Stock Market Forecast: Dialing Back the Euphoria

Fireworks largely continued yesterday. In stocks, it must be said – but the picture isn‘t one of universal strength as tech and value diverged again. As VIX is trading near the lower end of its recent spectrum, the bulls better wait for when Friday‘s Powell euphoria gets questioned in the markets. The most important turn of last week had been the removal of immediate and hard hitting taper (together with misplaced tightening notions) – now, we‘re enjoying the kiss of life this breathed into quality assets. Quality means those in strong, established bull uptrends, and those beaten down a bit too much in the prior whiff of fear.

Further Insights

We‘ll have to be selective as the fuel supply powering the „practically everything“ statement below, is getting tighter:

(…) The hazy taper silhouette remains just that, and his speech brought more implicit assurances than any dreaded hawkish turn, which was what the markets were clearly fearing given the jubilee thereafter. Practically everything caught a spark – tech, value, amazingly smallcaps, silver, gold, copper, a little lagging oil. It‘ll take a while for the currently undervalued emerging markets to catch up – look for that to happen once the dollar bids farewell to its trading range (it looks getting ready to test its lower border, in due time).

Credit markets confirm the risk-on moves to continue – there is no immediate warning to the contrary. But as you‘ll read further on, daily gyrations are likely to come back, and that has implications for the daily rotations between tech and value. Crucially, the dollar isn‘t protesting and remains subdued. Given the crosscurrent of a real economy slowdown in incoming economic data, and inventories replenishment needs amid challenged supply chains, the USD price action hints at the world reserve currency getting ready to welcome lower values. Understandably, that has positive implications for emerging markets as these saw their valuations decline a bit too much.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

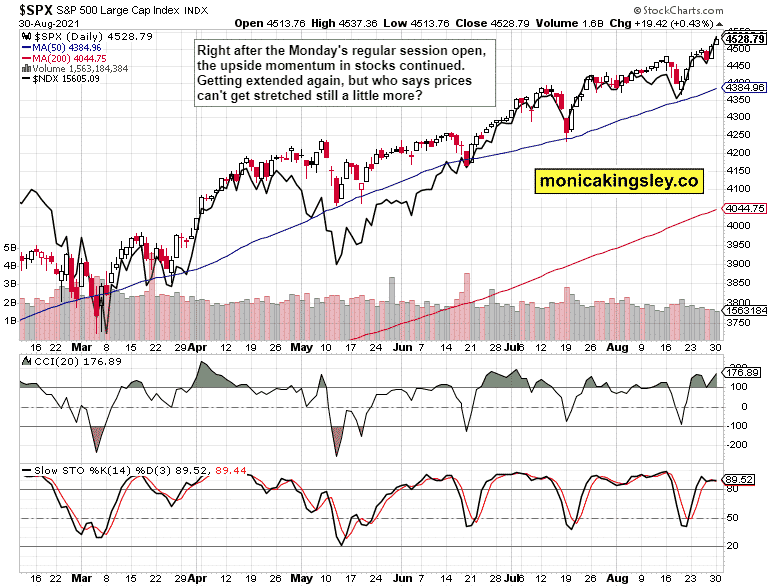

S&P 500 and Nasdaq Outlook

Strong upswing on the surface, but stocks look likely to consolidate the move next. By consolidate, I mean I am not looking for any kind of overly sharp drop.

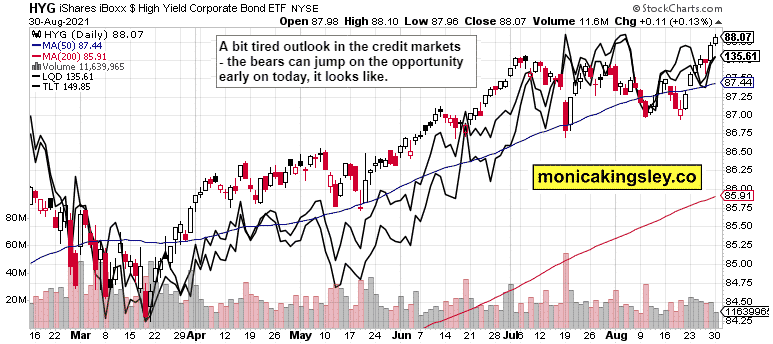

Credit Markets

Credit markets are supporting the stock market upswing, but getting a little tired – a brief pause wouldn‘t be unimaginable.

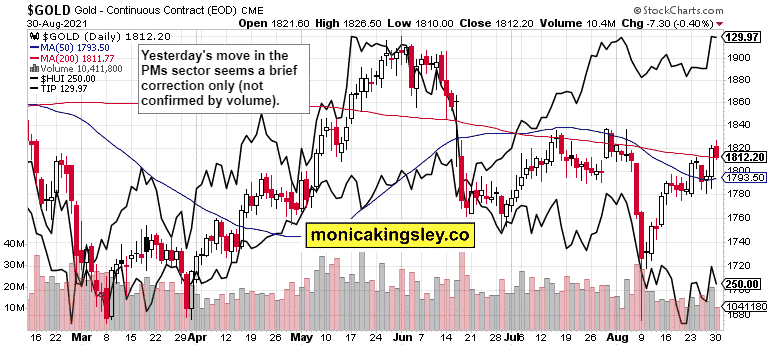

Gold, Silver, and Miners

Gold, silver, and miners got under modest pressure yesterday, but the silver downswing points to its temporary nature. Precious metals look primed to do better in the coming days.

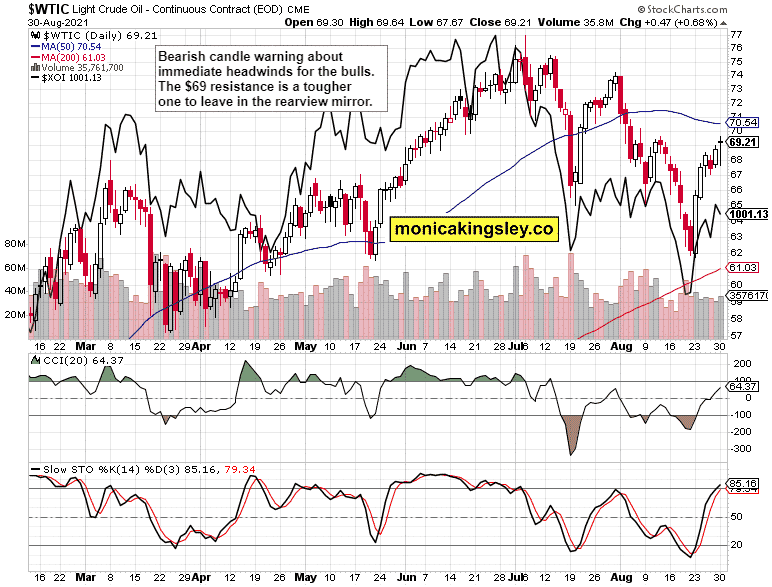

Crude Oil

Crude oil bulls barely closed the day unchanged, and a modest setback looks likely before higher prices reestablish themselves.

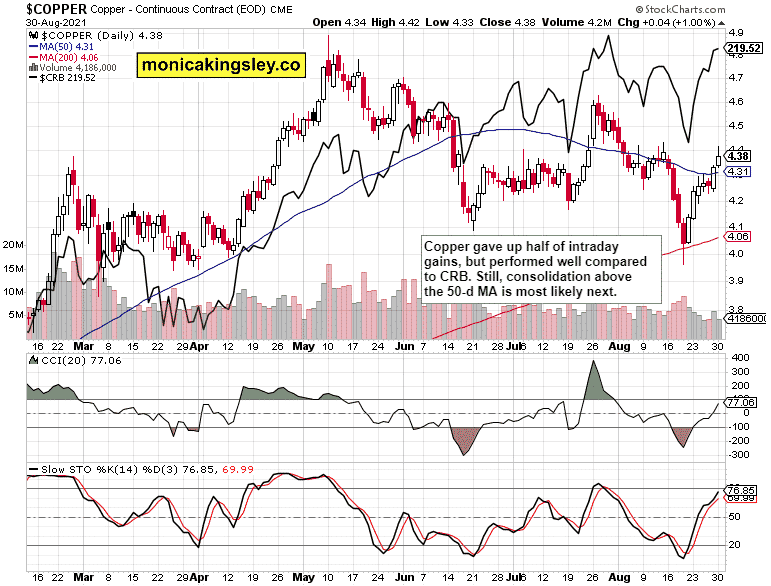

Copper

Copper is sending even more bullish signals than silver does – don‘t look at the red metal to escape the brief consolidation coming first though.

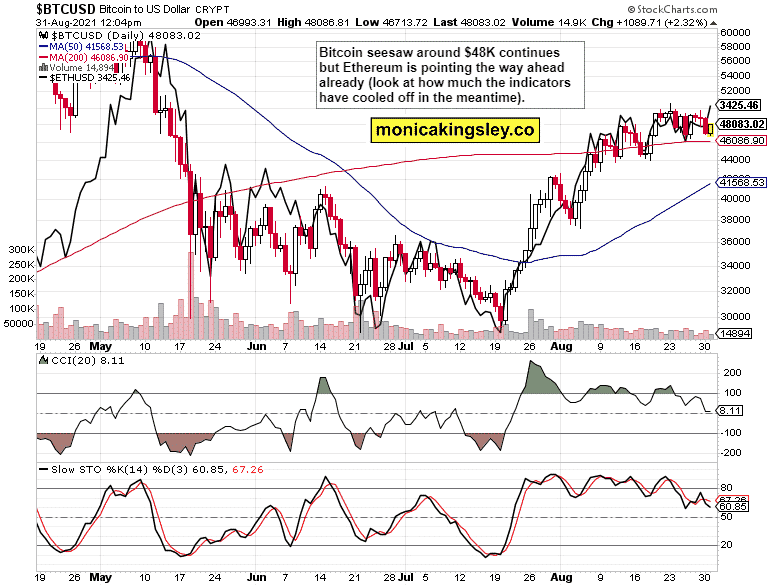

Bitcoin and Ethereum

As stated yesterday, cryptos keep on consolidating, base building, making mostly higher highs and higher lows. It appears only a question of time before the fresh upleg comes.

Summary

Risk-on trades look to be questioned a little next – what else to expect following the Powell dovish speech. Look for it to be a temporary move only though as there aren‘t enough reasons or catalysts to derail the bull market runs.

Thank you for having read today‘s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for all the five publications: Stock Trading Signals, Gold Trading Signals, Oil Trading Signals, Copper Trading Signals, and Bitcoin Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

Oil Trading Signals

Copper Trading Signals

Bitcoin Trading Signals

www.monicakingsley.co

[email protected]

* * * * *

All essays, research, and information represent analyses and opinions of Monica Kingsley that are based on availability and the latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks, and options are financial instruments not suitable for every investor. Please know that you invest at your own risk.

Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading, and speculating in financial markets may involve a high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

-

Support

-

Platform

-

Spread

-

Trading Instrument