Steel reverses from a seven-month high

The price of steel rebar futures dropped to CNY 4,200 a tonne, less than the over-seven-month high of CNY 4,252 reached on February 23rd on worries about weaker demand and pressure from regulators to cut prices.

According to the Chinese National Development and Reform Commission, measures have been established to monitor price increases brought on by speculative activity and to punish merchants who spread false information about products to push up prices.

In the meantime, the administration set a 5% growth goal for this year during the National People’s Congress session, dampening hopes for a more ambitious plan while still opening the door for additional stimulus for infrastructure and building.

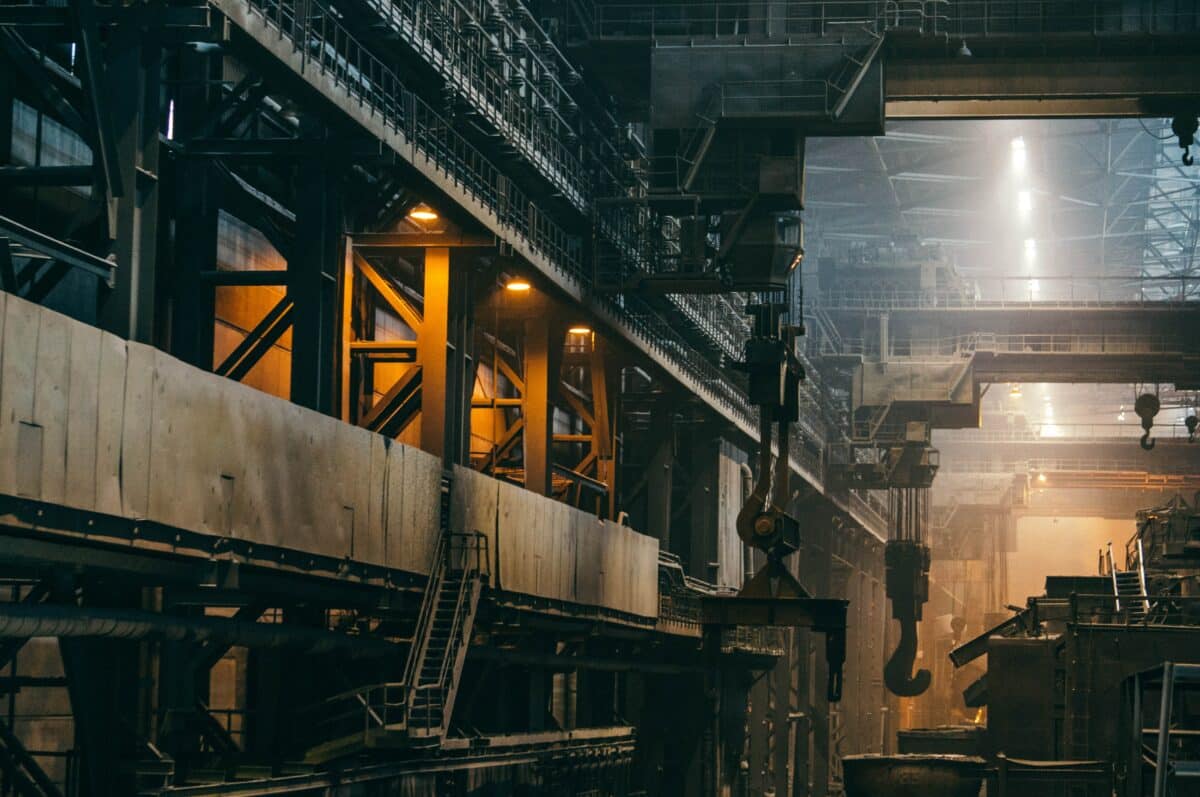

As Tangshan, a major hub for steel manufacturing was compelled to prolong its production halt due to severe pollution, signs of a constrained supply continued. Steel mills were compelled to bid at higher levels as a result of limited shipments due to bad weather in the world’s top two exporters of iron ore, Australia and Brazil, driving up the cost of scarce raw materials.

World producers of aluminum propose Q2 premiums between $125 to 145/T

According to five individuals directly involved in quarterly pricing discussions, international aluminum producers have offered Japanese customers premiums of $125-$145 per tonne for shipments of primary metals in April-June, up 45%-71% from this quarter.

The proposals indicate a perception among producers that demand from automakers is poised to go up if accepted by purchasers.

The largest primary metal importer in Asia, Japan sets the bar for the area with the premiums it agrees to pay for shipments over the LME cash price each quarter. The quarterly price talks between Japanese purchasers, such as rolling mills and trading firms, and international suppliers of aluminum ingots, such as Rio Tinto Ltd. and South32 Ltd., started last week and are anticipated to last until the end of the month.

Premium aluminum and steel prices drop in Japan

Japanese purchasers settled on a rate of $85-$86 per tonne (PREM-ALUM-JP) when securing shipments for the January-March quarter, marking a 13–14% decrease from the prior quarter.

As premiums in the US, Europe, and other parts of Asia were rising “because of good demand and limited supply” and anticipations of a recovery in auto manufacturing, a source at one major supplier said the company was considering hiking premiums.

But the majority of consumers lacked faith. A source at a Japanese rolling mill claimed that because domestic demand was still poor, his company was “stunned by the rapid jump.”

At the end of January, inventories of aluminum at three major Japanese ports (AL-STK-JPPRT) went up by 2.8% to 392,500 tonnes compared to the previous month. Marubeni Corp 8002 reported that the numbers were 34% higher than in the same time period a year before. This trend mirrored the lackluster demand. Due to the nature of the conversations, the sources declined to be named.