Stock Market Forecast: False Dawn or Not

S&P 500 rose after an initial consolidation, and its advance was broad-based. Modest dollar weakness accompanied by a daily increase in yields powered value and tech alike as the pendulum swang to risk-on again. VIX indeed had trouble rising, and the volatility metric has decidedly cooled down for now. These September storms seem quite tame compared to last year or before.

Commodities, though, remain on a tear – base metals, energy, and finally to be joined by agriculture. Oil resolved the two-day consolidation with an upswing and didn‘t drink on the inventories report. Precious metals didn‘t have a good day. The only positive sign was some miners resilience – the disconnect between copper and silver grows wider despite both metals (just as much as nickel) being needed for the green economy. Staying with copper, the red metal, though, has dealt me a nice opportunity to swiftly grab sizable daily profits yesterday, bringing the portfolio chart to a fresh high.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

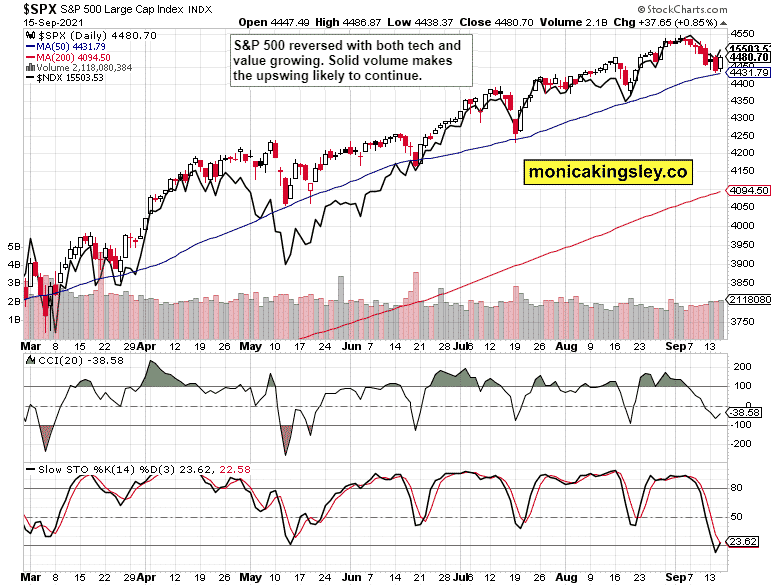

S&P 500 and Nasdaq Outlook

The bears lost the initiative, and the 50-day moving average stood firm again for the n-th time this year. It seems like no correction can make it too far too fast…

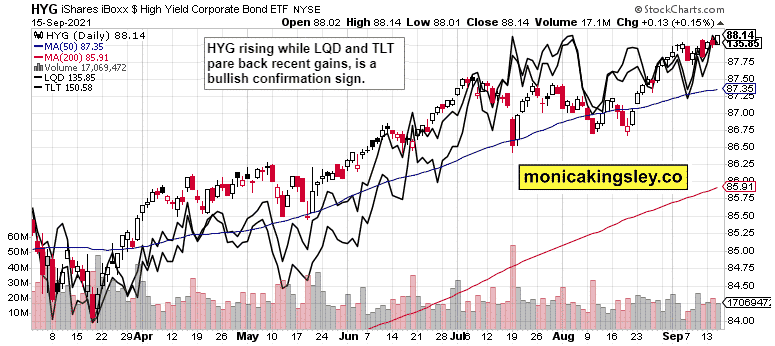

Credit Markets

Credit markets erased the prior risk-off turn, and HYG kicked into solid (not high, but very solid) gear again, confirming the daily upswing in S&P 500 as having legs.

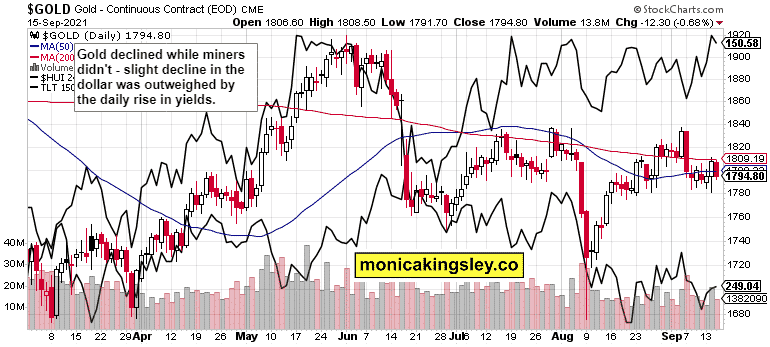

Gold, Silver, and Miners

Gold remains stuck since the Jun FOMC taper verbal plays capped further upside – the yellow metal has, for now, trouble overcoming 1,800 and could very well slowly grind a little lower in a fake show of weakness, only to rally on the no Sep taper announcement. As stated yesterday, the bulls better arm themselves with patience.

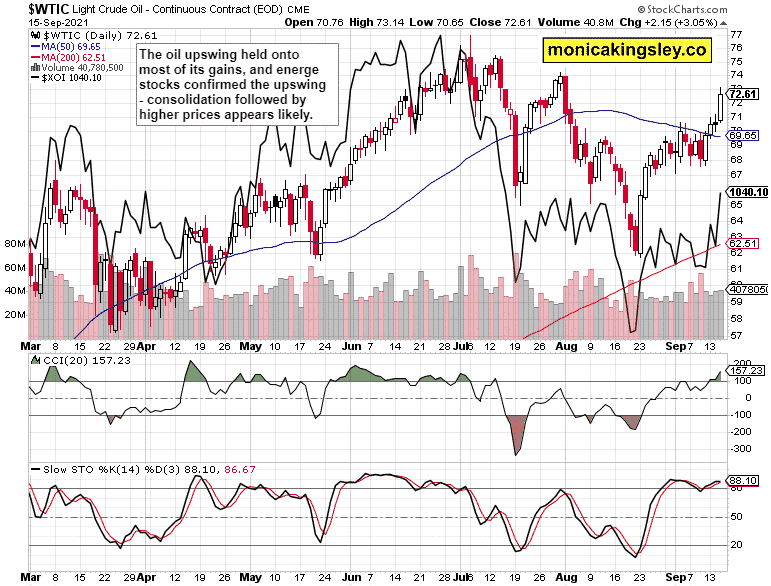

Crude Oil

Crude oil bulls had a field day, and oil stocks overwhelmingly approved of the upswing. As we‘re nearing the $74 – $76 area of prior local highs, expect a bit of consolidation before higher prices follow, with a triple-digit oil sticker slated for 2022.

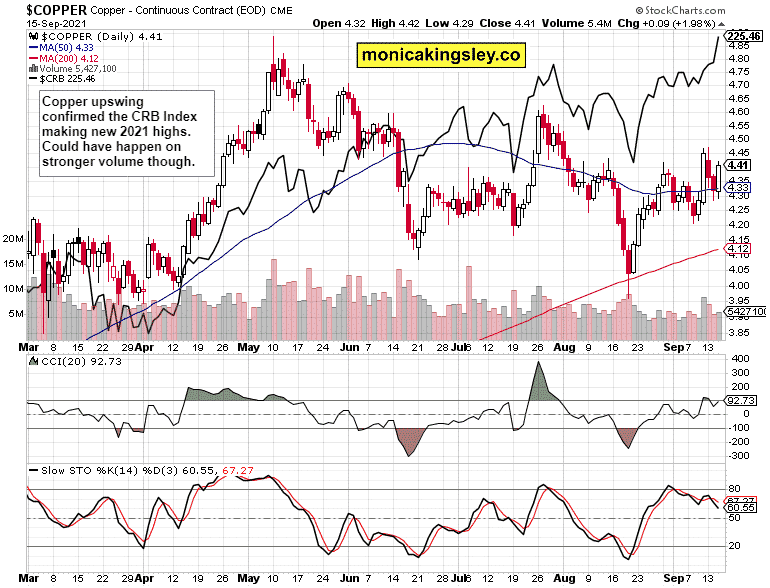

Copper

Copper indeed staged an upside reversal after trading a bit too much at odds with the CRB. As its underperformance vs. the broad commodities index grows, look for not entirely smooth sailing in the red metal ahead.

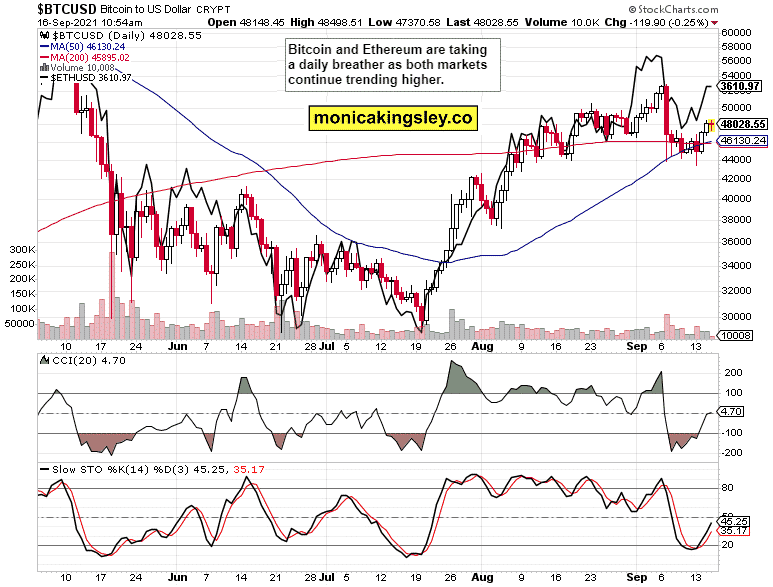

Bitcoin and Ethereum

Brief consolidation after the Bitcoin golden cross is here as both leading cryptos consolidate the last two days‘ gains.

Summary

Risk-taking in real assets has been to a degree joined by the paper one’s yesterday. Big picture, both classes are expected to do well unless the Fed presses the break pedal and decreases its pace of monetary activism. As that‘s unlikely to happen over the nearest weeks, we can look forward to riding out the Sep storms, followed by more price gains, namely in commodities and stocks.

Thank you for reading today‘s free analysis, which is available in full at my home site. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for all the five publications: Stock Trading Signals, Gold Trading Signals, Oil Trading Signals, Copper Trading Signals, and Bitcoin Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

Oil Trading Signals

Copper Trading Signals

Bitcoin Trading Signals

www.monicakingsley.co

[email protected]

* * * * *

All essays, research, and information represent analyses and opinions of Monica Kingsley that are based on available and the latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks, and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading, and speculating in financial markets may involve a high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

-

Support

-

Platform

-

Spread

-

Trading Instrument