Stock Market Forecast: Flirting with Fed Policy Mistake

S&P 500 didn’t like the underwhelming NFPs but didn’t collapse either. Orderly reaction to a bad number powerful enough to postpone Fed’s Nov taper, to be followed by a celebration of continued monetary support, or creeping worries about Fed policy mistake in letting inflation become an even bigger problem than it is already? Not that it’s not set to become one – even the lazy and slow PCE deflator has scored a jump not seen in decades.

The doubts are starting to be seen in the pressure on USD – the dollar looks set to swing lower next. It won’t break down but gradually trend lower. It’s telling that not even higher yields could power it up over the past week. Tech was relatively resilient, and value didn’t react much to TLT moves, making me think we’re in for a brief retracement of the prior downswing in the credit markets. And that includes the soundly beaten HYG – a bit too much, and the corrective move would take VIX to even lower to the border of its most recent (and worryingly slowly rising) border.

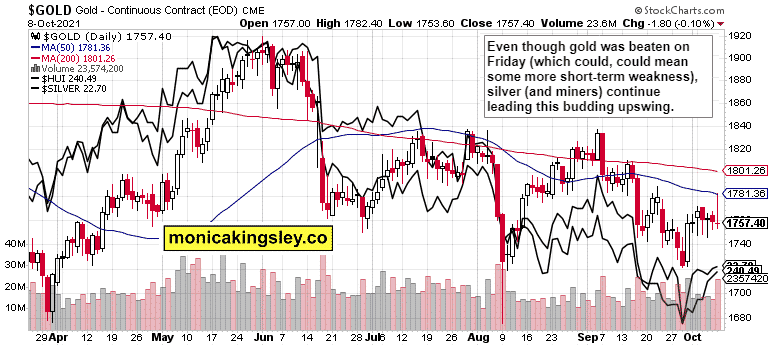

Precious metals should like the inflation spurt and rising inflation expectations outpacing the nominal yields increase. Real rates (short duration maturities are virtually flat) look to be getting more negative, miners to gold ratio turning, silver to gold ratio rising – good news for the precious metals sector as oil continues its run, and copper presents just one question mark: when it would catch up with other base metals. Cryptos are also set to be doing good when everyone talks about inflation.

Let’s move right into the charts (all courtesy of www.stockcharts.com).

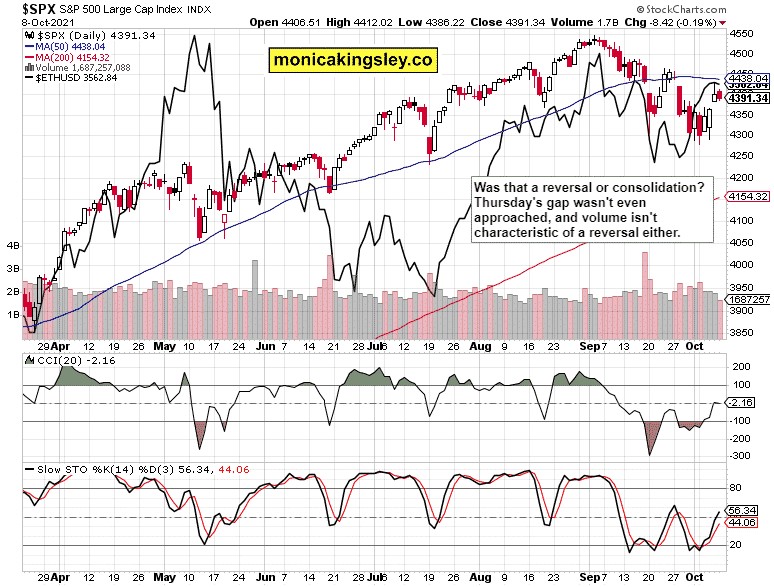

S&P 500 and Nasdaq Outlook

S&P 500 formed more of a consolidation than a true reversal candle – the volume wasn’t there, and prices haven’t moved much. No need to be outrageously bearish unless prices close Thursday’s gap.

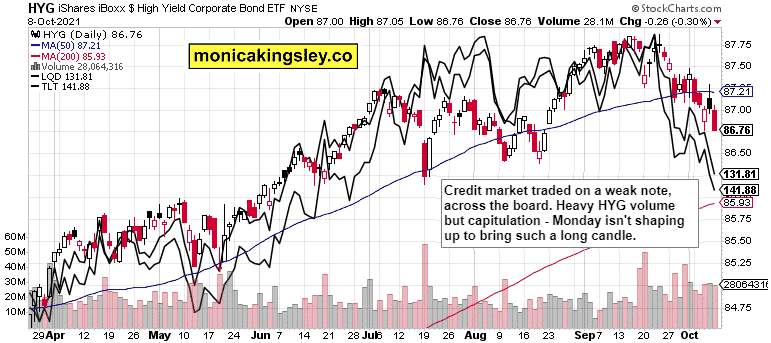

Credit Markets

HYG moved down alongside quality debt instruments, but a reprieve wouldn’t be too surprising here.

Gold, Silver, and Miners

Some life is returning to precious metals, even though it’s not apparent when looking at gold only. The yellow metal’s upper knot isn’t necessarily bearish. It can be reversed over the nearest week – the key thing is that silver and miners are waking up.

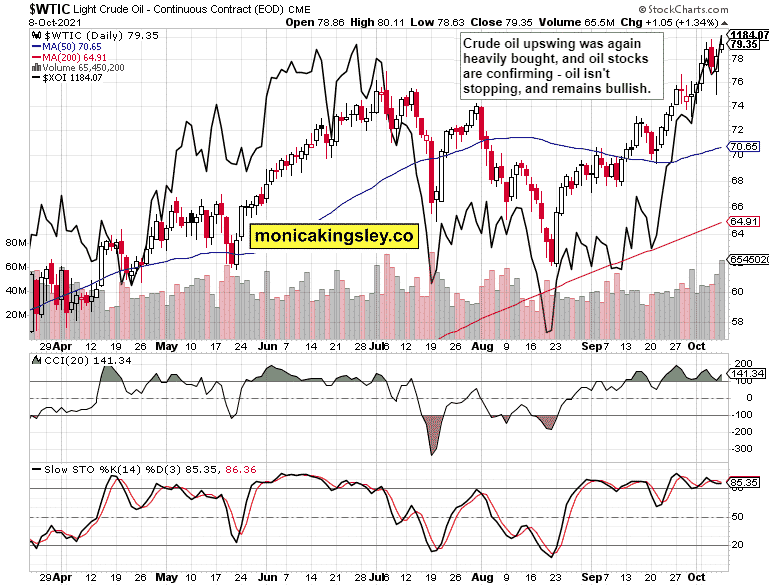

Crude Oil

Crude oil hesitation didn’t reappear on Friday. Oil stocks continue moving up – the chart remains bullish as there is no hint of follow-through selling to heavy volume days with a slight upper knot.

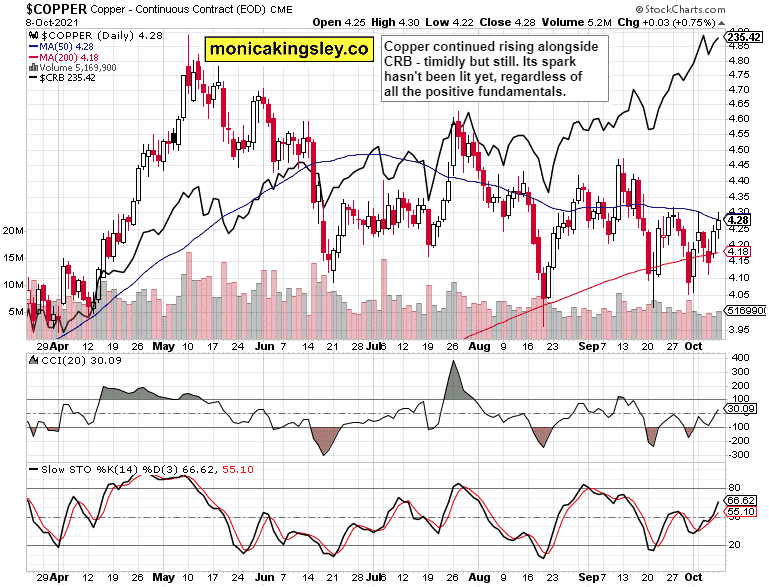

Copper

Copper continues underperforming both the CRB Index and other base metals, and its upswing appears a question of shortening time. Is silver sniffing out copper awakening soon?

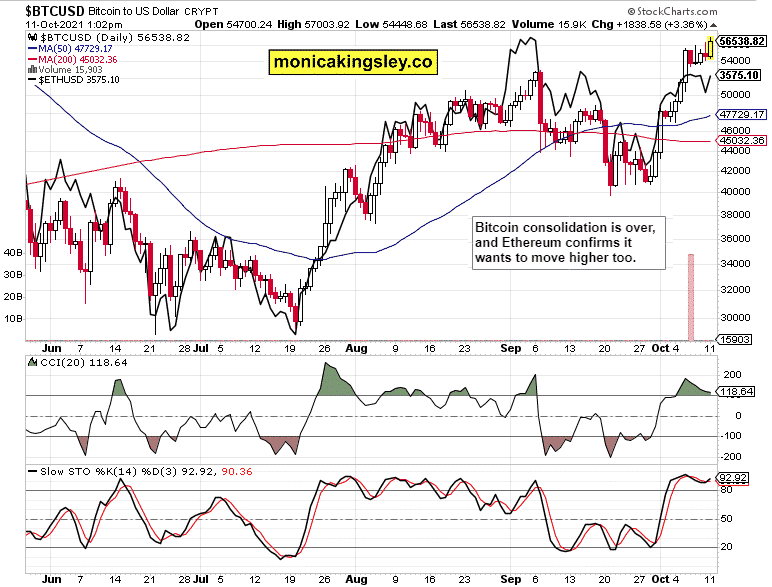

Bitcoin and Ethereum

Bitcoin and Ethereum are pushing higher after calm weekend trading, look set to be rising and lifting the available profits up!

Summary

Stocks are likely to pause and recover from Friday’s inconclusive downswing, and precious metals together with cryptos remain positioned for an upswing as stagflation growingly permeates everyday vocabulary.

Thank you for having read today’s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica’s Insider Club, which features real-time trade calls and intraday updates for all the five publications: Stock Trading Signals, Gold Trading Signals, Oil Trading Signals, Copper Trading Signals, and Bitcoin Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

Oil Trading Signals

Copper Trading Signals

Bitcoin Trading Signals

www.monicakingsley.co

[email protected]

* * * * *

All essays, research, and information represent analyses and opinions of Monica Kingsley that are based on availability and the latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes. Do not rely upon this as advice or construed as providing recommendations of any kind. Futures, stocks, and options are financial instruments not suitable for every investor.

Please know that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she is not responsible or liable for any decisions you make. Investing, trading, and speculating in financial markets may involve a high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings. She may make additional purchases and/or sales of those securities without notice.

-

Support

-

Platform

-

Spread

-

Trading Instrument