Stock Market Forecast: Impacts of the Dollar Decrease

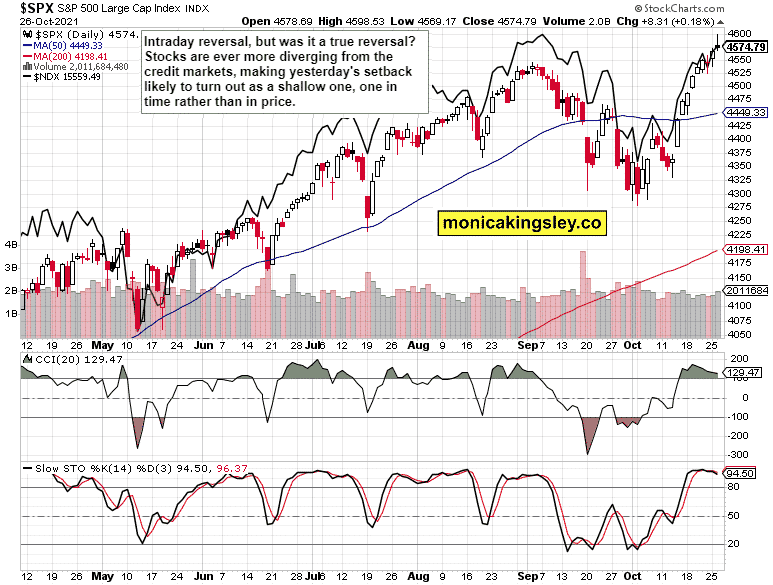

S&P 500 reversed intraday just as bonds did – but broader sectoral weakness is missing. Tech didn‘t rise as yields retreated, and value held up relatively well. Let alone financials or real estate – the latter would be though facing real pressure should rates rise too much and sink the upcoming home sales figures. Yesterday’s data were optimistic, almost as if we were approaching the house flipping mania leading to the Great Financial Crisis of 2007-9 – except that now, we‘re in everything bubble, and crucially in one where faith is being placed with the invincible Fed that‘s got the back of buy-the-dippers.

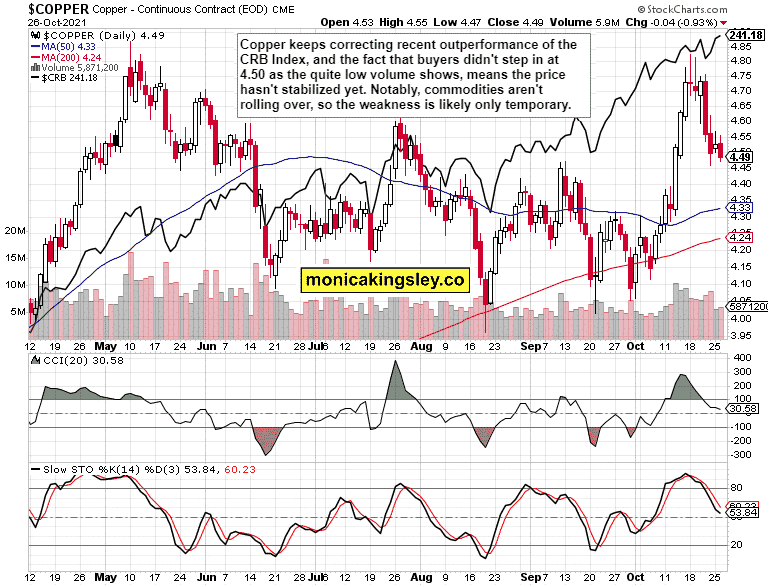

Little wonder, fresh money isn‘t needed to repair banks‘ balance sheets but flows directly into financial markets that are still most attentive to the money spigot. The VIX looks like wanting to rise, but I don‘t think the bears would make it far. Meanwhile, the pressures are being felt in select commodities such as copper and other base metals – given the fact that the CRB Index hasn‘t rolled over to the downside in the least (no, there‘s no revival in the Fed‘s perceived readiness to nip inflation in the bud, no – and it isn‘t in the bud for quite a few quarters anymore), the waiting is likely of temporary nature. Remember the stockpile situation and the fact that U.S. manufacturing is still improving.

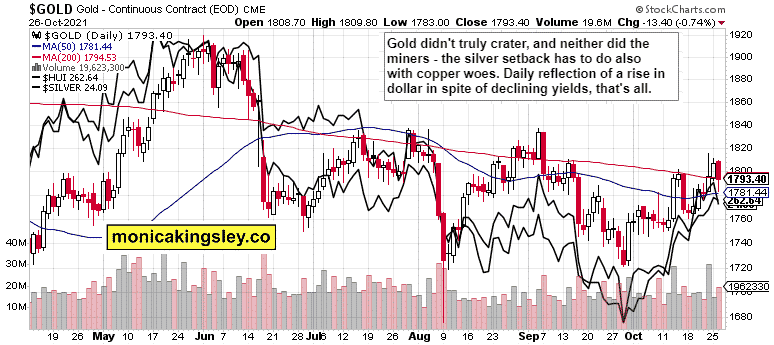

Precious Metals

Such were my yesterday‘s thoughts:

(…) the stock market correction is over (saw that great Tesla move?), and our open long profits can keep growing. In precious metals, silver continues to lead gold in the countdown to the Nov taper – don‘t dare to think, PMs bears, what would unfold should the Fed not deliver. Inflation expectations wouldn‘t be as tame as they are currently. The situation on the inflation front is in my view more dire than before the Jun Fed pacification talk – which turned out empty, of course, but served the key purpose of prepping the markets for the eventual taper arrival.

Here we are, taper is baked in the cake, but inflation expectations are trending higher. And it shows in the gold to silver ratio that‘s shifting ever more to the bullish silver side – as it should in an environment of permanently elevated inflation that I had been talking about relentlessly since early spring.

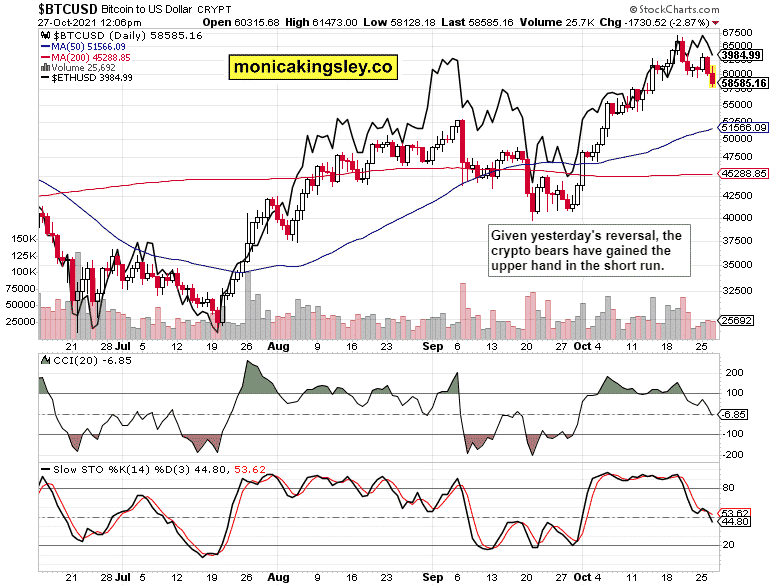

The daily decline in inflation expectations added to precious metals woes, but the gold to silver ratio didn‘t spike. Similar to the dollar that didn‘t meaningfully rise, that‘s another dog that didn‘t bark, carrying powerful implications for the real and crypto assets.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

S&P 500 and Nasdaq Outlook

S&P 500 is in a short-term precarious position but as long as the 4,550s don‘t come into jeopardy, the bulls are safe.

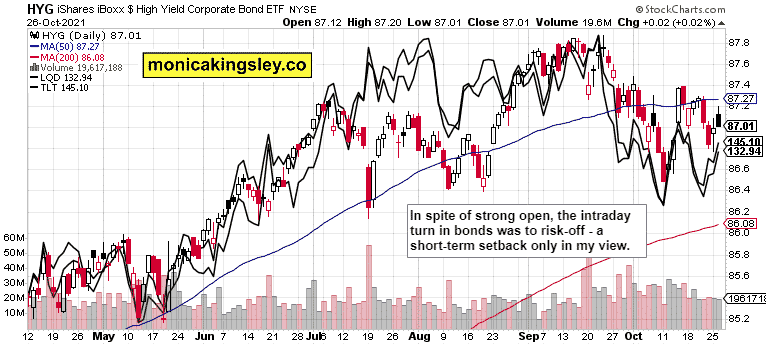

Credit Markets

We saw a serious whiff of risk-off in bonds yesterday, and the key question is whether there would be follow through or not. The low volume doesn‘t favor that at the moment.

Gold, Silver and Miners

The selling in gold and silver didn‘t attract heavy volume, making it likely temporary in nature – the miners anyway don‘t confirm such a degree of weakness. Precious metals look like misinterpreting the housing and manufacturing data.

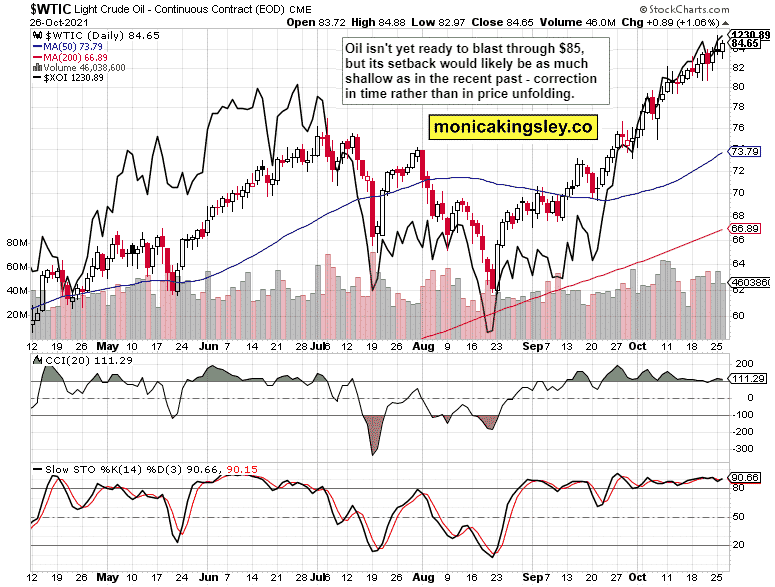

Crude Oil

Crude oil still can‘t beat $85, and the intraday dip was again readily bought. Similarly to 4,550s in S&P 500, the $83 – $84 zone appears still a solid support level. The energy crunch is far from over.

Copper

Copper couldn‘t keep modest intraday gains. Moreover, the selling inciting no buyers to step in is a warning sign that the bulls can‘t yet sound the all clear.

Bitcoin and Ethereum

The Bitcoin and Ethereum bulls gave up a solid starting position yesterday, and likewise, here the buyers haven‘t stepped in yet. It‘s as if the markets were afraid of the taper or the (elusive) prospect of raising rates.

Summary

Stocks are recovering from yesterday‘s hesitation, and fresh highs will likely follow, coupled with another invalidation of credit markets weakness. While the Fed practically has to taper in Nov. The dollar keeps having troubles rising, which relegates the monetary policy change to a storm in a teacup – a little dramatic exaggeration. But still, it‘s nothing to sink the stock, commodity, precious metals or crypto bull runs. With real rates going ever more negative and inflation expectations on a general uptrend, these antidollar plays stand to benefit – and as regards stocks, for as long as earnings projections don‘t disappoint.

Thank you for having read today‘s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for all the five publications: Stock Trading Signals, Gold Trading Signals, Oil Trading Signals, Copper Trading Signals, and Bitcoin Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

Oil Trading Signals

Copper Trading Signals

Bitcoin Trading Signals

www.monicakingsley.co

[email protected]

* * * * *

All essays, research, and information represent analyses and opinions of Monica Kingsley that are based on availability and the latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes. It should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks, and options are financial instruments not suitable for every investor.

Please know that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading, and speculating in financial markets may involve a high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings. It may make additional purchases and/or sales of those securities without notice.

-

Support

-

Platform

-

Spread

-

Trading Instrument