Stock Market Forecast: Feeling the Quickly Changing Pulse

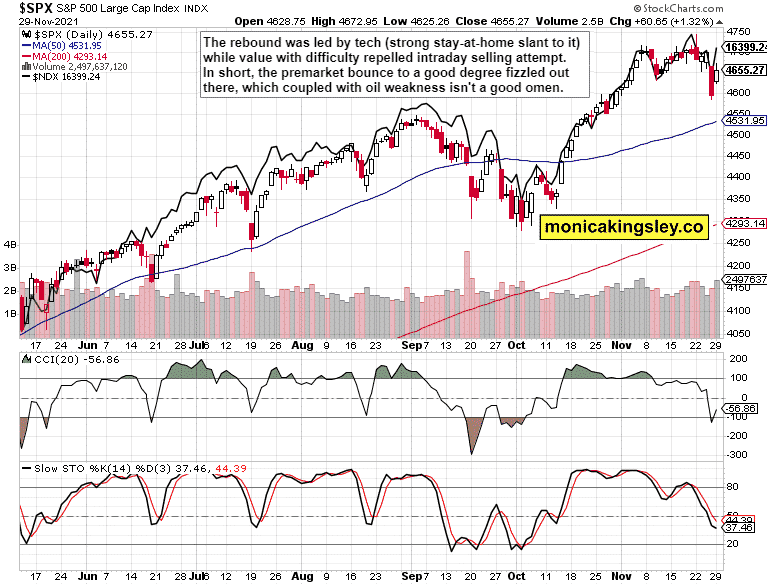

S&P 500 rebound still ran into selling pressure before the close – the bulls lost momentum however well the government and Fed‘s words were received. Credit markets hold the key – specifically, how corporate bonds and Treasuries perform compared to each other. This would be also reflected in the yield spreads, dollar moves, or cylicals vs. stay-at-home stocks.

Today‘s analysis will be shorter than usually, so let‘s dive into the charts to fulfill my title‘s objective (all charts courtesy of www.stockcharts.com).

S&P 500 and Nasdaq Outlook

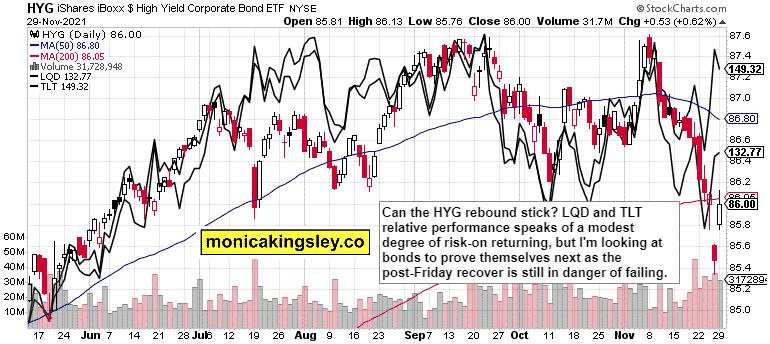

Credit Markets

As encouraging as the HYG upswing is, it‘s too early to call a budding reversal a done deal. LQD to TLT performance is a good start, which however needs to continue. The worst for the bulls would be renewed rush into Treasuries, sending other parts of the bond market relatively down.

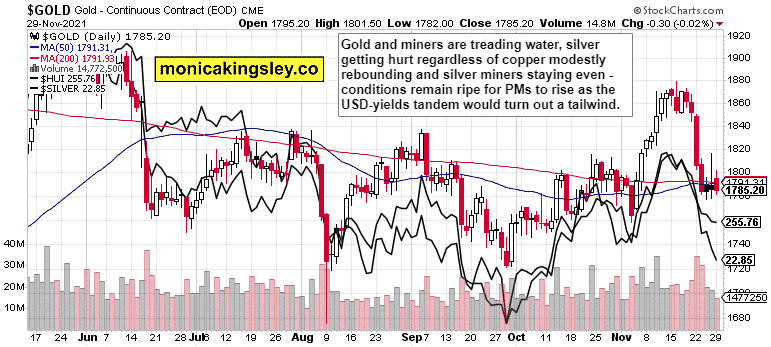

Gold, Silver and Miners

Precious metals retreated again, but the bullish case is very far from lost. As discussed in the caption, the upswing appears a question of time – gold and silver are ready to turn on soothing language of fresh accomodation.

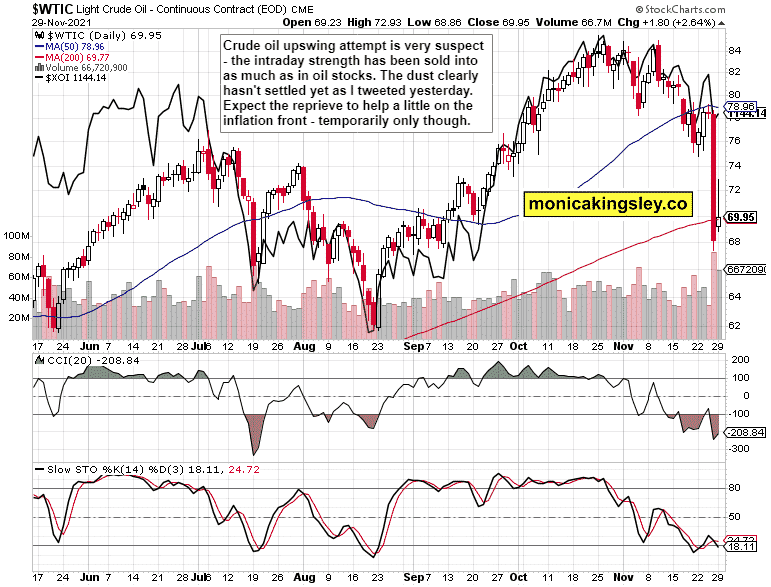

Crude Oil

Crude oil upswing left a lot to be desired and as I tweeted yesterday, remains the most vulnerable within commodities. The dust clearly hasn‘t settled yet within energy broadly speaking.

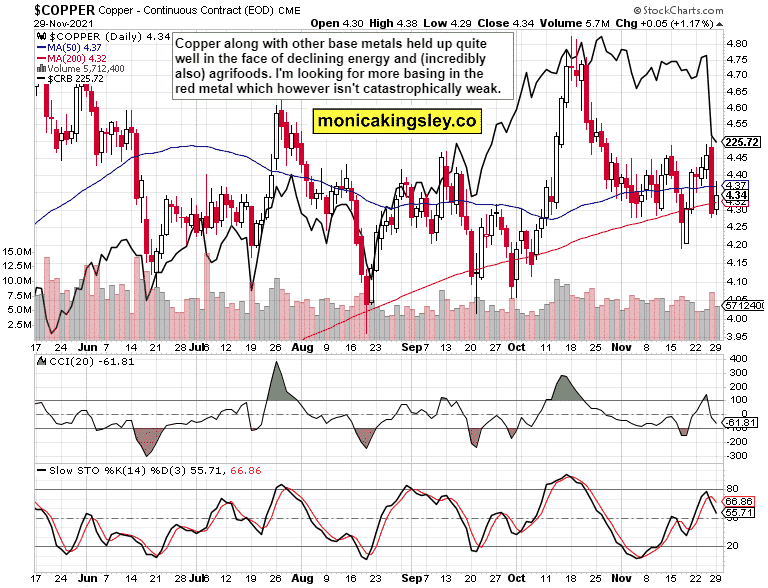

Copper

Copper held up considerably better than many other commodities, and gives the impression of sideways trading followed by a fresh upswing as having the highest probability to happen next.

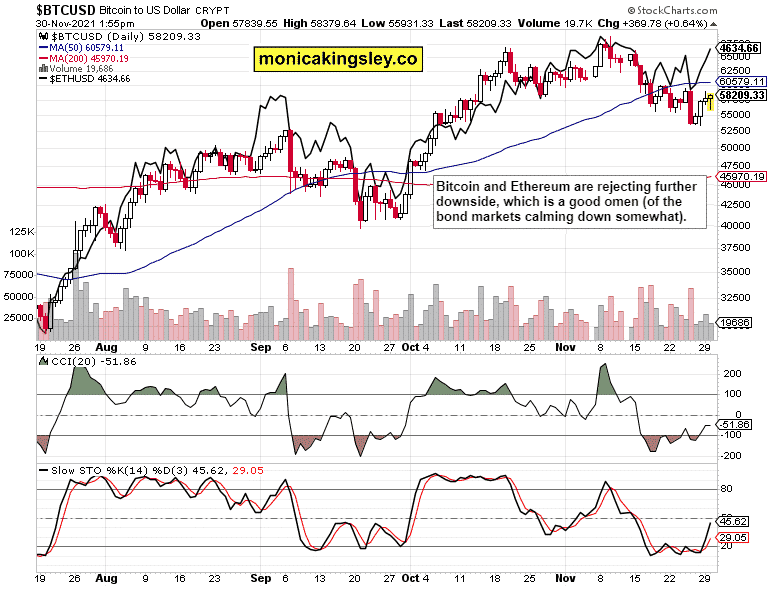

Bitcoin and Ethereum

Bitcoin and Ethereum marching up today, is a positive omen for gradual and picky return of risk-on trades. The overall mood is still one of catious optimism.

Summary

Friday‘s rout hasn‘t been reversed entirely, and markets remain vulnerable to fresh negative headlines. The degree to which current ones (relatively positive ones, it must be said) helped, is a testament of volatility being apt to return at a moment‘s notice. I‘m certainly not looking for the developments to break inflation‘s back – CPI clearly hasn‘t peaked. Precious metals are well positioned to appreciate when faced with any grim news necessitating fresh monetary or fiscal activism.

Thank you for having read today‘s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for all the five publications: Stock Trading Signals, Gold Trading Signals, Oil Trading Signals, Copper Trading Signals and Bitcoin Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

Oil Trading Signals

Copper Trading Signals

Bitcoin Trading Signals

www.monicakingsley.co

[email protected]

* * * * *

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

-

Support

-

Platform

-

Spread

-

Trading Instrument