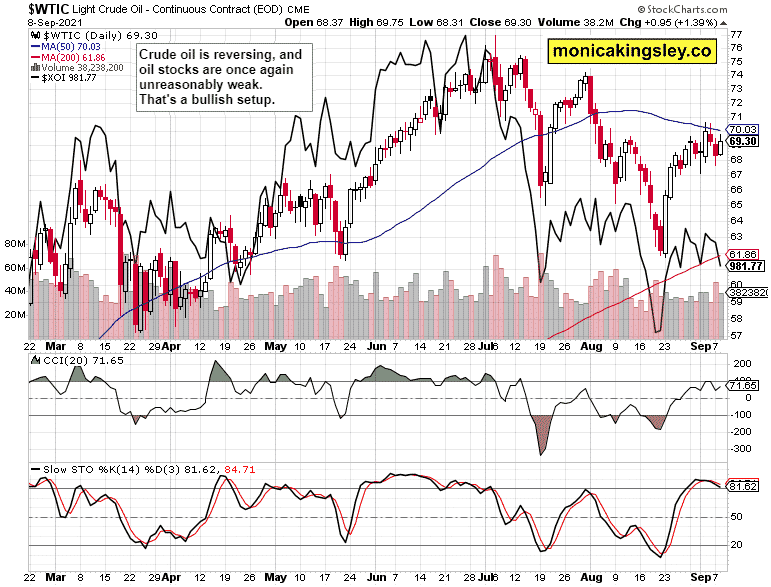

Crude Oil

Crude oil had a positive day in spite of the energy sector weakness – its volatile trading is likely to continue as the 50-day moving average presents an obstacle still.

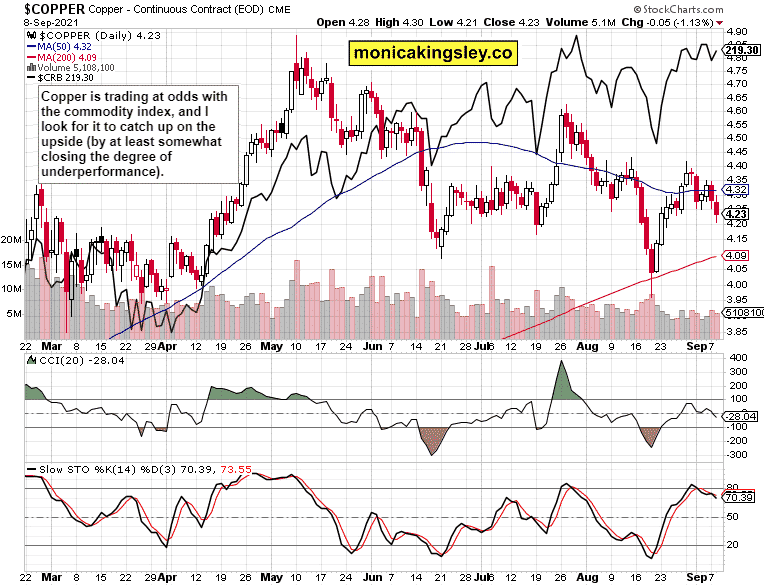

Copper

Copper declined in spite of the rising CRB Index – its relative weakness continues even if the red metal is likely to score gains today, making up for yesterday‘s excessive weakness.

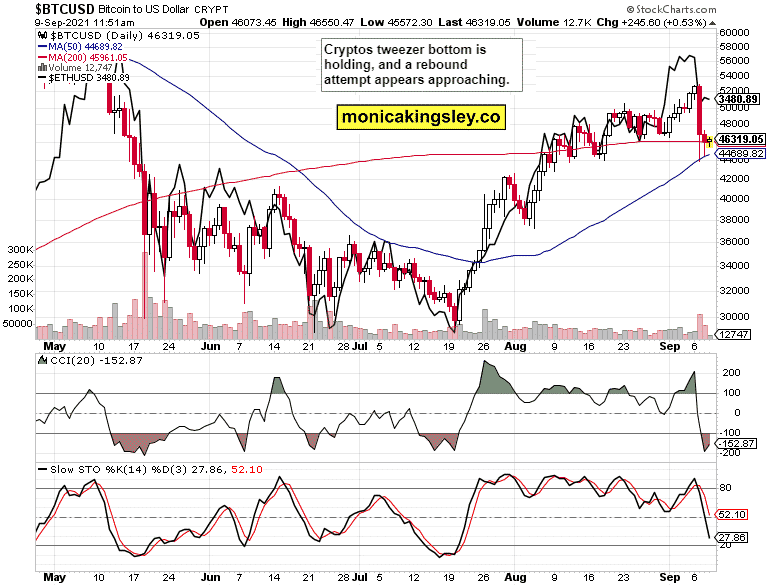

Bitcoin and Ethereum

Bitcoin and Ethereum still looks to have found a temporary floor, and the selling pressure appears abating. The bulls‘ chance is approaching.

Summary

Risk-off appears getting long in the tooth as those who have gotten used to two day corrections could say. Time for a pause in selling is at hand, but the volatile September is far from over. In the big picture, the stock market, PMs and commodity bull runs remain intact, and their upcoming trajectory will be dictated by the dollar and yields.

Thank you for having read today‘s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for all the five publications: Stock Trading Signals, Gold Trading Signals, Oil Trading Signals, Copper Trading Signals and Bitcoin Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

Oil Trading Signals

Copper Trading Signals

Bitcoin Trading Signals

www.monicakingsley.co

[email protected]

* * * * *

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

-

Support

-

Platform

-

Spread

-

Trading Instrument