Stock Market Forecast: Key Market Shift Confirmed

S&P 500 bulls didn‘t look back, and the credit markets spurt at close confirmed. The VIX is getting serious about reaching for early Sep lows, and it shows in the sharp upside reversal of value. The tech upswing hasn‘t been sold into either, and the overall picture is of improving market breadth.

Yesterday’s Insights

Such was my assessment going into yesterday‘s session:

(…) So, how far could the bulls make it? 4,420 is one resistance level, and then prior local highs at 4,470 await. The fate of this correction is being decided right there, and it‘s my view we have lower than 4,260 to go still. Therefore, I‘m taking a big picture view, and that is one of the continuous inflation surprises to the upside forcing the Fed to taper, which it may or may not do. The policy risks of letting inflation run wild are increasing, so the central bank would find it hard not to deliver fast – the market would consider that a policy mistake.

The tone of yesterday‘s FOMC minutes has calmed the Treasury market jitters, and the dollar succumbed. So did inflation expectations, but the shape of the TIP:TLT candle suggests that inflation isn‘t done and out. The Fed is in no position to break it, supply chain pressures, energy crunch and heating job market guarantee that it will be stubborn with us for longer than the steadily increasing number of quarters Fed officials are admitting to.

Counting on the Fed being behind the curve, inflation has the power to derail the S&P 500 bull run – the more so it runs unchecked. The 1970s stagflation brought several wild swings, cutting the index in half as it spent the decade in a trading range. And given the breadth characteristics of the 500-strong index these days, the risks to the downside can‘t be underestimated. So, what‘s my target of 4,260 in this light?

Portfolio POV

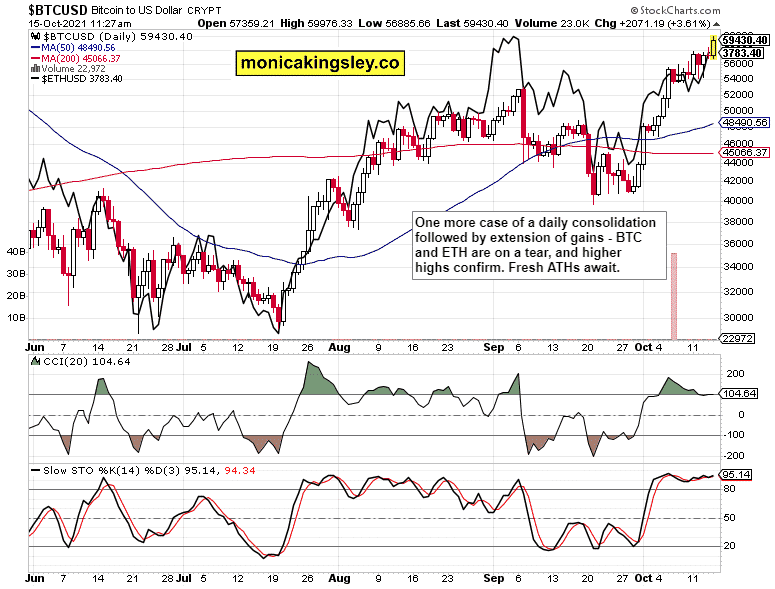

Let‘s consider that from the portfolio point of view – purely stock market traders might prefer to short exhaustion at 4,420 or the approach to 4,470, or balance the short position‘s risk in the stock market with precious metals, cryptos and commodity bets the way I do it – and it‘s working just fine as the precious metals and crypto positions do great while I‘m waiting for a retracement in oil and copper (in price or in time).

Today’s Performance

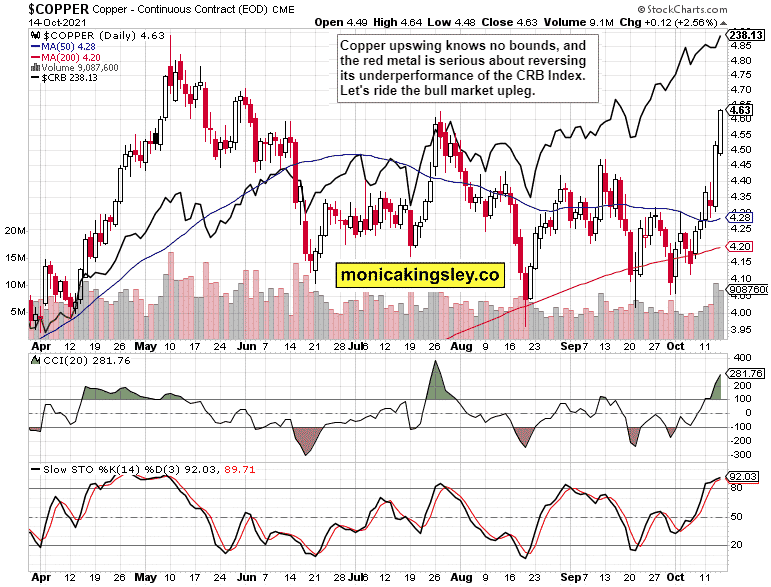

Let‘s check that against the following market performance. It seems bonds aren‘t throwing a tantrum anymore. They are continuously satisfied with the Fed‘s pronouncements. In fact, inflation expectations haven‘t been revolting over the last three days either. S&P 500 has a great chance of confirming the break back above the 50-day moving average. Neither oil nor copper has offered a reasonably modest retracement of their recent upswings (orderly in the former, stellar in the latter).

Reassessing the developments way earlier today (have you already subscribed to enjoy the real-time benefits?) – both from the total portfolio and stock market point of view – has unequivocally led me to join the profitable bullish S&P 500 side (the upswing is likely to easily overcome 4,470s and then 4,510s too) and enjoy the meteoric long copper gains. This represents more conviction behind the still rising tide of accommodative monetary policy (undaunted by the taper prospects, crucially) that is likely to keep positively affecting the open precious metals positions, and further extend the extraordinary crypto gains.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

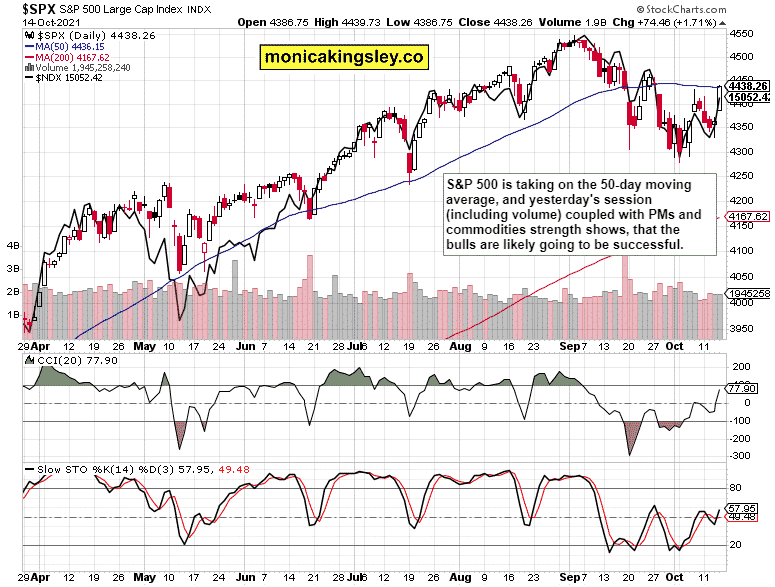

S&P 500 and Nasdaq Outlook

S&P 500 early stage bullish upswing goes on, and the next two days are likely to confirm – the cyclically sensitive sectors are behaving favorably. That‘s consumer discretionaries, financials and real estate.

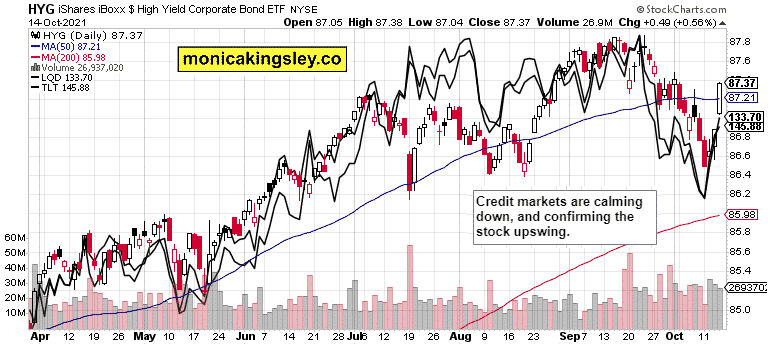

Credit Markets

Quality debt instruments and HYG are rebounding accordingly, and I like particularly the HYG strength.

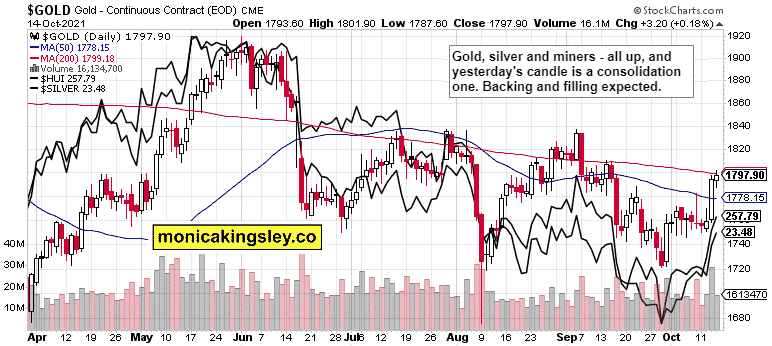

Gold, Silver and Miners

Gold is having trouble overcoming $1,800. However, miners and silver are saying the issues are only temporary. Lower volume and lower knot yesterday mean that a brief consolidation is likely ahead.

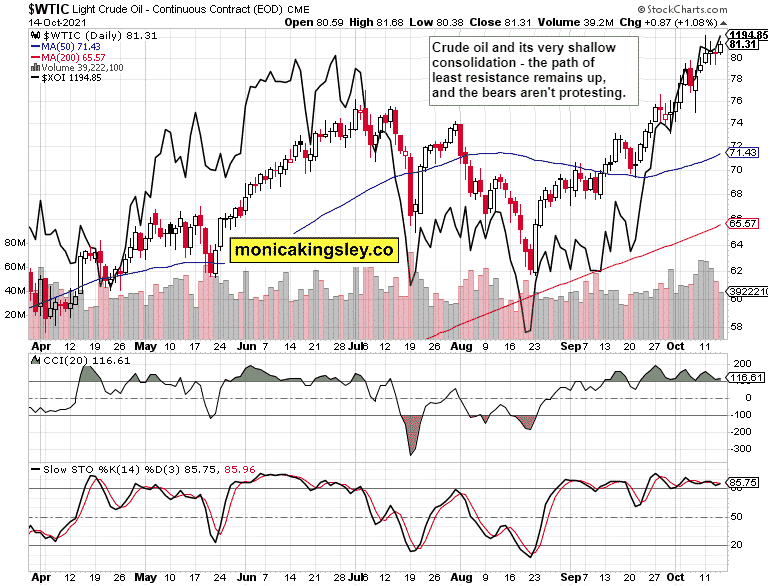

Crude Oil

Crude oil consolidation in a very narrow range will give way to price gains extension if oil stocks are seriously considered.

Copper

Copper steep upswing continues unabated, and volume isn‘t drying up. Just as in the CRB Index, the path of least resistance is up – and continued copper outperformance in the face of downgraded economic growth is the most encouraging sign.

Bitcoin and Ethereum

The expected crypto pause came and is again gone. Fresh highs await, and Ethereum is closer to these than Bitcoin is.

Summary

Stock market rebound has good odds of extending gains. But the most profitable case is made when it comes to commodities, cryptos and precious metals. Remember, I expect 5-7% inflation rates as the predictable, ongoing result. At the same time, inflation isn‘t yet strong enough to force S&P 500 into a bear market, let alone extend the way less than 10% correction just experienced. The path of slowly but surely increasing resistance in the S&P 500 remains up for now as the break above the 50-day moving average foretells.

Thank you for having read today‘s free analysis, which is available in full at my homesite. There you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for all the five publications: Stock Trading Signals, Gold Trading Signals, Oil Trading Signals, Copper Trading Signals and Bitcoin Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

Oil Trading Signals

Copper Trading Signals

Bitcoin Trading Signals

www.monicakingsley.co

[email protected]

* * * * *

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on availability and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. In fact, her content serves educational purposes. Do not rely upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor.

Please know that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she is not responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve a high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings. Finally, she may make additional purchases and/or sales of those securities without notice.

-

Support

-

Platform

-

Spread

-

Trading Instrument