Stock Market Forecast: Fed Game Plan

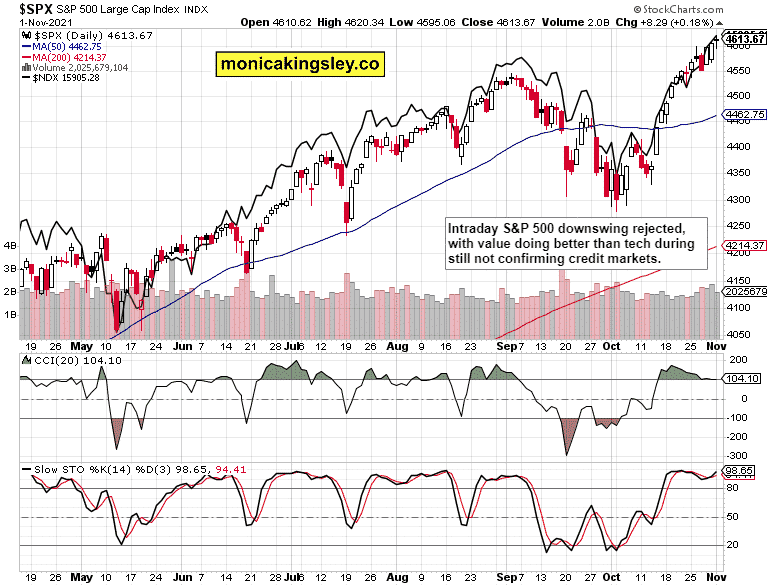

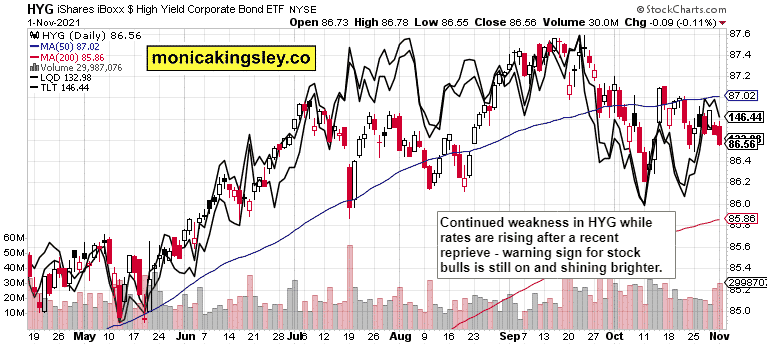

S&P 500 hesitation against weakening bonds – what gives? The yield curve keeps flattening, but long-dated Treasury yields seem again on the verge of another upswing, which hasn’t propped up the dollar yesterday much. The only fly in the ointment of a risk-off atmosphere was valued at outperforming tech.

Overall, stocks haven’t made much progress and are vulnerable to a quick downswing attempt, which probably wouldn’t come today as the VIX doesn’t look to favor it. Wednesday that could be another matter entirely. Still, there is no imminent change to the stock bull run on the horizon – the focus remains on ongoing Fed accommodation, which s why:

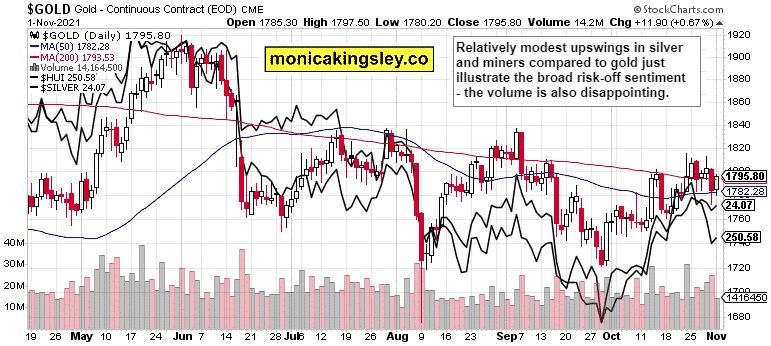

(…) The bears haven’t thus far made any serious appearance, and 4,550s held with ease in spite of the dollar reversing Thursday’s losses. All the more encouraging is the relative strength of both gold and silver when faced with one more daily decline in inflation expectations – as if balancing before the Fed act changes anything.

I ask, how serious can they be about delivering on taper promises when prices increase relentlessly (look at Europe too), these are being blamed on supply chain bottlenecks without acknowledging their persistent and not transitory nature. The real economy is markedly slowing down (not in recession territory, but still)?

Tomorrow’s Fed

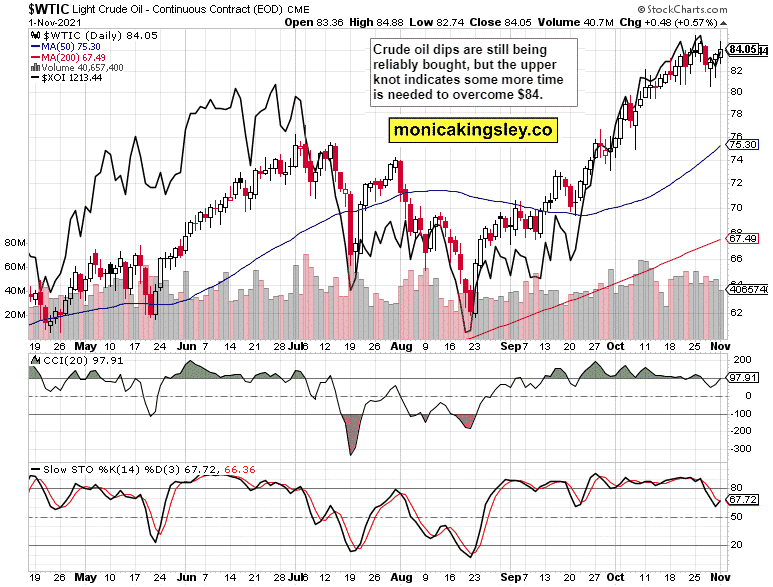

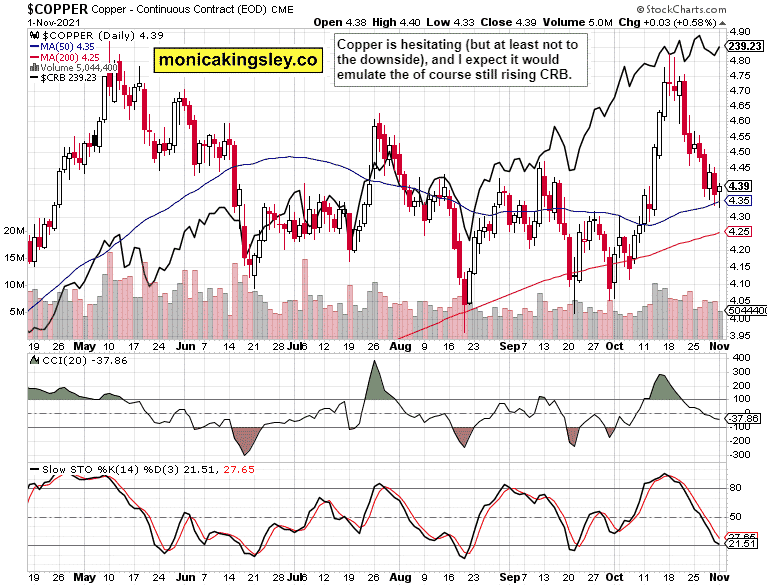

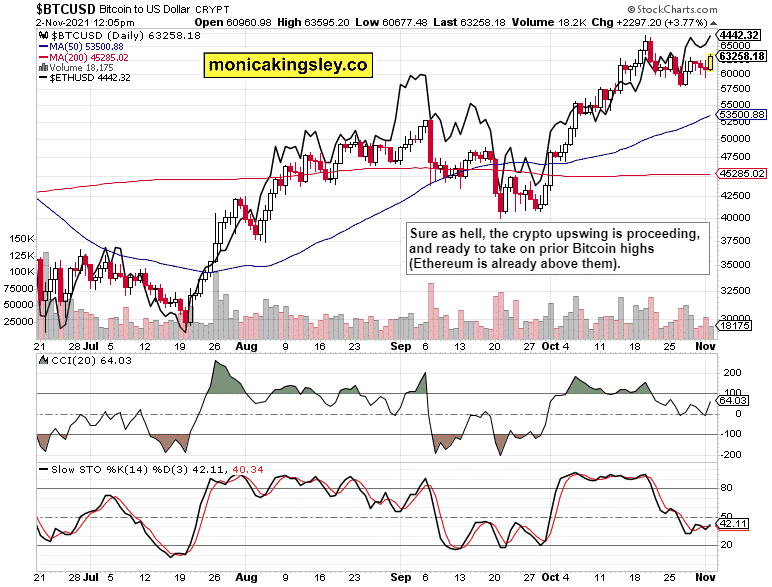

Tomorrow’s Fed taper announcement wouldn’t change a lot – so much can (and will) happen in the meantime, allowing them to backpedal on the projections, making rate hikes even more of a pipe dream. The Fed isn’t taking inflation seriously, hiding behind the transitory sophistry, and that’s one of the key drivers of rates marching up, rising commodities, and surging cryptos. Look for more oil and natural gas appreciation while copper goes up again too. Precious metals are still waiting for a catalyst (think dollar weakening when even rising rates won’t provide much support, and inflation expectations trending up faster than yields) – a paradigm shift in broader recognition of Fed obfuscation and monetary policy being behind the curve.

Let’s move right into the charts (all courtesy of www.stockcharts.com).

S&P 500 and Nasdaq Outlook

S&P 500 is entering a brief consolidation, with 4,590s being first to support, followed by the high 4,550s (if the bears can make it there). Given though yesterday’s sectoral rotation, that’s not likely happening today.

Credit Markets

HYG keeps acting really weak, volume is picking up, and buyers aren’t able to force at least a lower knot. Rising yields aren’t reflecting confidence in the economic recovery, but the arrival of stagflation bets.

Gold, Silver, and Miners

Gold indeed swung higher but needs more follow through, including volume. Otherwise we’re still waiting for the catalysts mentioned at the opening part of today’s analysis, which would also help the silver to gold ratio move higher.

Crude Oil

Crude oil keeps going up again, and is likely to extend gains above $84 even as this level presents a short-term resistance.

Copper

Copper buying opportunity is still here, and the red metal is primed to play catch up to the CRB Index again. Probably not so vigorous as before and taking more time to unfold, but still.

Bitcoin and Ethereum

The Bitcoin and Ethereum upswings can and do go on – as stated yesterday. It was a question of a relatively short time when cryptos are done with the sideways correction.

Summary

S&P 500 is likely to pause today, and the bond market performance would be illuminating. Ideally, some semblance of stabilization would occur for the bulls, tipping the (bullish) hand for tomorrow. That’s the big picture view – the very initial reaction to tapering an announcement would likely be disappointing and eventually reversed. Cryptos, commodities (first oil, then copper) would react best, with precious metals figuring it out only later.

Thank you for having read today’s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica’s Insider Club, which features real-time trade calls and intraday updates for all the five publications: Stock Trading Signals, Gold Trading Signals, Oil Trading Signals, Copper Trading Signals, and Bitcoin Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

Oil Trading Signals

Copper Trading Signals

Bitcoin Trading Signals

www.monicakingsley.co

[email protected]

* * * * *

All essays, research, and information represent analyses and opinions of Monica Kingsley that are based on availability and the latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks, and options are financial instruments not suitable for every investor.

Please know that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading, and speculating in financial markets may involve a high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings. She may make additional purchases and sales of those securities without notice.

-

Support

-

Platform

-

Spread

-

Trading Instrument